Bank Debt Surges

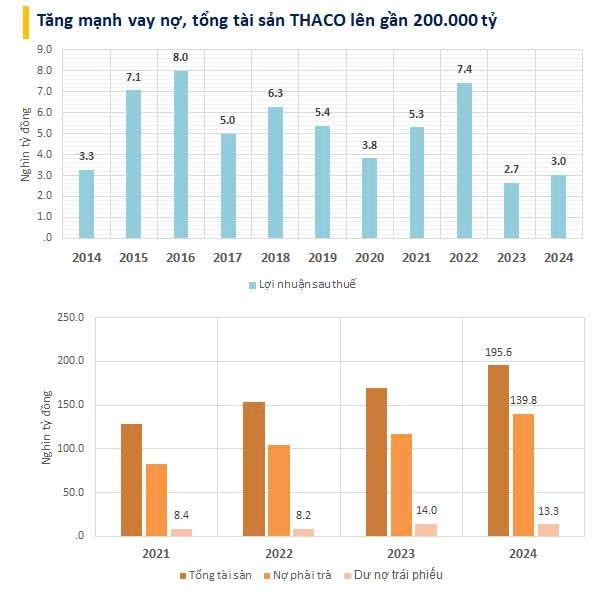

Truong Hai Group Joint Stock Company (THACO) recently announced its 2024 financial report, revealing a post-tax profit of VND 3,025 billion, marking a 14% increase compared to the same period last year.

As of December 31, 2024, the company’s equity reached over VND 55,800 billion, a 6% rise from the end of 2023.

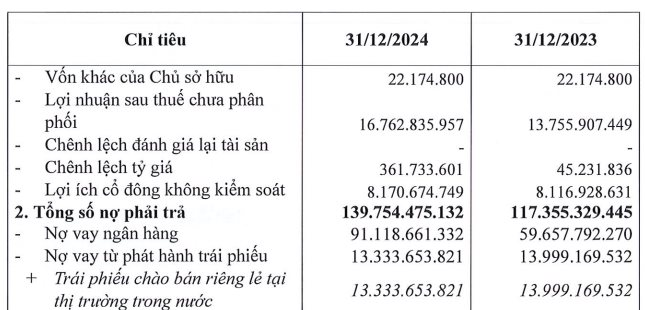

The debt-to-equity ratio climbed from 2.24 in 2023 to 2.50 in 2024, with total liabilities nearing VND 140,000 billion.

This significant debt increase is primarily due to a VND 31,400 billion rise in short-term loans, bringing the total to over VND 91,100 billion. Bond debt slightly decreased to VND 13,334 billion.

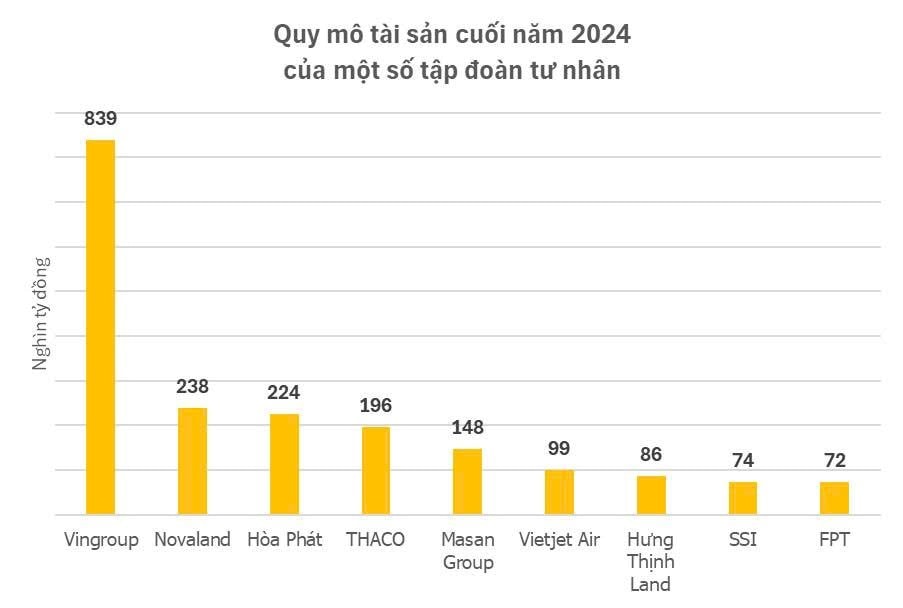

With total assets of nearly VND 196,000 billion, the debt-to-asset ratio stands at 0.71.

In terms of asset scale, THACO ranks among Vietnam’s leading private conglomerates, comparable to Novaland and Hoa Phat, and significantly ahead of Masan, Vietjet, Hung Thinh Land, SSI, and FPT.

Proposal for North-South High-Speed Railway Investment

In May 2025, THACO officially proposed investing in the North-South high-speed railway project, valued at VND 1,560 trillion (USD 61.35 billion), excluding land clearance costs handled by the government.

Including land clearance, the total investment could reach VND 1,710 trillion (USD 67.34 billion). The 1,541 km railway will feature a double-track system with a design speed of 350 km/h, 23 passenger stations, and 5 freight stations, connecting Ngoc Hoi (Hanoi) to Thu Thiem (Ho Chi Minh City).

Tran Ba Duong, THACO’s Chairman, requested government guarantees and 30-year interest subsidies for 80% of the project’s loan, totaling USD 49.1 billion.

The remaining 20% (USD 12.3 billion) will be funded through THACO’s equity and capital raising, ensuring Tran Ba Duong and his family retain controlling shares.

THACO will establish a project company, inviting other Vietnamese corporations to invest while maintaining control. The project will not be transferred to foreign entities.

Founded in 1997, THACO specializes in automobile manufacturing and assembly. Today, it operates across multiple sectors, including automotive (THACO AUTO), agriculture (THACO AGRI), manufacturing (THACO INDUSTRIES), logistics (THILOGI), construction (THADICO-DAI QUANG MINH), and services (THISO), employing over 77,000 people.

“Crystal Bay Vietnam: First-Half Losses and Soaring Debts”

Crystal Bay Vietnam JSC (CBVN) suffered a post-tax loss of nearly VND 1.2 billion in the first half of 2025, a stark contrast to the profit of over VND 5.3 billion in the same period last year, according to audited financial statements.

“F88 Records a Net Profit of Over VND 252 Billion in the First Half of 2025”

As of the end of the first half of 2025, F88 reported a net profit of VND 252.4 billion, a remarkable 2.8 times higher than the same period last year. The company’s total liabilities stand at over VND 3,612.3 billion.