Recall the Annual General Meeting of Vingroup Corporation in late April 2025, where Chairman Pham Nhat Vuong made a notable statement: “Should you choose VIC or gold? Choosing VIC is the right move, given the dedication and effort of so many people. Value will be created, and excellence will be recognized. However, just as a ship encounters waves and winds, jumping off prematurely makes it hard to keep swimming.”

Pham Nhat Vuong also emphasized, “Until you sell, you haven’t lost. VIC’s market price will rebound.” This prediction, made during VIC’s most challenging period, has now materialized with the stock’s remarkable surge.

Since then, VIC’s market price has skyrocketed from VND 58,000 per share to VND 143,100 per share, marking a 2.5-fold increase.

This rally has propelled Vingroup’s market capitalization to over VND 555 trillion, surpassing Vietcombank (VCB) to become the largest capitalized stock on the Vietnamese stock market.

VIC’s market price movement.

Previously, during 2018–2020, VIC was the market’s most capitalized company. However, from 2021 onward, Vietcombank took the lead until the session on September 17.

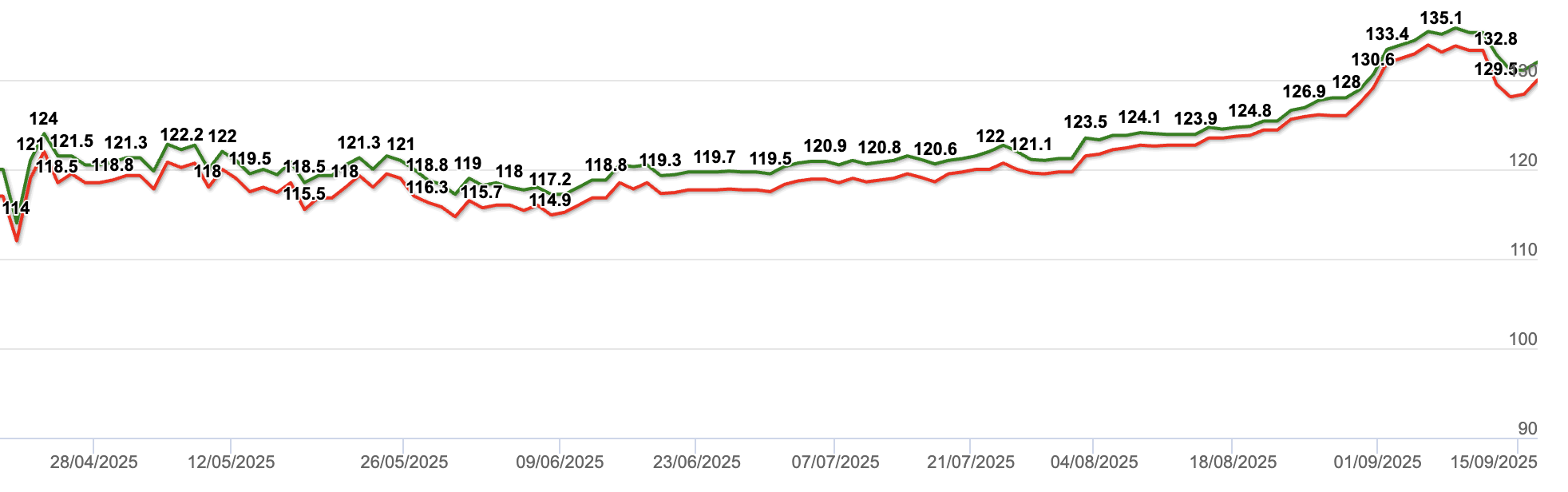

Meanwhile, compared to the gold price of VND 121 million per tael (as of April 24, when Pham Nhat Vuong made his assertion), gold has only risen 7% to VND 129 million per tael. The gold price increase pales in comparison to VIC’s surge.

Gold price movement over the past 5 months.

Not just VIC, two other Vingroup stocks, VHM and VRE, have also doubled in the past 5 months.

The surge in Vingroup stocks has significantly boosted Pham Nhat Vuong’s personal wealth.

According to Forbes, as of September 17, 2025, his net worth increased by USD 424 million to USD 14.2 billion. Compared to USD 4.4 billion at the end of 2024, his wealth has grown by USD 9.8 billion (VND 257.7 trillion) year-to-date.

With this wealth, he ranks 188th among the world’s richest billionaires and remains Vietnam’s wealthiest individual.

His net worth even surpasses the combined wealth of Vietnam’s four other billionaires: Nguyen Thi Phuong Thao (Vice Chair of HDBank, Chair of Vietjet Air), Tran Dinh Long (Chair of Hoa Phat), Ho Hung Anh (Chair of Techcombank), and Nguyen Dang Quang (Chair of Masan Group).

VinFast Poised to Dominate the World’s Largest Motorcycle Market with Electric Bikes, Challenging Industry Giants

VinFast, a Vietnamese automotive manufacturer, has boldly ventured into the global market by selecting a country 18 hours away by flight as its inaugural destination for electric motorcycle exports. This strategic move marks a significant milestone, showcasing VinFast’s ambition to expand its presence in the international electric vehicle arena.

Vingroup Achieves Unprecedented Milestone in Nearly Five Years

Vingroup has surpassed Vietcombank to become the most capitalized company on the Vietnamese stock market.