The Hanoi Stock Exchange (HNX) has recently published an official announcement regarding the principal and interest payment status of bonds issued by Novaland Group (Novaland, Stock Code: NVL, listed on HoSE).

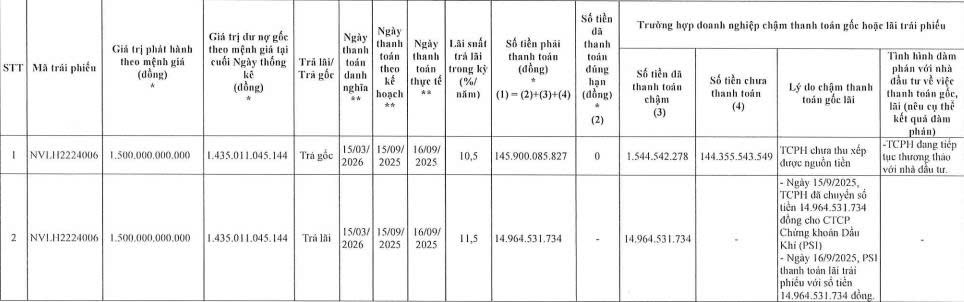

According to the schedule, on September 15, 2025, Novaland was expected to pay over VND 145.9 billion in principal and nearly VND 15 billion in interest for the bond series NVLH2224006. However, the company has only managed to pay approximately VND 15 billion in interest and more than VND 1.5 billion in principal, leaving nearly VND 144.4 billion in principal unpaid.

The bond series NVLH2224006, with a total issuance value of VND 1,500 billion, was issued from March 15, 2022, until its completion on June 13, 2022.

Source: HNX

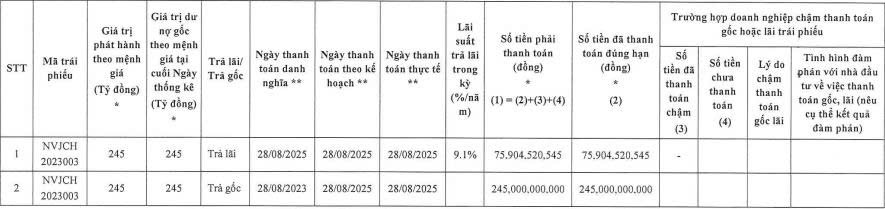

Previously, on August 28, 2025, Novaland successfully paid VND 245 billion in principal and over VND 75.9 billion in interest for the bond series NVJCH2023003, fully settling this bond series.

This bond series, issued on August 28, 2020, had a total issuance value of VND 245 billion, a 36-month term, and was originally set to mature on August 28, 2023. In 2023, bondholders agreed to extend the maturity by 24 months, setting the new maturity date as August 28, 2025.

In other developments, Novaland recently announced a Board of Directors resolution approving the implementation of a debt-to-equity swap plan, previously endorsed by the General Meeting of Shareholders.

Specifically, the company plans to issue over 168 million private placement shares at VND 15,746.667 per share to swap for a total debt of nearly VND 2,645.7 billion owed to three creditors: NovaGroup (VND 2,527 billion), Diamond Properties (VND 111.7 billion), and Ms. Hoàng Thu Châu (VND 6.676 billion).

The swap ratio is set at VND 15,746.667 per share, meaning each VND 15,746.667 of debt will be converted into one newly issued share. The expected allocation is 160.5 million shares for NovaGroup, 7.1 million shares for Diamond Properties, and 424,000 shares for Ms. Châu.

The issuance is planned for Q4/2025 – Q1/2026, with the exact timeline to be determined by the Board of Directors upon receiving approval from the State Securities Commission for the private placement registration file.

Truong Loc Real Estate Settles Nearly VND 2 Trillion in Principal and Interest on Bond Payments

Truong Loc Real Estate has successfully repaid a total of nearly VND 2 trillion in principal and interest for the TLOCB2425001 bond issuance.

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”

Raising $73 Million for the DatXanhHomes Parkview Project: An Ambitious Venture by Dat Xanh

“With a strategic move, Dat Xanh Group plans to offer 93.5 million private shares to raise an impressive VND 1,739.1 billion. This bold initiative aims to fuel the development of their flagship project, DatXanhHomes Parkview. This move underscores the company’s confidence and ambition in the Vietnamese market, as they seek to revolutionize the real estate landscape with this groundbreaking endeavor.”

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-218x150.png)

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-150x150.png)

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-100x70.png)