I. MARKET TRENDS IN WARRANTS

By the close of trading on September 18, 2025, the market saw 54 gainers, 173 decliners, and 20 unchanged securities.

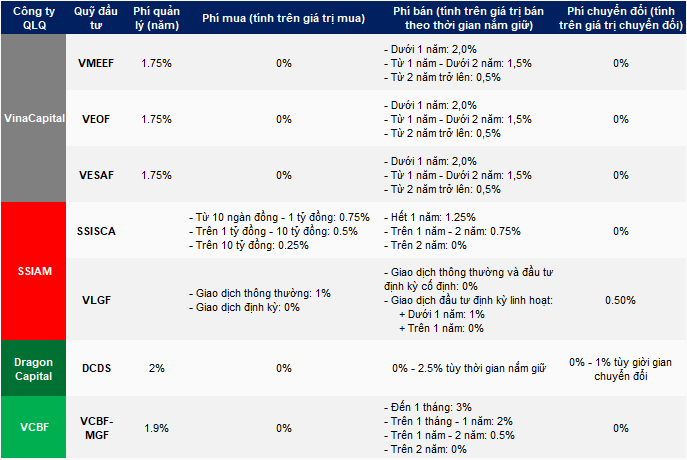

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

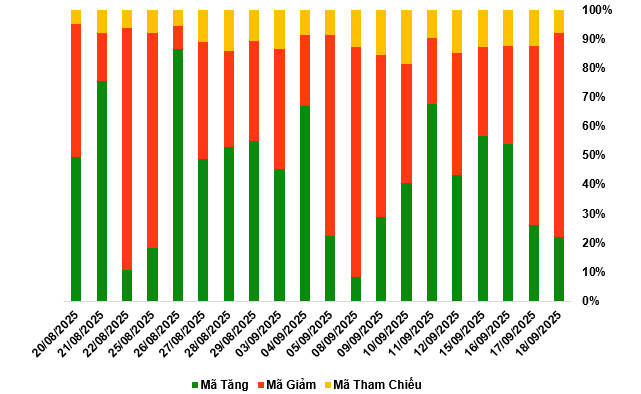

During the September 18, 2025 session, selling pressure dominated the market, leading to price declines in most warrant codes. Notably, the major warrant codes in the declining group were CVHM2502, CVPB2513, CMBB2511, and CHPG2518.

Source: VietstockFinance

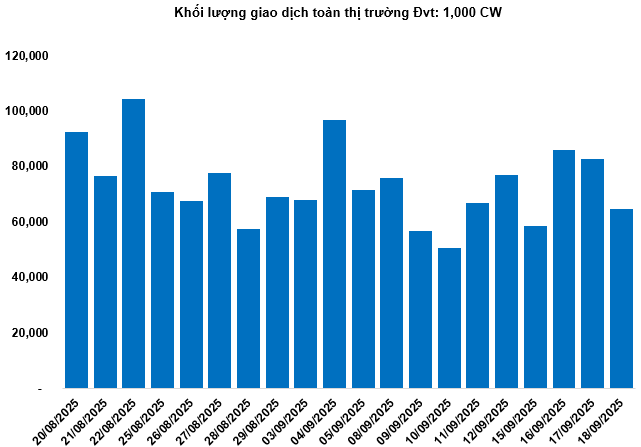

Total market trading volume on September 18 reached 64.78 million CW, down 21.54%; trading value hit 166.05 billion VND, down 11.46% compared to the September 17 session. Among these, CHPG2504 led the market in both trading volume and value, with a total volume of 4.83 million CW, equivalent to 14.76 billion VND.

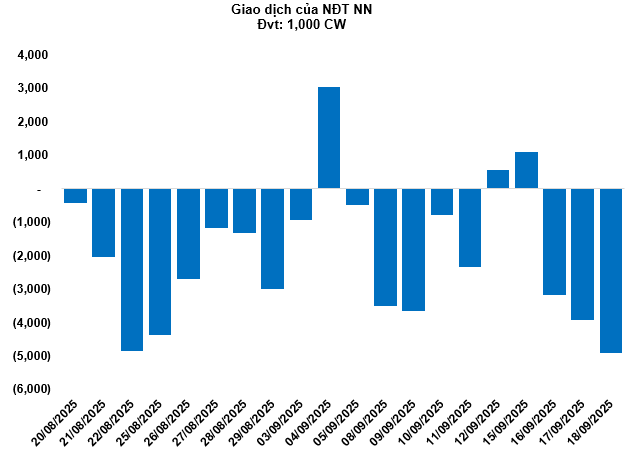

Foreign investors continued to net sell in the September 18 session, with a total net sell of 4.9 million CW. CMSN2508 and CHPG2514 were the two most heavily net-sold codes.

