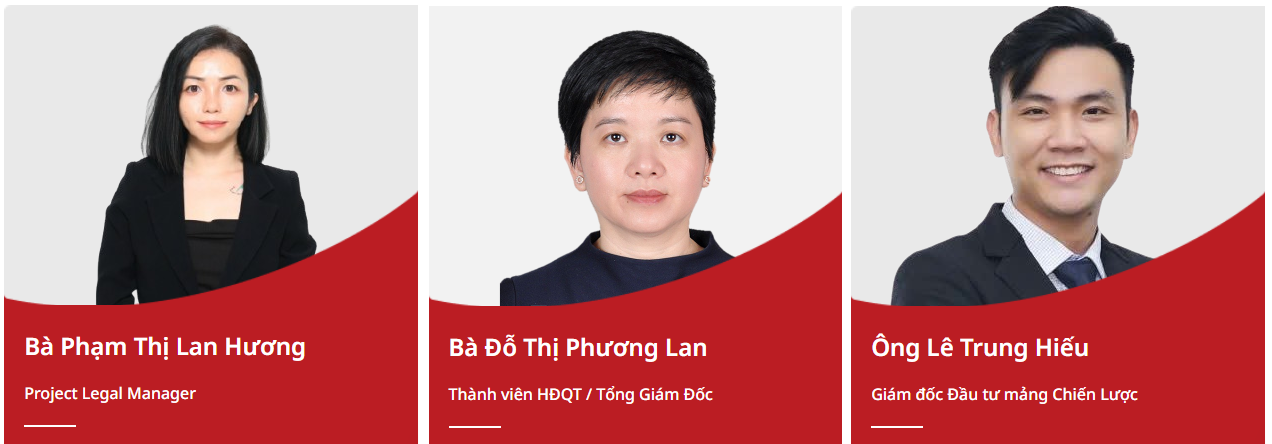

The resignation letters of Ms. Do Thi Phuong Lan and Ms. Pham Thi Lan Huong both indicate that they no longer find their roles suitable for the upcoming phase, citing changes in the company’s development direction alongside personal reasons. Meanwhile, Mr. Le Trung Hieu’s resignation is attributed to personal reasons.

All resignation letters express the desire to step down effective September 12th, pending approval at the nearest shareholders’ meeting.

In reality, all three resigning individuals held significant positions at Red Capital Investment Fund Management JSC, a company closely affiliated with SEA.

As of June 30, 2025, according to SEA’s 6-month report, Ms. Do Thi Phuong Lan serves as a Board Member and CEO of Red Capital. She also holds key roles in various organizations, including Capital Contributor at VLCC LLC (a major shareholder with over 48.6% of Red Capital’s equity); Board Member at Refico, TEDI, and Fecon Invest.

Historically, Ms. Phuong Lan served as Chairwoman and CEO of Gelex Land (2017–6/2020), overseeing real estate investment and development. She was also Vice Chairwoman of GELEX Group (2017–2020).

In 2022, Red Capital highlighted her role in advising Novaland Group’s restructuring and representing the company’s challenges at a State Bank meeting on February 8, 2023.

In the fund management sector, she previously held positions as Deputy Investment Director at Fund A2 and Investment Analysis Director at Thanh Viet Fund Management (7/2007–12/2010).

Similarly, Mr. Le Trung Hieu serves as Strategic Investment Director at Red Capital, with 15 years of experience at Mapletree, Deloitte, and PwC, specializing in investment, asset management, and capital markets.

Ms. Pham Thi Lan Huong, Legal Project Manager at Red Capital, brings over 10 years of expertise in real estate, M&A, and project development.

Three SEA leaders resigning held key roles at Red Capital – Image: Red Capital

|

As of June 30, 2025, Red Capital holds 18 million SEA shares (14.4%), ranking among the top three shareholders alongside SCIC (63.38%) and GEX (9.52%).

However, both Red Capital and GEX recently exited their major shareholder positions. On August 22nd, GEX sold nearly 8.9 million SEA shares, reducing its stake to 2.42%. Red Capital divested its entire 18 million shares between August 14th and 22nd.

Notably, on August 22nd, S.S.G Group acquired 14.9 million SEA shares (11.92%), potentially receiving transfers from Gelex and Red Capital.

During these transactions, SEA’s share price fluctuated significantly, peaking at VND 48,000 before stabilizing at VND 40,000. From the year’s start to September 16th (VND 48,000), SEA’s price rose over 9%.

SEA operates across multiple sectors, focusing on seafood while expanding into real estate. In H1 2025, the company reported VND 336 billion in revenue and VND 107 billion in net profit, both up over 8% year-on-year.

– 13:58 17/09/2025