The Board of Directors of Duc Long Gia Lai Group Joint Stock Company (HoSE: DLG) has approved a resolution to invest in the establishment of four affiliated companies.

Specifically, Duc Long Gia Lai plans to invest in the formation of two wind energy companies: CP1 Wind Energy JSC and CP2 Wind Energy JSC, each with a charter capital of 250 billion VND.

The company will contribute 117.5 billion VND to CP1 Wind, equivalent to a 47% stake in its charter capital, and 115 billion VND to CP2 Wind, securing a 46% ownership.

Similarly, Duc Long Gia Lai will invest in two solar energy companies, CP3 Solar Energy JSC and CP4 Solar Energy JSC, each with a charter capital of 225 billion VND. The company will invest 99 billion VND in each, holding a 44% stake in both.

In total, Duc Long Gia Lai will invest 430.5 billion VND. The investment is expected to be completed in Q3/2025. Upon completion, all four companies will become affiliates of Duc Long Gia Lai.

Duc Long Gia Lai’s investment of hundreds of billions in establishing four affiliates comes amid the company’s accumulated losses exceeding 2,411 billion VND.

Notably, this investment occurs as Duc Long Gia Lai faces accumulated losses of over 2,411 billion VND as of June 30, 2025.

The company’s total liabilities at the end of Q2/2025 stood at more than 3,747 billion VND, with short-term debt exceeding current assets by 529 billion VND. These factors have led auditors to raise concerns about the company’s ability to continue operating.

Duc Long Gia Lai’s leadership has outlined several measures to address these challenges, including corporate restructuring, debt renegotiation with banks and creditors, and expanding investments to seek partners for financial improvement.

Additionally, the company faces significant risks from its financial lending activities. With over 2,000 billion VND in loans, Duc Long Gia Lai has set aside 929 billion VND in provisions. The largest loan, nearly 800 billion VND, was extended to DLGL Industrial and Forest Tree Planting JSC, with provisions alone totaling 711 billion VND.

Silver Prices in Vietnam Soar to All-Time High

Today, silver prices soar to new heights, reaching unprecedented levels both domestically and internationally.

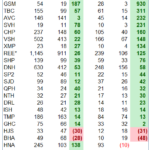

The Power Sector’s Blue Hue in Q2

In Q2 of 2025, the electricity industry witnessed a sea of green, with most businesses thriving. The hydroelectric group, in particular, shone brightly against the low base of the previous year. Thermal power plants showed some differentiation, but most were also in the green. Meanwhile, the renewable energy sector continued its growth trajectory, propelled by favorable policies.

“Solar Power Plant Developer Defaults on Bonds: The Case of Trung Nam Group’s Power Plant and 500KV Transmission Line Project”

“Trung Nam Thuận Nam, the renowned developer of the hybrid solar power plant, substation, and 220/500KV transmission line project in Ninh Thuan Province, has just reported a delay in the repayment of VND 73 billion in principal and interest on bonds.”