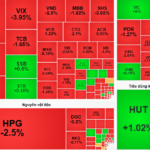

Closing the session on September 18, the VN-Index settled at 1,665 points, a slight decrease of 5.7 points or 0.35%.

During the morning session on September 18, the VN-Index exhibited a tug-of-war trend, fluctuating within a 15-20 point range around the reference mark. Market liquidity significantly declined, reflecting investors’ cautious sentiment as many large-cap stocks faced adjustment pressures. However, the green hue from the Vingroup stock group, including VIC and VHM, helped maintain market equilibrium.

In the afternoon session, negative developments from blue-chip stocks continued to drag the index down. Some pillar stocks like VIC and VHM narrowed their gains, even turning red at times. Notably, the VN-Index recorded its sharpest decline of 25 points near the end of the session before gradually recovering due to portfolio rebalancing activities by investment funds.

At the close, the VN-Index settled at 1,665 points, a slight decrease of 5.7 points or 0.35% compared to the previous session.

In contrast to the sluggishness of large-cap stocks, mid and small-cap stocks in sectors such as public investment, real estate, and steel saw strong inflows, becoming market highlights. These stocks showed positive accumulation signs, attracting investor attention.

Forecasting the September 19 trading session, VCBS Securities Company predicts the VN-Index will continue to move sideways with a fluctuation range of 20-30 points, interspersed with ups and downs. According to VCBS, the market may form an attractive price level, creating opportunities for demand to return. “Mid and small-cap stocks are maintaining stable price levels and showing positive upward signals. Investors may consider partial disbursement into stocks showing strong money flow signals in upcoming sessions,” VCBS recommends.

Meanwhile, Rong Viet Securities Company (VDSC) opines that for the market to regain sustainable growth, money flow needs to absorb the supply of stocks effectively. Therefore, investors should cautiously observe supply-demand dynamics and maintain a reasonable portfolio ratio, awaiting clearer accumulation signals from the market.

Pham Nhat Vuong Climbs the Ranks Among the World’s Wealthiest Individuals

According to Forbes, as of the afternoon of September 18th, Vingroup Chairman Pham Nhat Vuong’s net worth surged by nearly $800 million, elevating his total net worth to $14.3 billion. This impressive growth places him at the 186th position on the global billionaire list.

“Mega Shark” $2 Billion Fund Highlights Three Catalysts for Vietnam’s Stock Market to Enter a New Bullish Wave

This foreign fund expresses confidence in the growth potential of Vietnam’s stock market, signaling its readiness to seize investment opportunities across three key focal points.