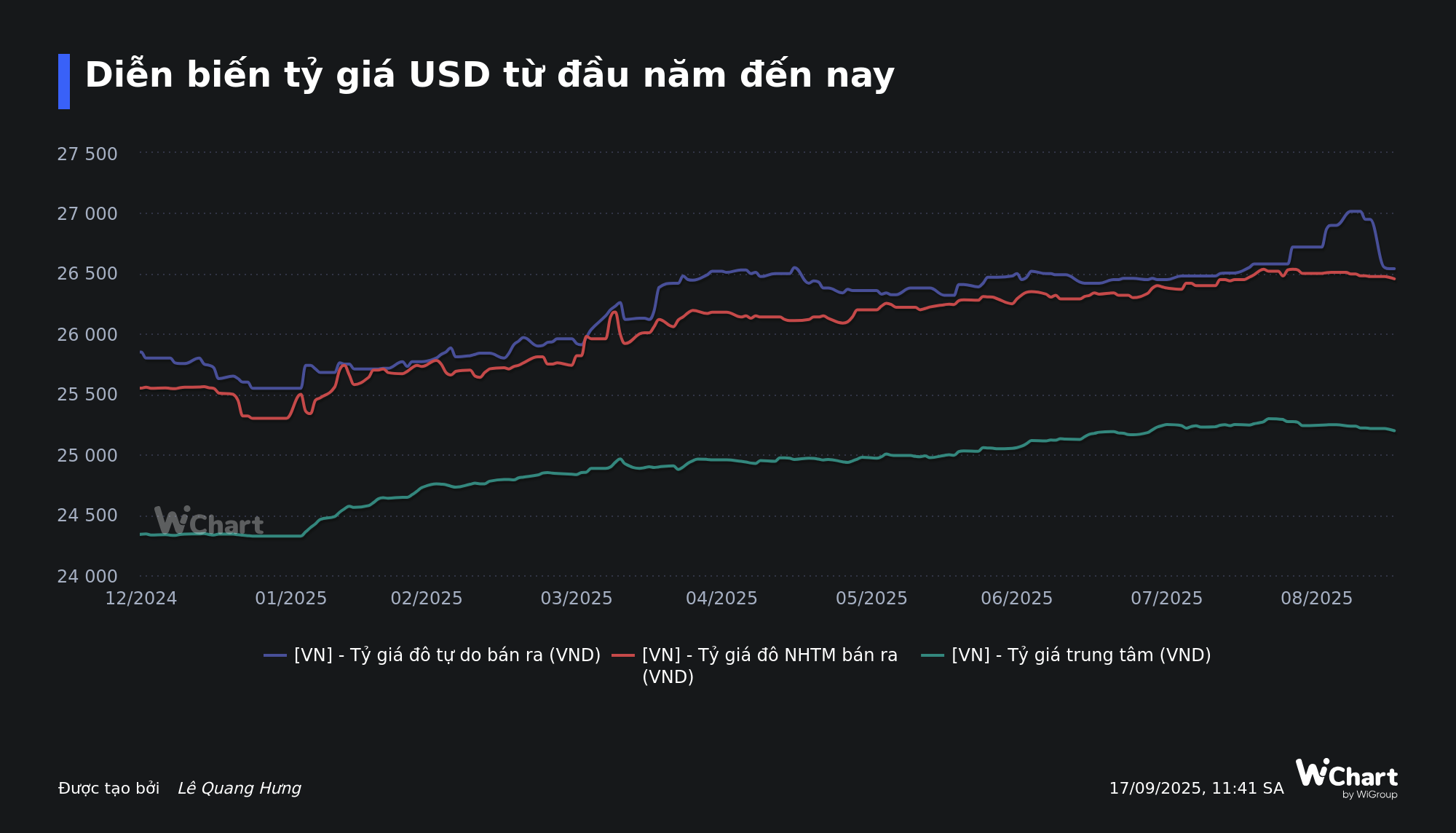

In the latter half of August 2025 and early September 2025, the USD/VND exchange rate witnessed a significant surge, particularly in the free market. Bank selling rates for USD consistently hit the ceiling and remained at record highs above 26,500 VND. The free market USD rate also climbed steadily, reaching a historic peak of 27,000 VND on September 10th.

The USD/VND rate soared despite the DXY index—a measure of the US dollar’s strength—continuing to decline in August and early September. This downturn was driven by expectations that the Federal Reserve (Fed) would soon cut interest rates. By September 16th, the index had fallen to 96.7 points, marking a 1% decrease from early August and nearly 11% since the start of the year.

Analysts attribute this trend primarily to the growing demand for foreign currency within Vietnam, especially as businesses ramp up imports of raw materials for year-end production. Additionally, the tendency to hoard USD amid the State Bank of Vietnam’s (SBV) loose monetary policy aimed at supporting economic growth has further pressured the exchange rate.

“Triple Pronged Approach”: Lowering the Cap, Increasing USD Supply, Tightening VND Liquidity

In response to this situation, the SBV has implemented multiple measures to cool down the USD/VND exchange rate.

First, the SBV has repeatedly adjusted the central exchange rate downward since late August. Compared to the peak of 25,298 VND/USD recorded on August 22nd, the central rate has since decreased by 100 VND.

