For the general public, the aviation industry boasts many well-known names, including airlines like Vietnam Airlines, British Airways, and Air France, airports such as Tan Son Nhat, Changi in Singapore, and Heathrow in London, and aircraft manufacturers like Airbus and Boeing.

However, for the aviation sector to operate smoothly and on a large scale as it does today, it relies heavily on aircraft leasing companies—giant corporations that often go unnoticed by those outside the industry. Whether operations run seamlessly or accidents occur, aircraft leasing companies remain largely unseen by the public eye.

Dry, Wet, and Damp Leasing

In aviation, there are three primary types of aircraft leasing: dry, wet, and damp.

Dry Lease: In a dry lease, the lessor provides only the aircraft, while the lessee is responsible for supplying the crew, maintenance, insurance, and all other operational costs. In the event of an accident, liability is typically shared between the aircraft manufacturer and the lessee (as they handle maintenance and crew selection), with the lessor usually exempt from responsibility.

Dry leases typically span two years or more and are common among airlines with well-planned long-term operations.

Wet Lease: In contrast to a dry lease, a wet lease includes the aircraft, crew, maintenance, and insurance (ACMI). The lessee only covers fuel, landing fees, and other flight-related expenses.

Wet leases are often used for short-term needs, such as unexpected surges in demand or when a specific aircraft model is grounded, requiring a substitute. This flexible arrangement allows airlines to quickly adjust their fleet size to match market conditions.

Damp Lease: A variation of the wet lease, a damp lease includes the aircraft, pilots, maintenance, and insurance (ACMI minus cabin crew). The lessee provides flight attendants and covers the remaining operational costs. This arrangement enables the lessee to maintain their brand and customer service standards on the flight.

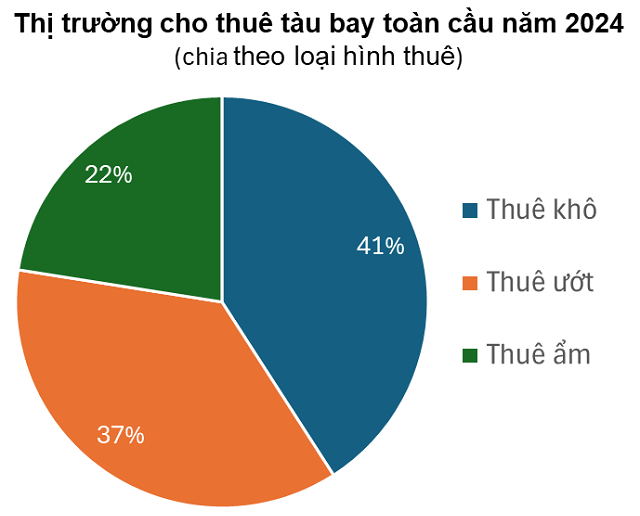

Dry leasing is the most common form of aircraft leasing globally – Source: Duc Quyen, compiled from gminsight.com

|

The Million-Dollar Question: Lease or Buy?

Leasing aircraft offers significant advantages over direct purchases, especially in the volatile aviation market. Key benefits include:

First, access to modern, fuel-efficient fleets: Leasing companies often invest in the latest, fuel-efficient aircraft models from leading manufacturers like Airbus and Boeing. Airlines can access advanced fleets with relatively low capital requirements.

Second, financial and operational flexibility: A new aircraft can cost upwards of $100 million. Airlines often prefer to allocate $100 million toward leasing dozens of aircraft to quickly expand market share and compete, rather than purchasing just one plane. Scaling the leased fleet up or down is also faster and easier than managing owned aircraft.

Third, comprehensive strategic support: Beyond providing aircraft, leasing companies offer consulting and management services, including route and schedule analysis, fleet optimization and planning, aircraft and engine acquisition advice, aircraft financing support, and global management services for leasing portfolios.

In practice, younger airlines with limited financial resources often focus solely on leasing aircraft. Some airlines prefer sale-and-leaseback (SLB) transactions, as these allow them to recognize significant one-time profits.

In Vietnam, Bamboo Airways (BAV), since commencing commercial operations in January 2019, has operated exclusively with leased aircraft. Vietjet Air (HOSE: VJC), which launched in December 2011, did not acquire its first aircraft until 2019, leasing the rest.

In contrast, Vietnam Airlines (HOSE: HVN) maintains a relatively high ownership rate. As of December 31, 2024, the national carrier owns 46 out of 103 aircraft, equivalent to 44.7% (including 6/6 turboprop planes, 33/66 narrow-body jets, and 7 wide-body jets).