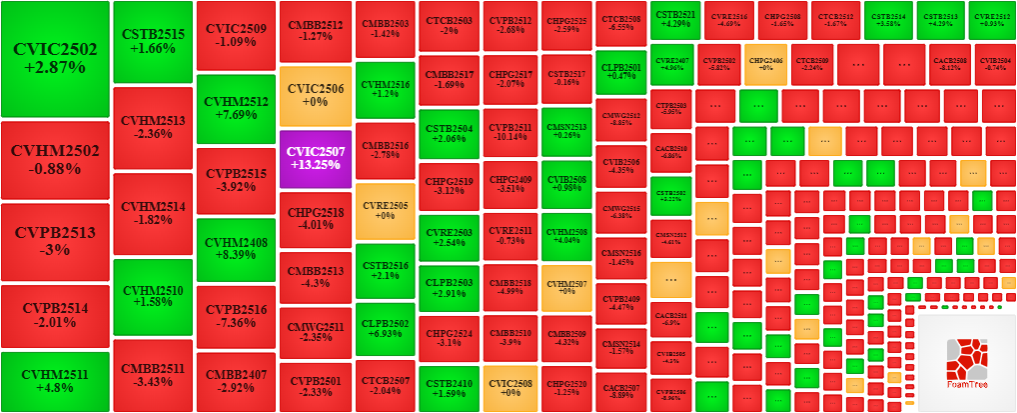

Securities companies SSI, ACBS, HCM, KIS, and VPBankS are currently the issuers with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

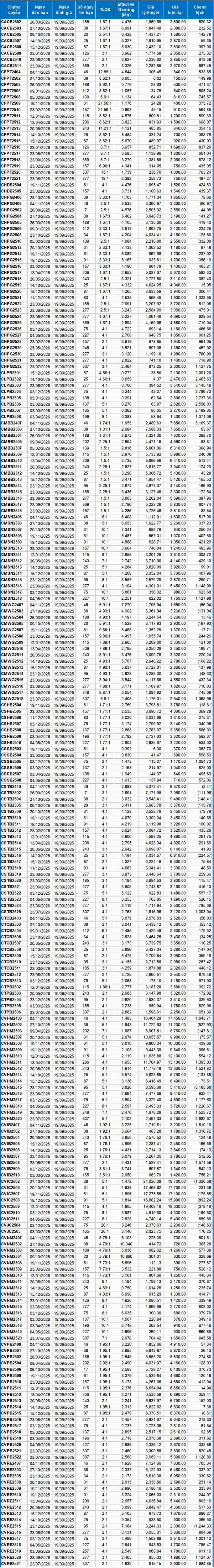

III. WARRANT VALUATION

Based on the appropriate valuation method as of the starting date of September 19, 2025, the reasonable prices of warrants currently trading on the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model has been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (Government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments appropriate for each type of warrant.

According to the above valuation, CVHM2515 and CVIC2502 are currently the two most attractively valued warrant codes.

Warrant codes with higher effective gearing will experience greater fluctuations in response to the underlying securities. Currently, CVNM2504 and CVNM2502 are the two warrant codes with the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 18/09/2025

September 11, 2025: Warrant Market Liquidity Continues to Decline

At the close of trading on September 10, 2025, the market saw 105 stocks rise, 106 fall, and 48 remain unchanged. Foreign investors continued their net selling streak, offloading a total of 799,500 CW.

“Diversifying Markets and Exports to Achieve a $30 Billion Trade Surplus.”

On September 9, Minister of Industry and Trade Nguyen Hong Dien chaired a trade promotion conference with the Vietnamese trade offices abroad for August 2025. The conference, themed “Diversifying Export Markets, Products, and Import Sources to Boost Trade Growth in 2025,” aimed at exploring strategies to enhance Vietnam’s trade performance.