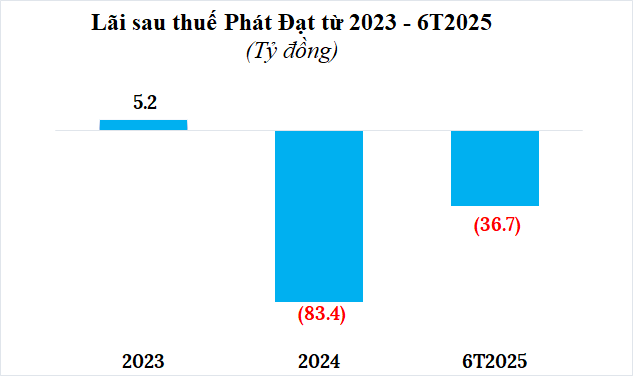

According to a report submitted to the Hanoi Stock Exchange (HNX), Phat Dat Real Estate Development and Investment Company Limited (Phat Dat) continued to incur a loss of nearly VND 37 billion in the first six months of 2025. The previous year, Phat Dat recorded a loss of over VND 83 billion, while in 2023, it achieved a modest profit of more than VND 5 billion.

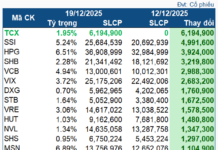

Source: Compiled by the author

|

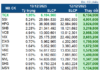

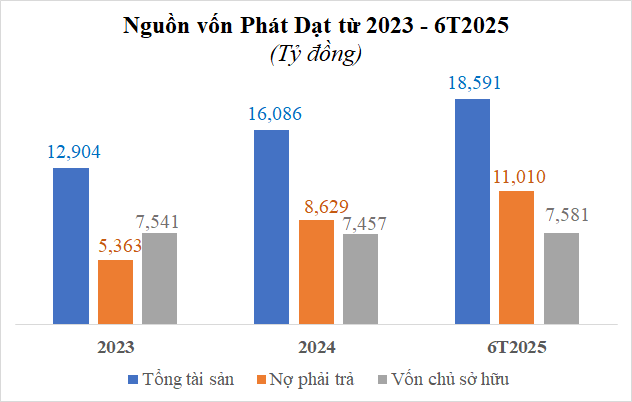

With the continued losses, the company’s accumulated deficit reached nearly VND 115 billion by the end of June. Total assets stood at approximately VND 18.6 trillion, an 18% increase compared to the first half of 2024. Equity attributable to owners of the parent company reached nearly VND 7,581 billion, a 1% increase.

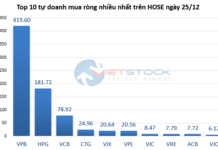

Source: Compiled by the author

|

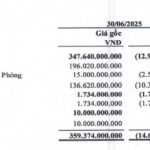

Meanwhile, total liabilities exceeded VND 11 trillion, a 35% increase. The primary reason was the surge in bank loans from VND 860 billion to over VND 2,900 billion, along with a bond loan of nearly VND 3,374 billion. In contrast, other payables decreased significantly by 36%, amounting to nearly VND 4,727 billion. The company also paid nearly VND 209 billion in interest to bondholders during the first half of the year.

The bond debt primarily stems from the PDACB2425001 batch, with a total value of VND 3,490 billion, an interest rate of 12% per annum, issued on September 12, 2024, with a one-year term, which matured on September 12, 2025.

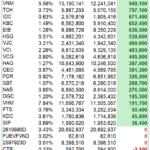

Phat Dat was established by Vinhomes JSC (HOSE: VHM) in March 2023, with a charter capital of over VND 7,008 billion, along with Truong Loc Real Estate Development and Investment Company Limited (charter capital of nearly VND 4,425 billion). VHM holds 99.9% of the capital in both companies.

In March 2023, VHM completed the transfer of 98.9% of its capital contributions in the two companies to partners for a total transfer value of VND 11,307 billion. VHM recorded a profit of VND 8,366 billion from these transactions.

From October to November 2023, VHM contributed additional capital to Phat Dat in the form of real estate, with a total value of VND 527.5 billion, thereby increasing its ownership stake to 7.93%. Currently, the company has a charter capital of nearly VND 7,696 billion, with Ms. Bui Thi Mai serving as the General Director and legal representative.

– 2:33 PM, September 17, 2025

HQC Chairman Truong Anh Tuan to Transfer Hoang Quan Binh Thuan Shares to Atesco

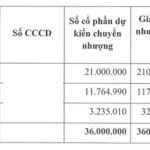

The Board of Directors of ATS Investment Group Corporation (Atesco, HNX: ATS) has approved a private placement plan to issue 36 million shares to nine individual investors. The offering price is set at VND 10,000 per share, half of the current market price, expected to raise VND 360 billion and increase the charter capital from VND 350 billion to VND 710 billion.

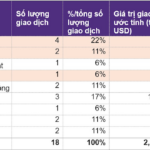

Vietnam’s August M&A Deals Surge Past $2.2 Billion with 18 Major Transactions

Strategic M&A deals continue to dominate the market in terms of volume, while the total transaction value for the month was primarily driven by corporate restructuring deals (78%).

Shocking Twist in ‘Mistaken Construction’ on Red Book Land: Landowner Reveals Startling Details

A landowner in Thien Huong Ward, Hai Phong City, claims their plot was unlawfully seized by strangers who brazenly constructed a house on it. The owner suspects the trespassers intentionally claimed a “mistaken build” to circumvent the property’s proximity to a grave, a factor that could devalue the land.