The Vietnamese government has issued Decree No. 248 on September 15, outlining salary, compensation, and bonus structures for direct representatives of state-owned enterprise (SOE) owners, representatives of state capital, and SOE auditors.

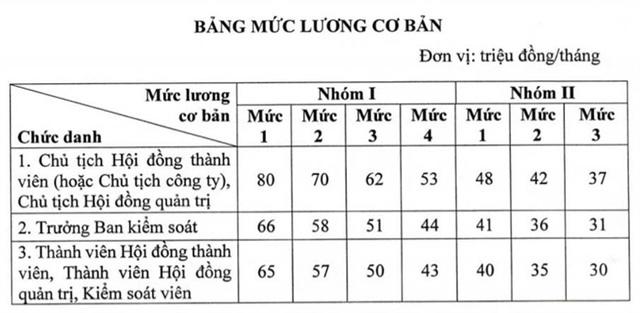

Decree 248/2025/NĐ-CP sets base salaries for board members and full-time auditors. |

Under the decree, SOE chairpersons fall into two groups, with base salaries ranging from VND 37 million to VND 80 million per month. Heads of audit committees, board members, and auditors receive salaries between VND 30 million and VND 66 million per month.

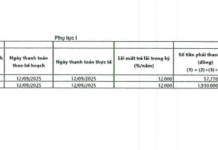

Decree 248 establishes maximum salaries for board members and full-time auditors based on their base salaries and the company’s profit performance.

If a company meets or exceeds its profit targets, the maximum salary is twice the base salary. For profits exceeding targets, an additional 2% of the salary is added for every 1% profit above the target, up to a maximum of 20% of the base salary multiplied by two.

If profits fall below targets, the maximum salary is 80% of twice the base salary, multiplied by the ratio of actual profit to the target. For companies without profit, the maximum salary is 70% of the base salary.

For companies experiencing losses or reduced losses, the maximum salary is determined as follows: 50% of the base salary for companies with losses, and 80% of the base salary for companies reducing losses (even without profit), based on the degree of loss reduction compared to the target.

Board members and full-time auditors appointed by the state to oversee restructuring or address issues in loss-making companies may receive an additional 50% of their maximum salary, after applying the above calculations.

Part-time board members and auditors receive compensation based on actual working hours, not exceeding 20% of the corresponding salary for full-time counterparts.

Bonuses for board members and auditors are drawn from the reward and welfare fund, as stipulated in the Law on Management and Investment of State Capital in Enterprises, government regulations on state capital management, and the company’s reward policy.

Annual bonuses for individual board members and auditors are capped at the number of months’ salary allocated to the reward and welfare fund, multiplied by the ratio of rewards to welfare as per company regulations, and further multiplied by the individual’s average monthly salary.

Minh Chiến

– 05:10 18/09/2025