Technical Signals of VN-Index

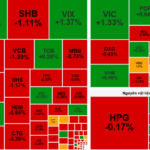

During the morning trading session on September 18, 2025, the VN-Index experienced a slight decline, gearing up to retest the short-term trendline (equivalent to the 1,645-1,660 point range). This threshold has proven to be a robust support level during previous market corrections.

Trading volume has consistently remained below the 20-day average in recent sessions, reflecting investor caution as the previous peaks from August and early September 2025 remain unbroken.

Technical Signals of HNX-Index

In the morning session on September 18, 2025, the HNX-Index witnessed significant volatility, forming a candlestick pattern resembling a Doji.

The index found support from the Middle line of the Bollinger Bands, amidst the formation of a Triangle pattern.

DHC – Dong Hai Ben Tre Corporation

On the morning of September 18, 2025, DHC shares saw a modest increase, accompanied by a long-bodied candlestick pattern and projected trading volume surpassing the 20-day average, indicating optimistic investor sentiment.

Currently, DHC remains close to the Upper Band of the Bollinger Bands, while the MACD indicator continues to form higher highs and higher lows, suggesting a persistent medium-term uptrend.

If technical factors remain positive and DHC successfully breaks through the June 2024 peak (around 34,600-35,700), the potential price target could reach the 200% Fibonacci Projection level (approximately 38,000-39,000).

VIC – Vingroup Joint Stock Company

During the morning session on September 18, 2025, VIC shares continued to rise, setting a new 52-week high, reflecting prevailing investor optimism.

The stock price is currently hugging the Upper Band of the Bollinger Bands, while the MACD indicator maintains its upward trajectory after generating a buy signal, indicating a favorable medium-term outlook with the Middle line providing solid support for VIC.

However, the Stochastic Oscillator has entered the overbought territory. Should this indicator revert and exit this zone in upcoming sessions, short-term downside correction risks may re-emerge.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:00 PM, September 18, 2025

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

September 19th Stock Market Update: Mid and Small-Cap Stocks Continue to Attract Investment Flow

The steady rise in mid- and small-cap stocks is fueling expectations that capital inflows into this segment will continue to grow.

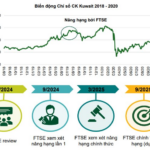

“Mega Shark” $2 Billion Fund Highlights Three Catalysts for Vietnam’s Stock Market to Enter a New Bullish Wave

This foreign fund expresses confidence in the growth potential of Vietnam’s stock market, signaling its readiness to seize investment opportunities across three key focal points.