This is a privately issued bond series from September 2024, valued at 100 billion VND, with an initial interest rate of 12.5% per annum, maturing in September 2027.

The raised funds are allocated for the development of the Bac Son 2 Industrial Cluster in Lang Son, spanning 25 hectares with a total investment of nearly 286 billion VND. The assets formed from the project, along with nearly 1 million TDG shares owned by CEO Le Minh Hieu, serve as collateral. HD Securities (HDBS) acts as the advisor and collateral asset manager, also purchasing 99% of the issuance value.

During the March payment, TDG paid nearly 6.2 billion VND in interest for this series and an additional 2.7 billion VND for another bond series. However, the company failed to meet the subsequent interest payment deadline.

Despite having two years until maturity, TDG’s Board of Directors approved the early repurchase of the TDGH2427001 series on August 22. This decision raises questions, as the company urgently needs capital for new investment projects, such as the Bac Son 2, Bac Son 1 (Lang Son), and Hai Dong (formerly Nam Dinh) industrial clusters. The repurchase plan was later postponed to September due to TDG’s inability to secure the necessary funds.

Rendering of the Bac Son 2 Industrial Cluster. Source: TDG

|

In the first half of 2025, TDG’s operating cash flow was negative by over 18 billion VND due to increased spending on inventory, receivables, and loan interest. An additional 31 billion VND was spent on fixed asset purchases, resulting in a net cash outflow of nearly 37 billion VND. Cash and non-term deposits at the end of the period totaled only 14 billion VND, while nearly 40 billion VND in term deposits were pledged as collateral.

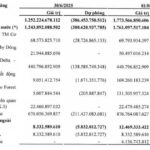

As of June 30, TDG’s total assets exceeded 873 billion VND, primarily consisting of short-term prepayments (125 billion VND), inventory (251 billion VND), and long-term prepaid expenses (204 billion VND). Of this, nearly 37 billion VND was advanced to Hai Yen Construction and Trading Co., Ltd., the contractor for the Bac Son 2 project, and 88 billion VND remains with IPC Group.

For the Bac Son 2 project, construction in progress increased by 30 billion VND to 86 billion VND. In addition to the two bond series, TDG has short-term bank debt of 346 billion VND.

| TDG’s assets are predominantly comprised of receivables and inventory |

Established in 2005 as Thai Duong Petroleum Joint Stock Company, TDG specializes in liquefied petroleum gas distribution. Its flagship product is the 12kg Thai Duong Petrol gas cylinder. In recent years, the company has expanded into construction steel, agricultural exports (bananas, dragon fruit), industrial park infrastructure development in Lang Son, and cattle farming in Laos.

In the first half of 2025, TDG reported revenue of 591 billion VND and net profit of 1.5 billion VND, both declining year-on-year. Core operations generated only 34 billion VND in gross profit, while interest and selling expenses totaled nearly 30 billion VND, leaving minimal residual profit.

To improve its financial position, TDG plans to privately issue nearly 65 billion VND in shares to fund the Bac Son 2 project and offer up to 307 billion VND in shares to existing shareholders for investment in the Bac Son 1 project, Hai Dong project equity acquisition, and working capital replenishment. However, these plans remain unexecuted.

TDG plans to raise over 371 billion VND through share offerings for industrial cluster projects

TDG Global seeks additional 100 billion VND from bondholders for Bac Son 2 Industrial Cluster

– 10:19 17/09/2025

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

Steel Company’s Stock Surges 140% in 5 Months Following Debt Recovery from Novaland

Novaland Group’s debt at SMC, encompassing Delta – Valley Binh Thuan Co., Ltd., Dalat Valley Real Estate Co., Ltd., and The Forest City Co., Ltd., has decreased by nearly VND 287 billion. Specifically, Dalat Valley’s debt reduced by over VND 157 billion, while The Forest City’s debt saw a decline of more than VND 126.5 billion.