I. MARKET DYNAMICS OF WARRANTS

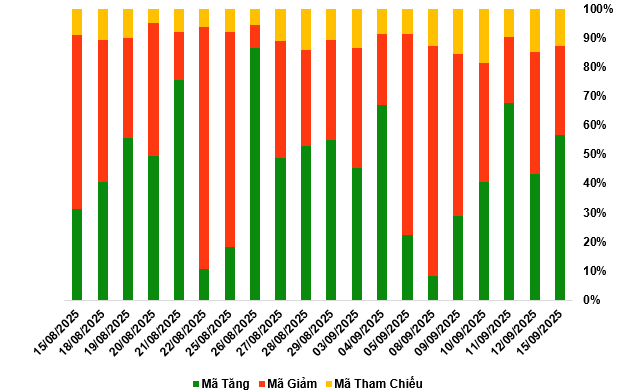

By the close of trading on September 15, 2025, the market recorded 147 gainers, 79 decliners, and 33 unchanged stocks.

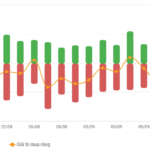

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

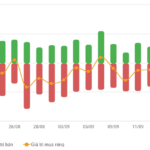

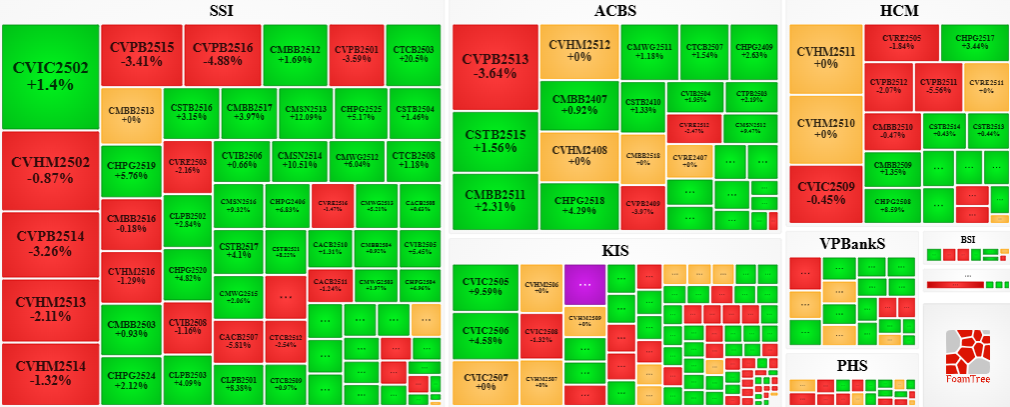

During the September 15, 2025 session, buyers maintained control, driving most warrant prices higher. Notable gainers included CVIC2502, CVHM2502, CHPG2518, and CMBB2511.

Source: VietstockFinance

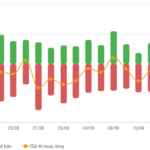

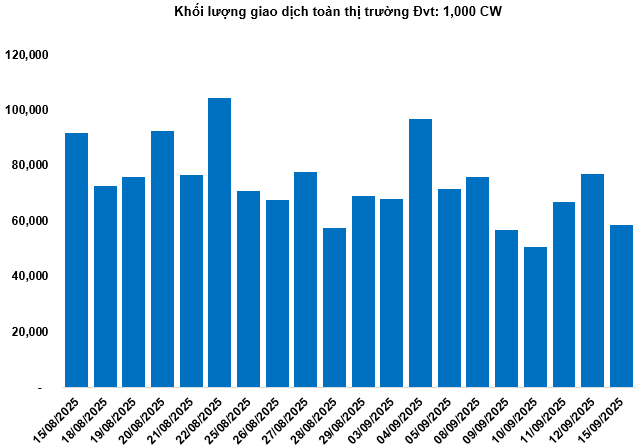

Total market volume on September 15 reached 58.42 million CW, down 24.1%; trading value hit VND 149.36 billion, a 19.2% decrease from September 12. CMSN2514 led in both volume and value, with 1.96 million CW traded, totaling VND 8.51 billion.

