Distinguishing Speculation from Accumulation

The government has recently issued Resolution 278 from the September 2025 specialized legislative session. In relation to the draft Law on Personal Income Tax (amended), the government mandates clear provisions stating that income from gold trading activities is subject to taxation. The Ministry of Finance is tasked with coordinating with the State Bank to unify this content in the draft law.

Experts support the imposition of personal income tax on gold transactions but emphasize the need for categorization and a phased implementation. Photo: Như Ý

This proposal has sparked concern among gold holders. Mr. Nguyễn Đức, an employee at a foreign company in Hanoi, shared that he allocates a portion of his monthly salary to purchase gold for retirement savings. “I have a high income and already pay personal income tax. With the remaining salary, I accumulate gold for retirement and my children’s future. If personal income tax is applied when I sell the gold, will it result in double taxation? I hope authorities will find a balanced solution,” Mr. Đức suggested.

On September 17th, SJC gold bars were quoted at VND 130-132.3 million per tael (buy-sell), while smooth gold rings were priced at VND 126-130 million per tael. Global gold prices stood at USD 3,677 per ounce, approximately VND 17 million per tael lower than domestic prices. Compared to early 2025, domestic gold prices have surged by over VND 40 million per tael, making it an attractive investment channel relative to others.

Speaking with Tiền Phong, Mr. Nguyễn Quang Huy (Department of Finance and Banking, Nguyễn Trãi University) noted that gold has long held a special place in Vietnamese life. It serves both as a traditional store of value, rooted in the mindset of “saving for a rainy day,” and as an investment vehicle during price fluctuations. In recent years, as gold prices have soared, its profit-making potential has gained prominence, leading to more speculative transactions. In this context, studying the application of personal income tax on gold transactions is a necessary step to enhance market transparency and stability.

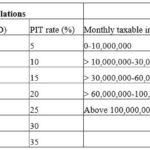

“The implementation of personal income tax on gold transactions requires careful consideration. Taxes should only be levied on profits from price differences between buying and selling, rather than on the entire transaction value. A suitable tax exemption threshold should be established to ensure that individuals selling small amounts for significant family needs are not burdened. This approach ensures fairness and focuses regulation on speculative or business-oriented transactions,” Mr. Huy recommended.

According to Mr. Huy, authorities should consider the holding period. Exempting or reducing taxes for long-term gold holdings would encourage stable accumulation, reducing short-term trading pressure. Repeated, large-volume transactions could be classified as business activities and taxed at higher rates, aligning with their nature.

Tax expert Nguyễn Văn Phụng observed that conditions for imposing personal income tax on gold are increasingly met, as most gold transactions now involve invoices and bank transfers. With technological and banking system support, tracing funds and determining gold profits is entirely feasible.

However, Mr. Phụng cautioned that the origin of gold must be clearly distinguished. Inherited, gifted, or long-accumulated gold should not be taxed like short-term investment gold. This distinction is crucial to prevent unfairness, confusion, and negative public reactions.

Restoring Fairness Among Asset Classes

Dr. Châu Đình Linh (Ho Chi Minh City Banking University) noted that from a tax policy perspective, gold has long been outside the “taxable zone,” despite potentially yielding profits comparable to stocks or real estate. According to Dr. Linh, gold investment profits are similar to those from other financial assets. Applying taxes would restore fairness within the tax system.

Dr. Linh highlighted that the significant spread between gold buying and selling prices has facilitated speculative profiteering. From before the 2025 Lunar New Year to the present, the market has witnessed multiple large-scale speculative waves, distorting domestic gold prices relative to global levels.

“Tax policies must clearly differentiate between accumulation and investment, between gold sales for personal use and speculative activities. It is inappropriate to categorize all gold transactions as speculative and impose blanket taxes. Such an approach would not only provoke backlash but also distort policy objectives,” Dr. Linh stated.

While supporting personal income tax on gold transactions, experts agree that this is not a standalone solution. Stabilizing the gold market and narrowing the domestic-global price gap also depend on other factors, such as increasing the supply of legal gold within the country.

Mr. Nguyễn Quang Huy emphasized that in the long term, taxes are just one tool. To sustainably curb speculation, it is essential to create safer, more transparent, and attractive investment alternatives, such as gold certificates, digital gold accounts, gold ETFs, and enhance the appeal of savings and bonds. Transparent price information, effective supply management, and gold business regulation are also indispensable.

“Personal income tax on gold transactions should be designed with balance and clarity: targeting speculators while safeguarding small-scale accumulators. Such a policy would not only enhance market transparency and stability but also strengthen societal trust and foster sustainable financial system development,” Mr. Huy added.

Finance Ministry: Tax Exemption for Public Sector Employees Likely to Spark Backlash

During the consultation process for the draft amendment to the Personal Income Tax Law, the Ministry of Public Security proposed exempting personal income tax on salaries funded by the state budget. However, the Ministry of Finance argued that the regulation should apply uniformly to all individuals whose income reaches the taxable threshold, as any deviation could provoke public backlash.