Lufthansa (Germany) operates a fleet of 735 aircraft, with an ownership rate of 88% and only 12% leased. Some major airlines actively increase their ownership rates because purchasing aircraft outright offers several advantages over leasing.

Over the long term, total leasing costs often exceed purchasing costs. During sudden demand drops, such as during the COVID-19 pandemic, lessees must continue paying lease fees, while aircraft owners incur no such costs.

Owned aircraft can also serve as collateral for loans, providing liquidity during challenging times like COVID-19. Leased aircraft, of course, cannot be used for this purpose.

Source: Duc Quyen, compiled from gminsight.com

|

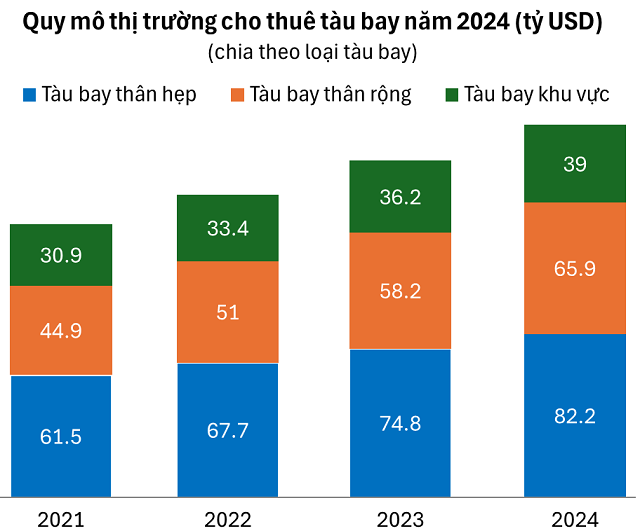

The Giants in the $200 Billion Leasing Market

According to market research firm Polaris, the aircraft leasing market was valued at $192.5 billion in 2024. The compound annual growth rate over the next decade is projected at 11.1%, with the market expected to reach $551.5 billion by 2034. The Business Research Company estimates the market will grow to $209 billion by 2025 and surpass $292 billion by 2029.

Among the largest aircraft leasing companies globally are AerCap and Air Lease.

As of June 30, 2025, Air Lease owns a fleet of 495 aircraft, including 357 narrow-body and 138 wide-body jets. Additionally, the company manages 53 other aircraft. The average fleet age is a relatively young 4.8 years. Air Lease has 241 aircraft on order, scheduled for delivery in the coming years. The company serves 109 airlines across 55 countries. In 2024, Vietnam Airlines was Air Lease’s fourth-largest customer.

AerCap has long been among the world’s largest aircraft leasing companies, but its acquisition of GE Capital Aviation Services (GECAS) in 2021 propelled it to the top, far ahead of competitors.

As of June 30 this year, AerCap owns 1,443 passenger jets, 81 cargo aircraft, and 311 helicopters, totaling 1,835 aircraft. The company also owns 467 engines.

In Q2 2025, AerCap recorded 116 aircraft and engine transactions, including 71 leases, 21 purchases, and 24 sales. During the pandemic, Vietnam Airlines negotiated with AerCap for payment deferrals, reductions, and lease rate adjustments.

Like most aircraft leasing companies, AerCap is headquartered in Ireland due to the country’s low corporate tax rates, tax treaties with over 70 nations (including all major aviation markets), and lenient regulations for the aircraft leasing industry.

– 12:00 16/09/2025

“The $100 Aircraft-Grade Fastener Conundrum: Why Vietnam’s Manufacturing Sector is Yet to Take Off.”

“Vietnam’s current focus on manufacturing neglects the crucial need to invest in infrastructure and technology. Without a shift in focus, we risk remaining confined to low-end segments and missing out on global supply chains. A telling example is the country’s inability to produce a $100 bolt used in commercial aircraft wheels, highlighting the urgent need for a strategic rethink to elevate our position in the global market.”

A Visionary Forecast: 20 Million International Passengers Through Long Thanh Airport in Its Inaugural Year

The anticipated international passenger volume is expected to reach 20 million per year when Long Thanh International Airport’s first phase becomes operational. Thus, it is imperative to initiate the second phase of the Long Thanh International Airport project immediately after the completion of the first. This entails investing in the construction of an additional passenger terminal and a third runway to cater to the burgeoning demand.

The Sky’s the Limit: Vietnamese Aviation Soars with a Double Boost, as Sun PhuQuoc Airways Prepares for Takeoff

The Vietnamese aviation industry witnessed a spectacular second quarter in 2025, with leading airlines reporting record-breaking revenue and profits. This remarkable performance is attributed to the robust recovery of the market and significantly lower fuel prices, marking a pivotal moment for the sector.