At Resolution 283 dated September 16, 2025, during the specialized session on legislative development in August 2025, the Government agreed on the necessity of drafting a policy dossier for the amended Tax Administration Law. This aims to institutionalize the Party’s guidelines and the State’s policies.

The Government directs several tax management issues for business households when drafting the amended Tax Administration Law.

Simultaneously, the Government aims to refine the organizational structure of tax administration, establish a legal framework for digital transformation, streamline administrative procedures, enhance decentralization, and combat tax evasion. These efforts are designed to meet practical demands and support socioeconomic development in the coming period.

The Government approved eight policy proposals submitted by the Ministry of Finance in Reports No. 481 and 482 dated August 10. The Ministry of Finance is tasked with integrating content related to information technology applications from Policy 8 into other policy groups.

The Government has assigned the Ministry of Finance to lead and collaborate with relevant ministries and agencies. Their responsibilities include researching, maximizing the absorption of feedback from Government members and meeting attendees, and further refining the draft law.

Policies should be framed as a principle-based legal framework, outlining only the content within the National Assembly’s jurisdiction. Detailed and specialized content will be delegated to the Government for regulation.

Thorough reviews of policy content will ensure alignment with the Constitution and related laws, including the Land Law, Electronic Transactions Law, Value-Added Tax Law, Corporate Income Tax Law, and Inspection Law.

Regarding business household management, the Government mandates that the Ministry of Finance conduct a more thorough impact assessment. This ensures that alternative solutions, such as electronic declarations and invoices, are feasible, with a reasonable transition timeline to minimize disruption to citizens’ business activities.

During the drafting process, emphasis should be placed on enhancing decentralization and accountability among leaders. Proposed amendments and additions must align with regulations on decentralization, authority delineation, and the organization of two-tier local governments. Clear definitions of state management responsibilities for local authorities are essential.

Efforts should also focus on reducing and simplifying administrative procedures. The application of information technology and database development will modernize and streamline tax management processes.

Deputy Prime Minister Hồ Đức Phớc has been tasked with overseeing the development and finalization of the Law.

According to the Ministry of Finance, Vietnam currently has over 5.2 million business households, generating 8–9 million jobs across diverse sectors. If just 20% of these households transition into enterprises, approximately 1 million new businesses would be added to the economy. This would effectively achieve the goals outlined in Resolution 68-NQ/TW dated May 4, 2025, by the Politburo, targeting private sector development by 2030.

In line with the Politburo’s Resolution 68 on private sector development, lump-sum tax payments will be eliminated starting in 2026. This shift will introduce self-declaration and tax payments based on actual revenue, enhancing tax management transparency. However, this transition also presents significant challenges for business households.

Ultimate Data Cleansing for Real Estate

The Ministry of Agriculture and Environment is racing to cleanse data for 49.7 million land plots, while the Ministry of Construction is accelerating the upgrade of its housing information system. Both agencies are intensifying their efforts to “purify” data within this year.

Deputy Prime Minister: Government Secures Funding for Universal Healthcare Exemption

On the morning of September 16th, during the National Conference on Implementing the Political Bureau’s Resolutions, Deputy Prime Minister Lê Thành Long presented Topic 2, focusing on the key and core contents of Resolution No. 72-NQ/TW dated September 9, 2025, issued by the Political Bureau. This resolution outlines breakthrough solutions to enhance the protection, care, and improvement of the people’s health, along with the Government’s Action Plan to implement it.

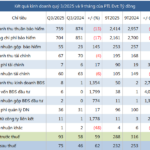

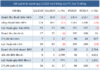

Unveiling VPBank’s New Super Profit Premier Edition

Building on the success of its Super Profit tool, VPBank has recently upgraded and launched a new, superior version: Super Profit Premier. This enhanced version guarantees 24/7 deposit and withdrawal access for customers, while also expanding yield limits to deliver even more flexible and highly efficient financial experiences.