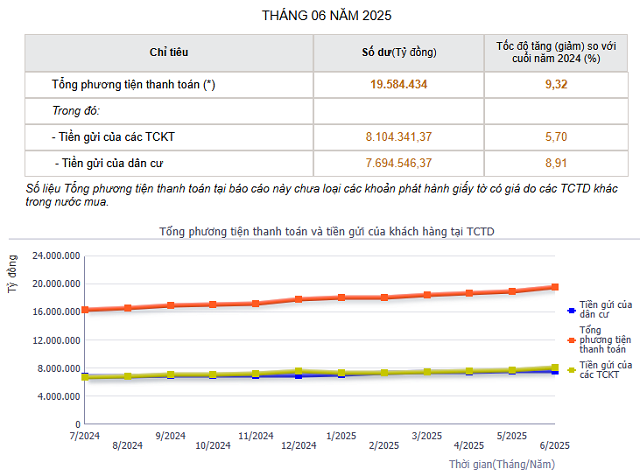

Source: State Bank of Vietnam (SBV)

|

According to the State Bank of Vietnam (SBV), as of the end of June, the total means of payment reached 19.58 trillion VND, marking a 9.32% increase compared to the beginning of the year.

Within this, deposits from economic organizations exceeded 8.1 trillion VND, reflecting a 5.7% growth, while deposits from individuals reached 7.69 trillion VND, up by 8.91%.

Consequently, the total deposit inflow into the banking system approached nearly 15.8 trillion VND.

Additionally, the SBV reported that for VND transactions, average interest rates in the mid-September week showed a downward trend across most key terms. The average overnight and one-week interest rates both decreased by 0.39%, settling at 4.16%/year and 4.36%/year, respectively.

For USD transactions, average interest rates remained relatively stable. Both the overnight and one-week average rates held steady compared to the previous week, maintaining levels of 4.29%/year and 4.32%/year, respectively.

– 09:28 19/09/2025

Enhancing Internal Control, Audit, and Inspection in Credit Institutions

To ensure the safety, sustainability, and legal compliance of the financial system, the State Bank of Vietnam (SBV) regularly issues notifications and warnings to credit institutions through its supervisory, inspection, and monitoring activities. These communications emphasize strict adherence to legal regulations, SBV guidelines, and directives from relevant authorities.

VIB at 29: Pioneering Innovation, Elevating Financial Experiences for Millions of Vietnamese Customers

On September 18, 2025, Vietnam International Commercial Joint Stock Bank (HOSE: VIB) celebrates its 29th anniversary—a nearly three-decade journey fueled by the ambition to craft intelligent financial solutions through deep customer understanding, elevating the financial experience for Vietnamese users.