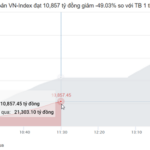

The stock market opened the September 18th session in the green following the Federal Reserve’s interest rate cut. However, investor sentiment remained cautious amid low liquidity, leading the VN-Index to face significant downward pressure during the session. The index recovered toward the close, ending the day down 5.79 points (-0.35%) at 1,665.18. Foreign investors continued to be a drag, net selling a substantial VND 1,678 billion across the market.

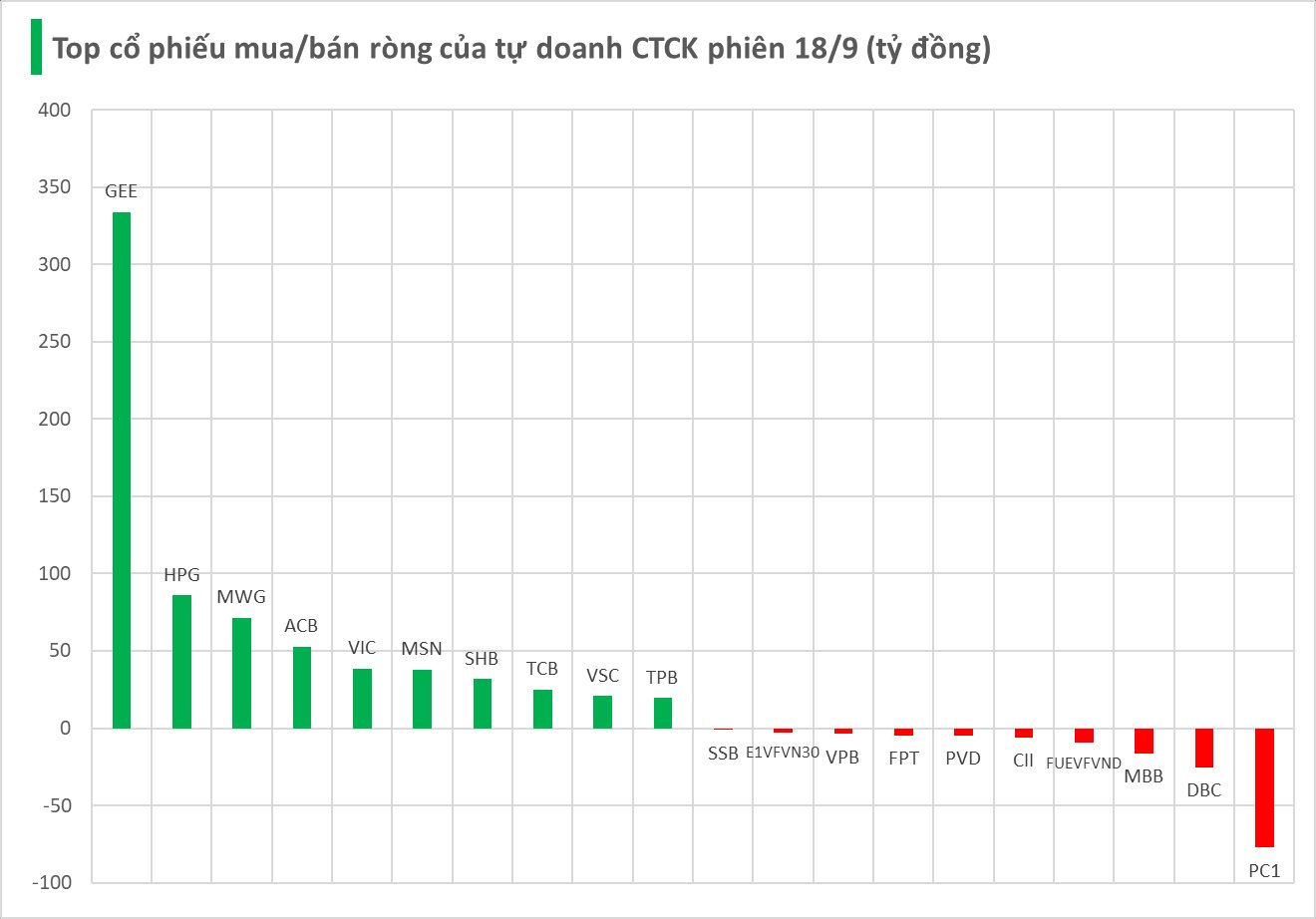

Securities firms’ proprietary trading desks boosted net buying to VND 769 billion on the Ho Chi Minh Stock Exchange (HOSE).

Specifically, GEE dominated net buying with VND 334 billion, far outpacing other stocks. This was followed by HPG (VND 86 billion), MWG (VND 72 billion), ACB (VND 53 billion), VIC (VND 38 billion), MSN (VND 38 billion), SHB (VND 32 billion), TCB (VND 25 billion), VSC (VND 21 billion), and TPB (VND 19 billion), all of which saw strong buying from securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in PC1, with a value of -VND 77 billion, followed by DBC (-VND 25 billion), MBB (-VND 16 billion), FUEVFVND (-VND 10 billion), and CII (-VND 6 billion). Other stocks also recorded notable net selling, including PVD (-VND 5 billion), FPT (-VND 5 billion), VPB (-VND 4 billion), E1VFVN30 (-VND 3 billion), and SSB (-VND 1 billion).

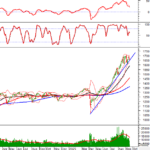

Technical Analysis for the Afternoon Session of September 19: Shaking Near Support Levels

The VN-Index extended its decline, retesting the short-term trendline support (around 1,645-1,660 points) as the Stochastic Oscillator signaled a sell opportunity. Meanwhile, the HNX-Index traded sideways, remaining locked in a tug-of-war around the Bollinger Bands’ Middle line.

Market Pulse 19/09: Strong Divergence Persists as Foreign Investors Ramp Up Net Selling of VHM

At the close of trading, the VN-Index fell by 6.56 points (-0.39%), settling at 1,658.62 points, while the HNX-Index dropped by 0.68 points (-0.25%), closing at 276.24 points. Market breadth tilted toward the downside, with 434 decliners outpacing 323 advancers. Similarly, the VN30 basket saw red dominate, as 24 stocks declined, 4 advanced, and 2 remained unchanged.