This is a wholly-owned subsidiary operating in the transportation sector under MHC.

Additionally, MHC holds two other subsidiaries: MHC Investment Corporation (99% owned by MHC), primarily engaged in financial investments, and MHC Land Corporation (99% owned by MHC), specializing in real estate.

According to the 2025 semi-annual financial report, the original investment cost of MHC in Hai Phong Maritime Transport and Services was 15 billion VND. With the current transfer price, the company is incurring a 66% loss on this investment.

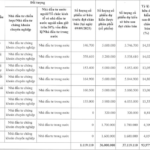

|

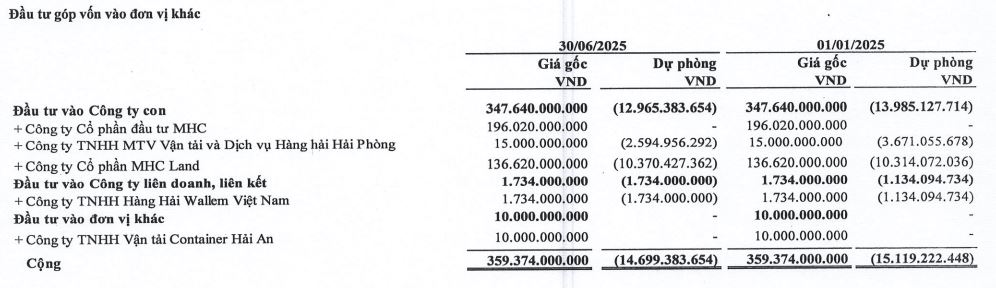

MHC‘s Capital Contributions to Other Entities

Source: 2025 Semi-Annual Financial Report

|

Regarding the investment in MHC Land with an original cost of 136.6 billion VND, MHC has also set aside a provision of over 10.3 billion VND.

As of June 30, 2025, MHC‘s total capital contributions to other entities amounted to nearly 360 billion VND, with total provisions of approximately 14.6 billion VND. The provision value has slightly decreased from the earlier figure of over 15.1 billion VND.

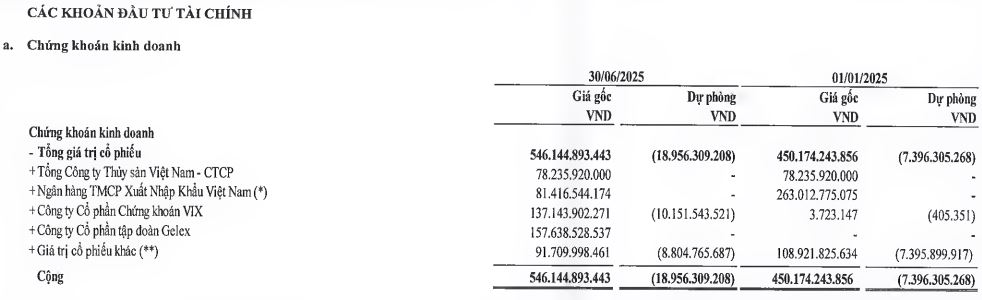

At the same time, MHC holds a trading securities portfolio valued at nearly 206 billion VND at cost. Notable stocks include FDC, EIB, SEA, VIX, and GEX. The investments in VIX (valued at 137 billion VND) and GEX (valued at nearly 158 billion VND) are the largest holdings. The company has set aside a provision of over 10 billion VND for the VIX investment.

Notably, MHC is using over 2.7 million shares of EIB as collateral for a 150 billion VND bond issued by its subsidiary, MHC Investment. Additionally, the company is using 525,000 shares of VHL (Viglacera Ha Long Corporation) as collateral for a 150 billion VND bond issue by MHC Investment.

|

MHC‘s Securities Investment Portfolio

Source: 2025 Consolidated Semi-Annual Financial Report

|

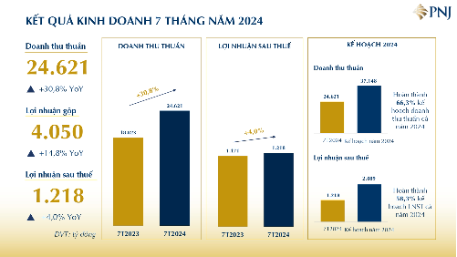

In terms of business performance, MHC achieved a net revenue of 43.7 billion VND in the first half of 2025, a 5.5-fold increase year-over-year. However, the cost of goods sold exceeded revenue, resulting in a gross loss of nearly 3 billion VND.

Thanks to financial income of nearly 39 billion VND, the company still recorded a net profit of 22 billion VND, 3.7 times higher than the same period last year. MHC attributed this result to the significant upturn in the financial market during the first six months, driven by efforts to upgrade the stock market. The company also benefited from the reversal of previous provisions and the realization of profits from certain investment portfolios.

| MHC‘s Business Results |

– 11:13 18/09/2025

Shocking Twist in ‘Mistaken Construction’ on Red Book Land: Landowner Reveals Startling Details

A landowner in Thien Huong Ward, Hai Phong City, claims their plot was unlawfully seized by strangers who brazenly constructed a house on it. The owner suspects the trespassers intentionally claimed a “mistaken build” to circumvent the property’s proximity to a grave, a factor that could devalue the land.

Unlocking Long Xuyên’s Real Estate Potential

Once considered a relatively quiet real estate market compared to other major cities in the Western region, Long Xuyên is now experiencing a powerful resurgence, capturing the attention of investors. This transformation is fueled by two golden factors: a revolutionary upgrade in transportation infrastructure and a robust foundation in the service-based economy.

Chairman of Hoang Quan Real Estate Divests Entire Stake in Subsidiary

Trương Anh Tuấn, Chairman of the Board of Directors at Hoang Quan Real Estate Services and Trade Consultancy JSC, is set to transfer 21 million shares, representing 52.5% of the charter capital, in Hoang Quan Binh Thuan Real Estate Services and Trade Consultancy JSC.