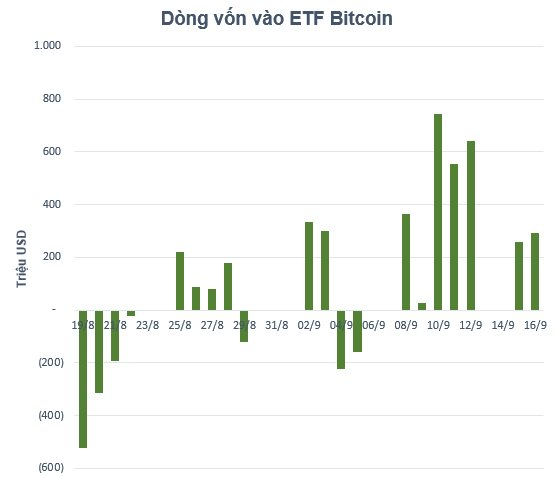

Bitcoin ETFs continue their strong net inflow trend, with global funds attracting a total of $2.88 billion over the past seven days. Leading the pack is the iShares Bitcoin Trust (IBIT), the largest in its category, which drew in approximately $1.5 billion. Closely following is the Fidelity Wise Origin Bitcoin Fund (FBTC), securing nearly $959 million in net inflows.

Currently, global Bitcoin ETFs manage a combined total of $144.5 billion in assets. The iShares Bitcoin Trust (IBIT) leads with over $86 billion, followed by another fund exceeding $21 billion in assets under management.

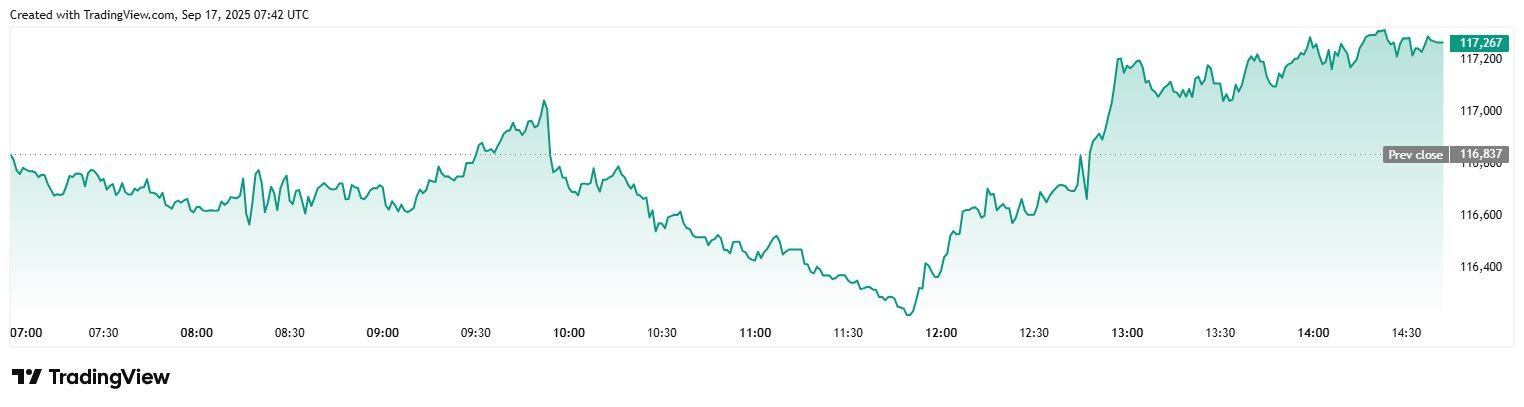

This robust capital inflow coincides with Bitcoin’s price recovery, nearing its historical peak. Bitcoin has surged past $117,000, elevating its market capitalization to $2.325 trillion .

The cryptocurrency market’s recovery is fueled by expectations of a potential Fed rate cut in the upcoming meeting. Analysts suggest that lower interest rates typically result in cheaper capital and increased liquidity, encouraging investors to seek higher yields in asset classes like equities, cryptocurrencies, and gold. Bitcoin is seen as a direct beneficiary in this environment.

Globally, the influx of institutional capital into Bitcoin ETFs instead of direct Bitcoin purchases is understandable. Bitcoin ETFs allow investors to gain exposure to Bitcoin’s price without navigating the technical complexities of cryptocurrency storage and security. Additionally, these ETFs trade on major stock exchanges, offering high liquidity and ease of trading.

However, spot Bitcoin ETFs face challenges due to Bitcoin’s high price volatility, making their performance difficult to predict. Direct reliance on a highly speculative asset increases risk, particularly during sudden market reversals.

Furthermore, the regulatory framework for cryptocurrencies remains under development in many countries. Policy changes could impact ETF operations, from product structure to approval and oversight processes.

MBS: Central Bank Intervenes with $1.5 Billion to Cool Exchange Rate

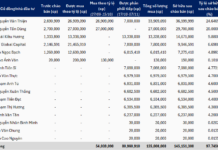

According to MBS, the State Bank of Vietnam (SBV) sold approximately $1.5 billion over the two days of August 25-26 through 180-day forward contracts (with cancellation options) to credit institutions with negative foreign exchange positions, at a rate of 26,550 VND/USD.

Today, September 8: Gold Ring and SJC Gold Prices Drop Sharply

The relentless rally in gold prices has finally taken a breather, with gold rings and SJC gold witnessing a unanimous decline today.