I. MARKET DYNAMICS OF WARRANT CERTIFICATES

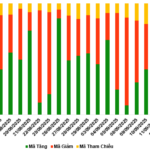

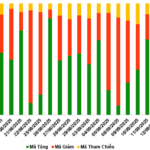

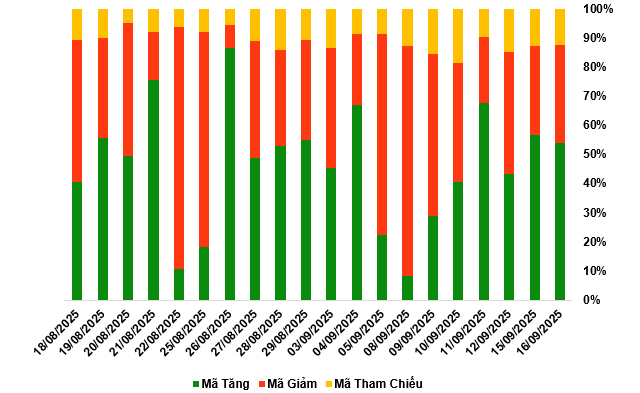

By the close of trading on September 16, 2025, the market recorded 140 advancing codes, 87 declining codes, and 32 unchanged codes.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

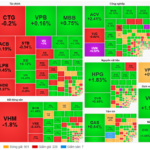

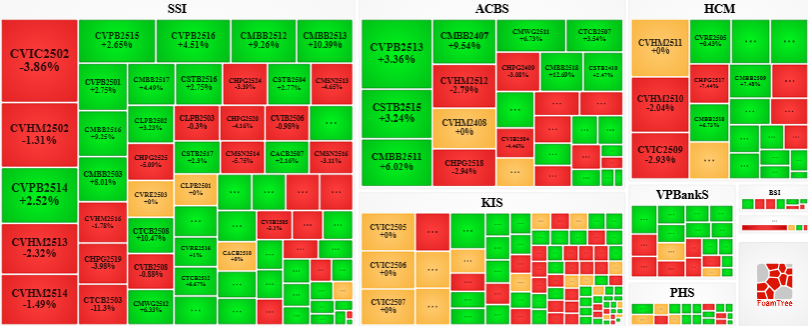

During the September 16, 2025 trading session, buyers continued to dominate the market, driving up the prices of most warrant certificates. Notably, the top gainers included CVPB2513, CSTB2515, CMWG2511, and CMBB2511.

Source: VietstockFinance

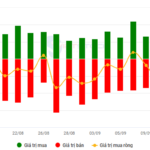

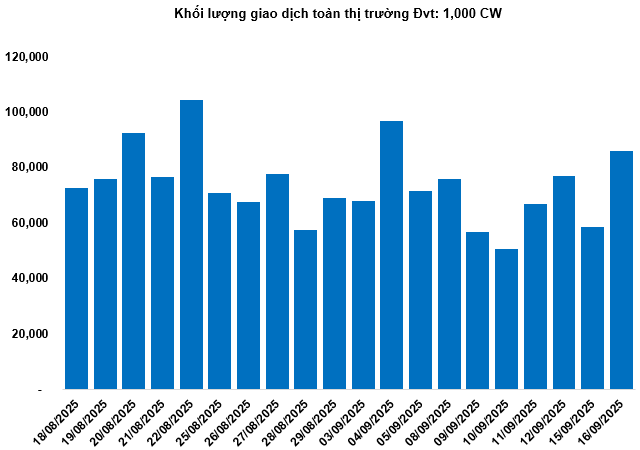

Total market volume on September 16 reached 85.96 million CW, a 47.14% increase, while trading value hit 223.45 billion VND, up 49.59% compared to September 15. CFPT2512 led in volume with 5.88 million CW, and CVIB2504 topped in trading value at 10.11 billion VND.

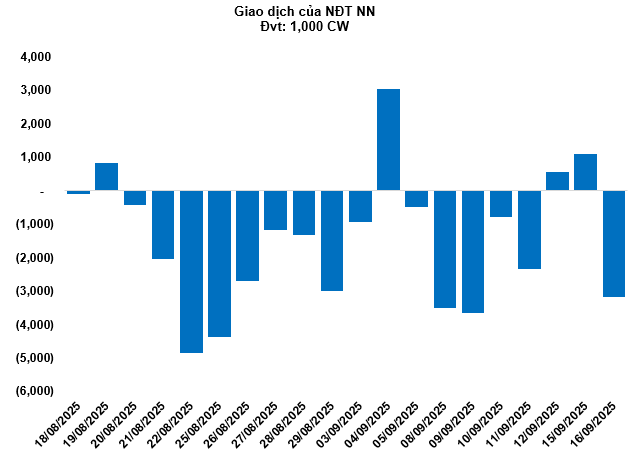

Foreign investors resumed net selling on September 16, totaling 3.18 million CW. CMSN2517 and CMSN2508 were the most heavily sold.

Securities firms SSI, ACBS, HCM, KIS, and VPBankS currently issue the most warrant certificates in the market.

Source: VietstockFinance

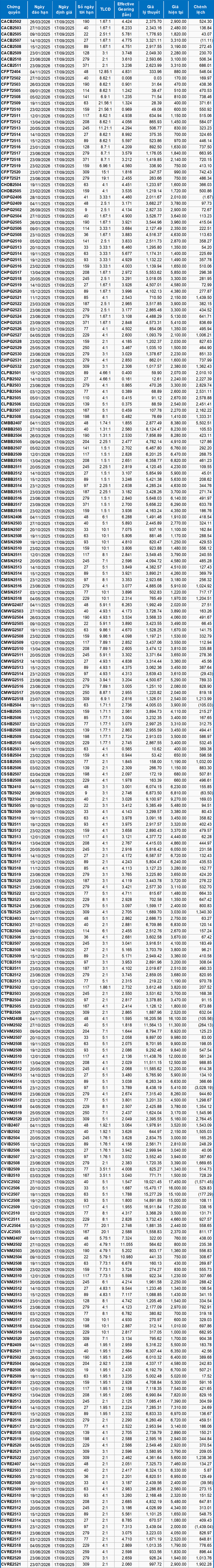

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method appropriate as of September 17, 2025, the fair prices of actively traded warrant certificates are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each warrant type.

According to the valuation, CVHM2515 and CVIC2502 are currently the most attractively priced warrant certificates.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2502 and CVNM2504 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 September 16, 2025

Market Warrants Overview for the Week of September 15-19, 2025: Overall Market Liquidity Continues to Improve

At the close of trading on September 12, 2025, the market saw 112 stocks rise, 109 fall, and 38 remain unchanged. Foreign investors returned to net buying, with a total net purchase of 568,200 CW.

Market Pulse 15/09: VN-Index Surges Over 17 Points, Extending Positive Momentum

At the close of trading, the VN-Index surged by 17.64 points (+1.06%), reaching 1,684.9 points, while the HNX-Index climbed 4.18 points (+1.51%) to 280.69 points. Market breadth favored the bulls, with 507 gainers outpacing 233 decliners. Similarly, the VN30 basket saw green dominate, as 22 stocks advanced, 6 retreated, and 2 remained unchanged.

Vietstock Daily 16/09/2025: Accelerating Growth Continues

The VN-Index extended its winning streak to a fifth consecutive session, successfully testing its short-term trendline (equivalent to the 1,630-1,645 point range). The index’s short-term outlook has turned more positive, with the Stochastic Oscillator generating a fresh buy signal. Momentum is expected to strengthen further if trading volume surpasses its 20-day average in upcoming sessions.