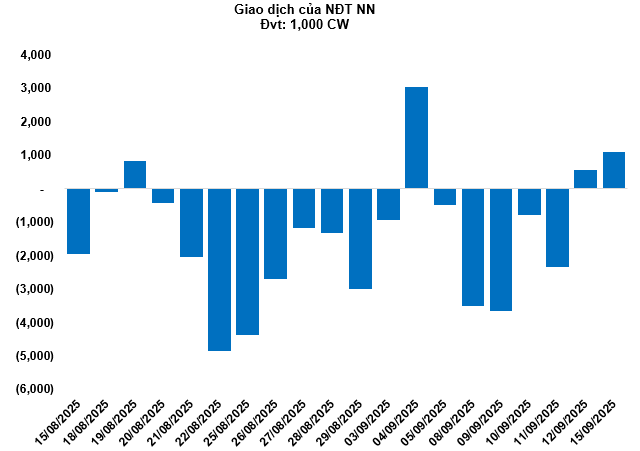

Foreign investors continued net buying on September 15, totaling 1.09 million CW. CMSN2506 and CMSN2508 were the most net-bought warrants.

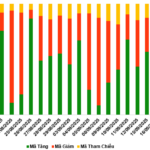

Securities firms SSI, ACBS, HCM, KIS, and VPBankS currently issue the most warrants in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

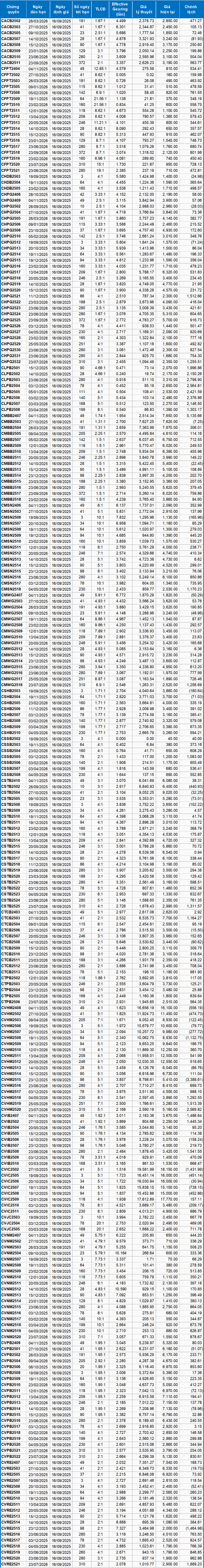

Using a valuation method effective from September 16, 2025, the fair prices of traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVHM2515 and CVRE2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CVNM2512 and CVNM2504 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 September 15, 2025

Vietstock Daily 17/09/2025: Market Shakes at the 1,700-Point Threshold

The VN-Index retreated after facing profit-taking pressure at its August 2025 peak and early September 2025 highs (around 1,690–1,711 points). Volatility near this resistance zone is likely to persist in the short term. Should selling pressure dominate, the short-term trendline support (approximately 1,635–1,650 points) will be critical for the index.

Vietstock Daily 19/09/2025: Market Volatility Persists – Can Stability Be Regained?

The VN-Index swiftly narrowed its decline and closed just above the Middle Bollinger Band. This indicates that the short-term trendline (ranging between 1,645 and 1,660 points) continues to effectively support the index. However, with trading volume showing no signs of improvement, expectations for a short-term breakout or surge remain low.

Vietstock Daily 18/09/2025: Cautious Sentiment Prevails?

The VN-Index persists in its corrective phase, with trading volumes remaining below the 20-day average for seven consecutive sessions, reflecting investors’ cautious sentiment. However, short-term risks appear manageable as the Stochastic Oscillator has generated a buy signal, and the short-term trendline (equivalent to the 1,635-1,650 point range) continues to provide robust support.

September 18, 2025: A Mixed Bag for the Warrant Market

As the trading session closed on September 17, 2025, the market witnessed 68 stocks advancing, 159 declining, and 32 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 3.93 million CW units.