Xuan Thien Securities Corporation (XTSC) has announced the registration of share transactions by several insider shareholders.

Among them, Chairman of the Board Le Huy Dung plans to sell his entire stake of 2.7 million shares, representing 20.03% of XTSC’s charter capital. If successful, Mr. Dung will no longer hold any shares in XTSC.

During the same period and for the same reason, Board Member and CEO Ho Ngoc Bach registered to sell 1.42 million shares, reducing his ownership from 2.68 million shares (19.88%) to 1.26 million shares (9.33%).

Similarly, Board Member Thai Kieu Huong registered to sell 709,412 shares, decreasing her ownership from 2.04 million shares (15.12%) to 1.33 million shares (9.88%).

Lastly, Khang An Agricultural Trading Company Limited registered to sell its entire stake of 2.7 million shares, equivalent to 20% of XTSC’s charter capital. If successful, the company will no longer hold any shares in XTSC.

All transactions are scheduled to take place between September 22 and October 22, 2025, with the purpose of restructuring assets through transfer agreements.

Notably, these shareholders are divesting ahead of XTSC’s upcoming share offering to existing shareholders based on their ownership ratios.

Specifically, on September 26, XTSC will finalize the shareholder list for the issuance of 135 million shares (10 times the current outstanding shares).

The rights ratio is 1:10, meaning shareholders holding 1 share will be entitled to purchase 10 new shares. The offering price is set at VND 10,000 per share.

The transfer period for purchase rights is from September 27 to October 8, 2025, with rights transferable only once. The subscription and payment period is from September 27 to October 15, 2025.

As of August 4, XTSC has 62 shareholders, including 6 major shareholders: 3 individuals and 1 organization mentioned above. Two other major shareholders are Vo Van Von, holding 9.9%, and FICO (Construction Materials Corporation No. 1), holding 5%.

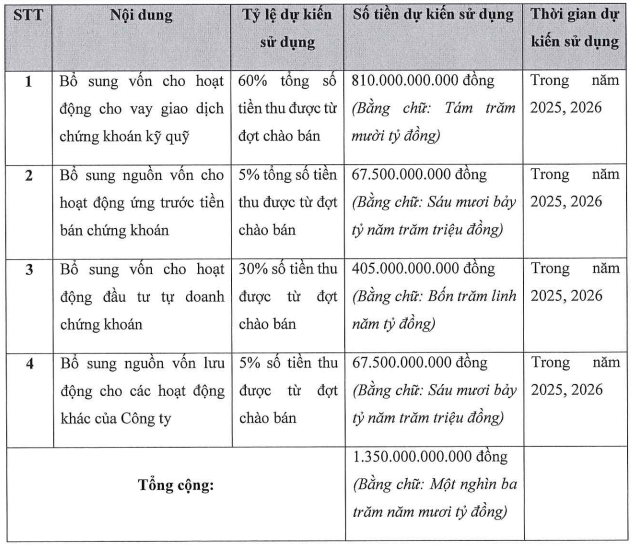

Upon completion of this issuance, XTSC’s charter capital will increase from VND 135 billion to VND 1,485 billion. The VND 1,350 billion raised is expected to be allocated as follows:

Source: XTSC

This is one of the two capital increase plans approved at the 2025 Annual General Meeting. Additionally, XTSC plans to issue 151.5 million shares privately to three strategic investors:

Mr. Nguyen Van Thien, Chairman of Xuan Thien Group, intends to purchase 50 million shares; Mr. Nguyen Tan Dung plans to buy 51.5 million shares; and Xuan Thien International Finance JSC will acquire 50 million shares.

Privately issued shares will be restricted from transfer for 3 years. At an issuance price of VND 10,000 per share, XTSC expects to raise VND 1,551 billion. Of this, 65% will be allocated to margin lending and advance payments; 30% to proprietary trading; and 5% to working capital.

If both issuances are completed, XTSC’s charter capital will exceed VND 3,000 billion.

Xuan Thien Securities is the new name of Golden Lotus Securities (GLS) following the 2025 Annual General Meeting held in June.

At the meeting, GLS’s leadership announced the participation of a major shareholder, Khang An Agricultural Trading Company Limited, a member of the Xuan Thien Group ecosystem.

The name change aims to leverage the brand value and internal strengths of Xuan Thien Group. Consequently, the meeting approved the company’s rebranding.

The meeting also approved an ambitious 2025 business plan, targeting VND 179 billion in revenue (a 1,205% increase) and VND 70 billion in after-tax profit (a 19,839% increase compared to 2024).

FTS Fails to Sell Nearly 1.2 Million MSH Shares

FPT Securities Corporation (HOSE: FTS) registered to sell nearly 1.2 million shares of MSH from August 18 to September 16. However, due to unfavorable market prices, FTS was unable to execute the sale, retaining its full holding of approximately 13.2 million shares, equivalent to 11.728% of MSH’s capital.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.