Becamex IDC (BCM), a leading industrial investment and development corporation, has recently announced the results of a written shareholder poll regarding a public offering of additional shares to increase its charter capital. The shareholder list was finalized on June 19, 2025.

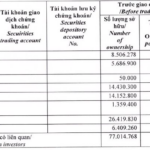

The company distributed 5,976 ballots, representing over 1.03 billion BCM shares (100% of the equity). Of these, 136 ballots were returned, accounting for more than 1.01 billion shares, or 98.29% of the total voting shares. Among these, 134 ballots were valid (98.29%), while 2 were invalid, representing only 7 shares.

Notably, only 128 ballots, representing nearly 29.5 million shares (2.85% of voting shares), approved the capital increase. The remaining 6 ballots, representing over 987.8 million shares (95.44%), abstained, and no shareholders opposed the proposal.

This indicates that the State shareholder, the People’s Committee of Binh Duong Province, which holds 95% of Becamex IDC’s capital, did not express an opinion during this offering.

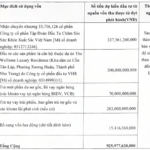

According to the proposal, Becamex IDC plans to issue 150 million shares to the public via an auction on the Ho Chi Minh City Stock Exchange (HoSE). The starting price will not be lower than the latest book value, the average closing price of the last 30 sessions, or VND 50,000 per share.

The expected minimum proceeds of VND 7.5 trillion will be allocated as follows: VND 2.5 trillion for project investments, VND 3.33 trillion to increase capital for existing subsidiaries, and VND 1.67 trillion for debt repayment.

Previously, Becamex IDC intended to issue 300 million shares at a starting price of VND 69,600 per share, aiming to raise over VND 20.8 trillion. However, due to market volatility caused by U.S. countervailing duties, the company postponed the auction as share prices declined. Becamex IDC later revived the plan before adjusting it to the current offering structure.

On the stock market, BCM shares are trading at VND 69,200, down over 2% year-to-date. The market capitalization stands at over VND 71 trillion.

Dragon Capital Exits Major Shareholder Status at The Gioi Di Dong, Selling Over 3 Million Shares

Dragon Capital Group has offloaded over 3.2 million shares of MWG, reducing its ownership stake below 5% and ceasing to be a major shareholder in the retail company. This transaction occurred amid a rising MWG stock price and the company’s positive first-half 2025 financial performance.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

The Ultimate Capital Boost: Unveiling NRC Corporation’s Extraordinary General Meeting

The NRC Group, a dynamic organization with a fresh vision, is leaving no stone unturned to ensure its success. With a new name, a new CEO, and an extraordinary general meeting on the horizon, the Group is set to discuss a private placement plan to boost its charter capital. This forward-thinking approach demonstrates the Group’s commitment to growth and innovation, as it charts a new course for the future.