|

Khang An Company, originally established as Ninh Binh Goat Milk Limited Liability Company on February 12, 2018, rebranded to its current name in July 2023. The company is headquartered at Xuan Thien Building, Xuan Thanh Urban Area, Ninh Binh Province. Since its inception, the company has maintained a charter capital of 1,000 billion VND. According to the latest business registration in June 2025, the shareholder list includes Ms. Thai Kieu Huong (50.5%), Mr. Nguyen Van Thien, Chairman of Xuan Thien Group (45%), and Mr. Do Viet Tap, CEO and Legal Representative (4.5%). |

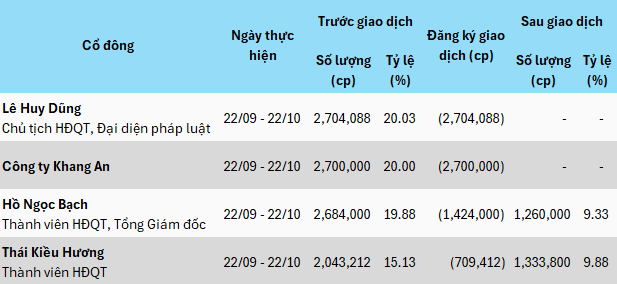

Among the shareholders, Mr. Le Huy Dung, Chairman of the Board and Legal Representative, and Khang An Agricultural Trading LLC have registered to sell their entire holdings of 2.7 million shares (20.03%) each.

Two additional shareholders seeking to divest are Mr. Ho Ngoc Bach, Board Member and CEO, who plans to sell over 1.4 million shares, reducing his stake from 19.88% to 9.33%, and Ms. Thai Kieu Huong, Board Member, who intends to sell over 709,000 shares, lowering her stake from 15.13% to 9.88%.

Collectively, these four shareholders have registered to sell over 7.5 million shares, representing 55.83% of XTSC’s capital. All transactions will be conducted through asset restructuring agreements.

|

Four XTSC Shareholders Plan to Transfer Significant Stakes

Source: XTSC, compiled by the author

|

The capital transfer is scheduled for September 22 – October 22, while XTSC will finalize its shareholder list on September 26 for a rights issue. This offering includes 135 million shares (1:10 ratio) for existing shareholders. The transfer of purchase rights will occur from September 27 – October 8, with subscription and payment from September 27 – October 15.

Priced at 10,000 VND per share, XTSC aims to raise 1,350 billion VND, allocated as follows: 60% for margin lending (810 billion VND), 5% for advance payments (67.5 billion VND), 30% for proprietary trading (405 billion VND), and 5% for working capital (67.5 billion VND). Funds are expected to be utilized in 2025 and 2026.

As of August 4, when XTSC’s Board approved the rights issue, the shareholder list included 62 investors, with six major shareholders: Mr. Le Huy Dung (20.03%), Khang An Agricultural Trading LLC (20%), Mr. Ho Ngoc Bach (19.88%), Ms. Thai Kieu Duong (15.13%), Mr. Vo Van Von (9.9%), and Fico Corporation (5%).

This list is likely to change once the transfers are completed.

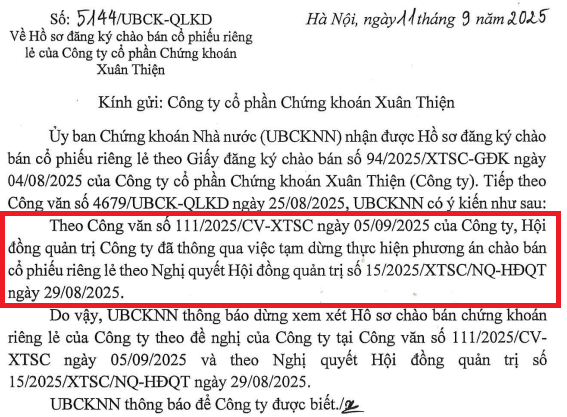

Private Placement Postponed, 3,000 Billion VND Capital Plan on Hold

In addition to the rights issue, XTSC previously approved a private placement of 151.5 million shares to raise 1,515 billion VND. However, the State Securities Commission’s September 11 notice halted the review due to XTSC’s decision to suspend the plan.

XTSC Suspends Private Placement Plan – Source: XTSC

|

Consequently, XTSC will only increase its capital from 135 billion VND to 1,485 billion VND, instead of the initially planned 3,000 billion VND. This decision is surprising, as the company previously stated that 3,000 billion VND was appropriate for current conditions.

– 16:53 18/09/2025

LPBS Offers 878 Million Shares to Shareholders

LPBS is set to launch an offering of 878 million shares to existing shareholders, commencing on September 15 and concluding on October 15, 2025. Upon successful completion, the company’s chartered capital is projected to rise to 12,668 billion VND.

Dragon Capital Securities: Eight Investors Poised to Acquire 48 Million Individual Shares

Dragon Capital Securities has announced a private placement of 48 million shares, representing 17.65% of its total outstanding shares, to be offered exclusively to eight select investors.