Once confined to Hanoi’s Old Quarter in Hoan Kiem District, the price of VND 1 billion per square meter is now commonplace across many other areas of the city.

For instance, a 12-story house on Lang Ha Street (Lang Thuong Ward) with 242 sqm and a 22-meter frontage is listed for VND 259.9 billion, equivalent to VND 1.07 billion per sqm. This is an unprecedented price for this neighborhood.

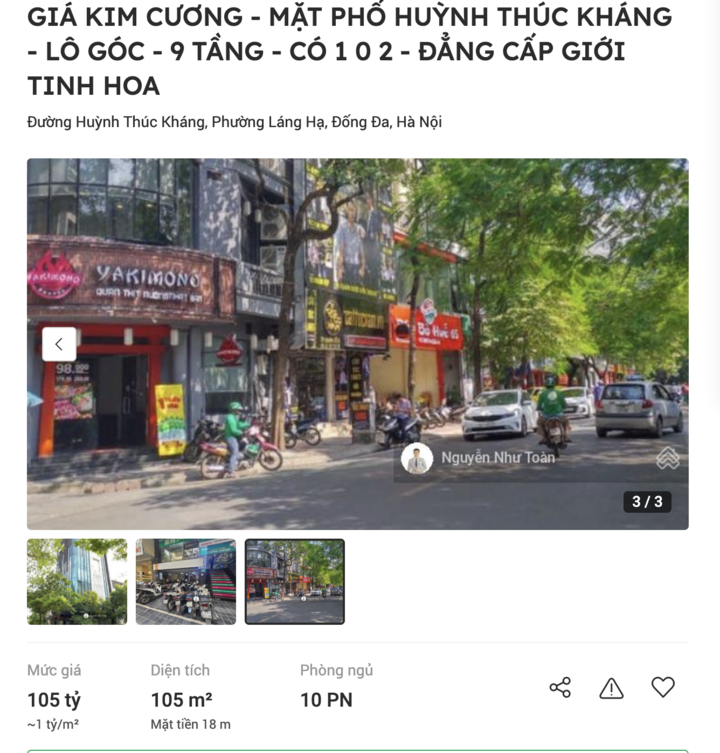

Similarly, a 9-story house on Huynh Thuc Khang Street (Lang Ha Ward) with 105 sqm and an 18-meter frontage is priced at VND 105 billion, or VND 1 billion per sqm. Another property on the same street, with 85 sqm, is listed for VND 115 billion, averaging VND 1.35 billion per sqm.

On Xa Dan Street (Nam Dong Ward), an 8-story house with 131 sqm and a 12-meter frontage is available for VND 147 billion, or VND 1.12 billion per sqm.

A house on Huynh Thuc Khang Street listed at VND 1 billion per sqm. (Screenshot)

On Thai Ha Street (Trung Liet Ward), a 5-story townhouse with 26 sqm is priced at VND 24.5 billion, nearly VND 1 billion per sqm. Another 6-story property with 70 sqm is listed for VND 72 billion, or VND 1.03 billion per sqm.

Chua Boc Street now features multiple properties priced between VND 950 million and over VND 1 billion per sqm. Just over a year ago, prices here ranged from VND 720 to 810 million per sqm. One 89 sqm property is currently listed for VND 106 billion, averaging VND 1.19 billion per sqm.

In Hoan Kiem District’s historic areas like Hang Ngang, Hang Dao, and Hang Gai, prices have long exceeded VND 1 billion per sqm, with some reaching nearly VND 2 billion per sqm.

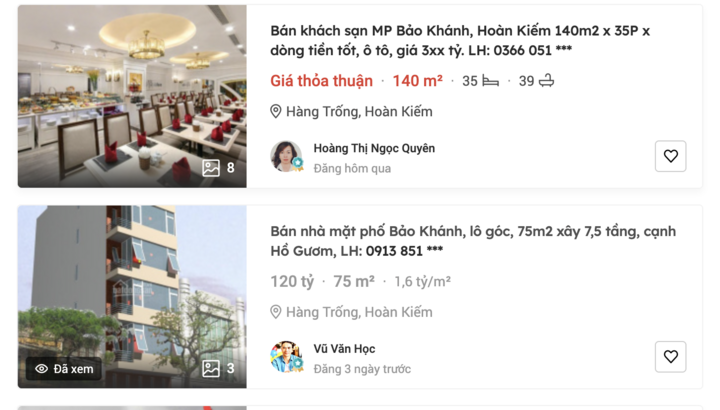

On Bao Khanh Street (Hang Trong Ward), a 70 sqm property with three frontages is listed for VND 125 billion, or VND 1.79 billion per sqm. Another 75 sqm, 7-story house is priced at VND 120 billion, averaging VND 1.6 billion per sqm.

Bao Khanh Street, where prices range from VND 1.6 to 1.7 billion per sqm. (Screenshot)

Despite high prices, supply in this segment is scarce, with only 1-2 properties available per major street, according to brokers.

Transactions are also challenging, as properties priced in the hundreds of billions are only suitable for a select few investors with substantial capital. These investors are in no rush to buy or sell, resulting in extremely slow liquidity.

Additionally, while investment costs are high, rental yields are modest. For example, a VND 200 billion property on Lang Ha Street may only rent for VND 30-50 million per month.

Beware the Risk of Capital Lock-In

Explaining the surge in street-front property prices, Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, notes that Hanoi’s street-front properties remain a resilient and highly valuable segment, even in downturns. These properties are particularly sensitive to rental potential.

Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association, adds that despite their high cost, central commercial properties in Hanoi consistently attract investor interest. Over time, their scarcity drives significant value appreciation compared to other investment channels.

However, street-front properties are suited only to investors with substantial capital and long-term vision. While they offer strong price growth and liquidity, their high cost poses a real risk of capital lock-in. Investors are strongly advised against leveraging debt for such investments.

Another key point is that while street-front properties retain value well, their price growth is slower than other segments. During market upswings, other segments may rise 30-100% annually, while street-front properties typically increase by 15-20%.

Nguyen The Diep, Vice Chairman of the Hanoi Real Estate Club, believes that street-front and whole-house properties are ideal for safe, stable capital preservation as the market recovers.

Diep notes that these properties’ high prices, often tens of billions per unit, limit their buyer pool. To maximize returns, buyers should thoroughly research legal and construction quality. Once purchased, renting or leveraging the property for business can enhance profitability.

Experts advise investors to prioritize properties with stable cash flow over mere price appreciation. A property generating VND 100-200 million monthly in rent can maintain value even in a cooling market.

Unlocking Long Xuyên’s Real Estate Potential

Once considered a relatively quiet real estate market compared to other major cities in the Western region, Long Xuyên is now experiencing a powerful resurgence, capturing the attention of investors. This transformation is fueled by two golden factors: a revolutionary upgrade in transportation infrastructure and a robust foundation in the service-based economy.

Revitalizing Dead Rivers: A Trillion-Dollar Transformation to Green Waterways and the Rise of Riverfront Projects

After investing over 16,000 billion VND in constructing a massive wastewater treatment plant and an extensive sewage collection system, Hanoi is now allocating hundreds of billions more to build pipelines channeling water from the Red River and West Lake. This ambitious project aims to permanently transform the color and quality of the To Lich River.

Unveiling Chairman Truong Anh Tuan’s Partner in Acquiring Hoang Quan Binh Thuan Shares

ATS Investment Group is set to acquire a 90% stake in Hoang Quan Binh Thuan from three shareholders, including HQC Chairman Truong Anh Tuan.