Significant Growth Potential

In the latest update, Vietcap Securities (stock code: VCI) forecasts robust disbursement and construction activities for highways in the remaining months of the year. This will bolster the asphalt output of Petrolimex Petrochemical Joint Stock Corporation (stock code: PLC) in the second half of the year.

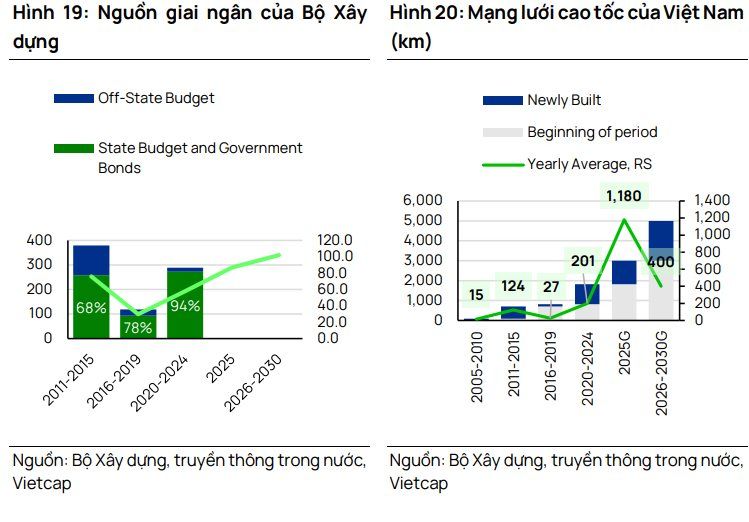

In the first eight months of the year, the Ministry of Construction disbursed 40.8 trillion VND, completing 49% of the annual plan. Vietcap predicts that full-year disbursement will reach only 41–42%, meaning nearly 60% of the capital will be carried over to 2026. Delayed disbursement shifts the workload to next year, sustaining high demand for construction and asphalt in 2026.

Additionally, highway development is a key growth driver for PLC. As of August 2025, Vietnam has commissioned 2,476 km of highways, adding 656 km since the beginning of the year (56% of the annual plan). Vietcap estimates that the total length completed in 2025 could reach 991 km (84% of the plan), bringing the national total to approximately 2,800 km by year-end.

Project momentum is also strengthening, with several new projects expected to peak in 2026. The Ministry of Construction has outlined 18 projects to commence in 2025, with 9 starting before August and the remainder slated for Q4/2025. These include major highway and tunnel projects transitioning to the construction phase in 2026–2027.

Furthermore, the Prime Minister approved a new list of national key projects in August 2025, featuring new highways like Chợ Mới–Bắc Kạn, Bắc Kạn–Cao Bằng, Quảng Ngãi–Kon Tum, and Cà Mau–Đất Mũi, along with expansions of existing routes such as Hòa Lạc–Hòa Bình and TP.HCM–Trung Lương–Mỹ Thuận. This workload ensures continuity and acceleration of activities in 2026.

2025 Net Profit Could Surge Nearly 200% Year-on-Year

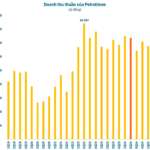

Vietcap projects PLC’s asphalt sales volume to reach 1.6 million tons in 2025–2029 (+25% compared to 2020–2024).

For 2025 specifically, Vietcap analysts forecast a net profit after tax for the parent company’s shareholders of 126 billion VND, up 193% year-on-year.

In 2026, Vietcap expects profits to climb further to 252 billion VND, a nearly 100% increase, primarily driven by the asphalt segment. Sales volume is projected to rise by 10% amid increased public investment in Vietnam, while margins are expected to expand by 2.2 percentage points due to reduced competition from Iranian asphalt and lower oil prices.

This enables PLC to benefit from lower input costs while focusing on higher-value products for key infrastructure projects, which yield better margins.

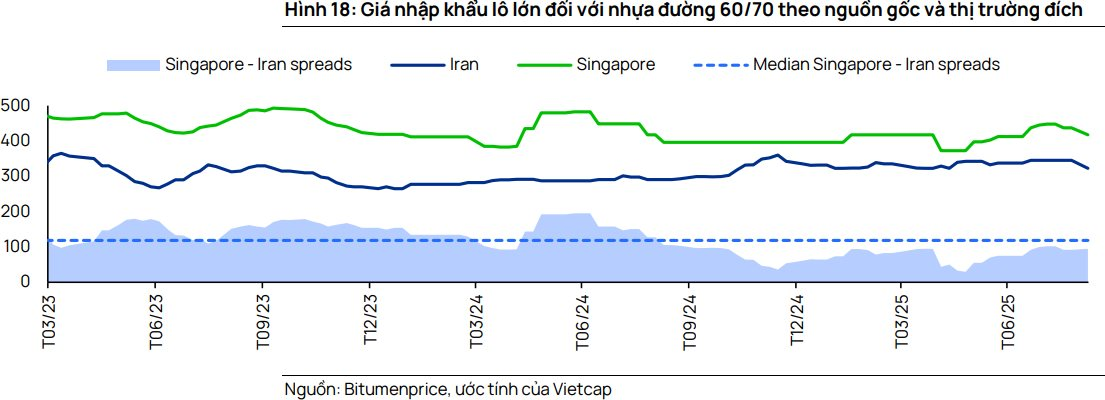

Globally, the price gap between Singapore and Iranian asphalt narrowed to 76 USD/ton in the first eight months of 2025 (-48% YoY). This trend enhances PLC’s cost competitiveness relative to Iranian imports, as PLC relies heavily on Singapore as a primary import source.

With infrastructure demand expected to rise from 2025 onward, Vietcap believes PLC is well-positioned to leverage this cost advantage, gain market share, and restore margins as the competitive gap with Iranian suppliers narrows.

The Billionaire’s Bet: VinFast’s Endless Funding Assurance.

Beyond the philanthropic donation, billionaire Pham Nhat Vuong also orchestrated a subsidiary share transfer deal worth over VND 1,800 billion.