Technical Signals of the VN-Index

During the morning trading session on September 19, 2025, the VN-Index continued its downward trend, testing the short-term trendline (equivalent to the 1,645-1,660 point range).

The Stochastic Oscillator indicator has issued a sell signal, suggesting that short-term market volatility is likely to persist.

Technical Signals of the HNX-Index

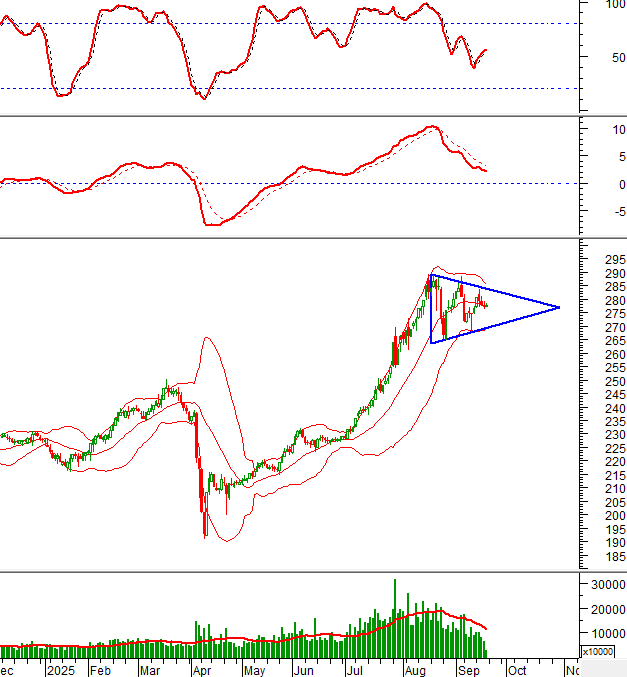

In the morning session on September 19, 2025, the HNX-Index moved sideways with low trading volume, indicating a prevailing sense of caution in the market.

The index continues to oscillate around the Middle line of the Bollinger Bands, while a Triangle pattern is still forming in the short term.

NT2 – Nhon Trach 2 Power JSC

On the morning of September 19, 2025, NT2 shares rose, accompanied by a long-bodied candlestick pattern and trading volume exceeding the 20-session average, reflecting optimistic investor sentiment.

Currently, NT2 continues to set new 52-week highs as the MACD indicator has reissued a buy signal. This suggests that the medium-term uptrend is likely to continue in the near future.

Additionally, NT2’s share price has breached the Upper Band of the Bollinger Bands, while the ADX indicator remains in the gray zone (20 < adx < 25).

PC1 – PC1 Group Corporation

During the morning session on September 19, 2025, PC1 shares edged higher, testing the Middle line of the Bollinger Bands, indicating that investor sentiment is not overly pessimistic.

However, the stock has consistently formed small-bodied candlestick patterns with alternating increases and decreases, accompanied by trading volume below the 20-session average. This reflects ongoing cautious trading behavior among investors.

Currently, the Stochastic Oscillator has risen out of the Oversold region after issuing a buy signal there. If PC1 maintains strong support above the 50-day SMA alongside improvements in liquidity and technical signals, a short-term recovery is likely to resume.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 11:58 AM, September 19, 2025

Market Pulse 19/09: Strong Divergence Persists as Foreign Investors Ramp Up Net Selling of VHM

At the close of trading, the VN-Index fell by 6.56 points (-0.39%), settling at 1,658.62 points, while the HNX-Index dropped by 0.68 points (-0.25%), closing at 276.24 points. Market breadth tilted toward the downside, with 434 decliners outpacing 323 advancers. Similarly, the VN30 basket saw red dominate, as 24 stocks declined, 4 advanced, and 2 remained unchanged.

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

“Mega Shark” $2 Billion Fund Highlights Three Catalysts for Vietnam’s Stock Market to Enter a New Bullish Wave

This foreign fund expresses confidence in the growth potential of Vietnam’s stock market, signaling its readiness to seize investment opportunities across three key focal points.