This move not only serves a technical purpose by compelling banks to reduce their quoted rates within the mandated ceiling (central rate + 5%) but also sends a policy signal: the regulator is prepared to “anchor market expectations” and prevent widespread USD hoarding. Lowering the cap helps temper the exchange rate’s volatility, thereby easing speculative pressures.

Furthermore, on August 22nd, the SBV announced plans to sell foreign currency through 180-day forward contracts with a mutual cancellation option. According to MBS estimates, on August 25th-26th, the SBV sold approximately $1.5 billion in forward contracts to credit institutions with negative foreign exchange positions at a rate of 26,550 VND/USD.

Experts view this intervention as an immediate remedy to address the system’s short-term USD liquidity needs, especially amid heightened pressures. More importantly, it underscores the SBV’s commitment to “supplying foreign currency as needed,” a pledge it has repeatedly emphasized.

“This is considered a flexible measure that both stabilizes market sentiment and preserves foreign exchange reserves in case banks cancel transactions when exchange rate pressures subside,” MBS Securities noted.

Beyond direct intervention in the foreign exchange market, the SBV has also indirectly alleviated pressure on the exchange rate through open market operations. On the collateralized lending channel (OMO), the SBV has reduced auction volumes and maintained a net withdrawal of VND liquidity for three consecutive weeks (August 25th – September 12th). This has brought the outstanding OMO volume down to 148.736 trillion VND from the record high of 225.430 trillion VND at the end of July.

With VND liquidity less abundant, overnight interbank interest rates have risen from 2% at the end of August to over 4%. This increase in domestic interest rates reduces the attractiveness of USD as interest rate differentials narrow, indirectly easing pressure on the USD exchange rate.

These three synchronized measures—both “soft” in managing expectations and “hard” in regulating USD-VND liquidity—have contributed to the recent cooling of the USD/VND exchange rate.

At commercial banks, USD selling rates have dropped by nearly 80 VND from the late-August peak, falling to 26,457 VND/USD. Free market USD rates have also plummeted by nearly 500 VND in the past week, reaching 26,540 VND/USD.

Upward Pressure on Exchange Rates Persists

Despite the slowdown in the upward trend, pressure on the exchange rate remains significant, even as the Fed is likely to cut interest rates at its September meeting. During this “sensitive” period, with most banks still quoting at the allowed ceiling, the USD rate could rebound if faced with adverse factors.

MBS Securities identifies four internal factors that will continue to sustain upward pressure on the exchange rate in the coming period:

First, the VND-USD interest rate differential remains high even if the Fed lowers rates to 4%. Second, import demand will rise as the 0% tax on US goods takes effect, while exports slow, narrowing the trade surplus.

Third, FDI inflows are slowing as investors await clearer tariff policies. Finally, the gap between domestic and international gold prices remains significant.

“We forecast the average exchange rate for 2025 to fluctuate between 26,600 and 26,750 VND/USD, a 4.5-5% increase from the start of the year,” MBS stated.

Vietcombank Securities (VCBS) also predicts that exchange rate pressures will persist in the next month, though the pace of increase will slow compared to the previous month as expectations grow for a Fed rate cut in September.

Toward the end of the year, VCBS anticipates more positive developments in the foreign exchange market, given expectations of Fed rate cuts and easing trade tensions compared to earlier periods. This should encourage capital inflows into Vietnam, replacing the current cautious sentiment.

“The VND may depreciate relatively against the USD with a reasonable fluctuation of around 5% for the entire year of 2025,” VCBS forecasts.

At the regular July government meeting held online with provinces and centrally-run cities on August 7th, chaired by the Prime Minister, SBV Governor Nguyen Thi Hong noted that the exchange rate faces considerable pressure due to the dual impact of economic factors and market sentiment. In this context, the Governor stated that if pressures continue to intensify, the SBV would consider halting further interest rate cuts to avoid destabilizing the exchange rate and, consequently, macroeconomic stability.

“We will closely monitor developments and prioritize appropriately at each stage, aiming for the overarching goal of macroeconomic stability and sustainable economic growth support,” Governor Nguyen Thi Hong affirmed.

Why Does the USD/VND Rate Keep Rising Despite a Weakening DXY?

Explaining why the VND has depreciated against the USD despite the DXY’s decline, Pham Chi Quang, Director of the VND Monetary Policy Department, noted that maintaining a currency’s strength requires it to be attractive. Attractiveness is partly determined by interest rates. However, the SBV has implemented policies to maintain low interest rates to support economic growth. Consequently, low interest rates come with trade-offs, including exchange rate impacts. The low VND interest rate environment in the interbank market has led to a negative interest rate differential between VND and USD, making USD more appealing and causing shifts in foreign exchange supply and demand dynamics. Additionally, the withdrawal of foreign investment flows, such as foreign activity in the stock market, has influenced market liquidity.

Dollar Dips: Commercial Banks See a Fall in USD Rates on September 10th.

As of 8:25 a.m. today, leading commercial banks Vietcombank and BIDV posted their USD exchange rates at 23,192-23,482 VND/USD (buy-sell), a decrease compared to yesterday’s morning rates.

“Credit Growth and Inflation: The Vice Governor’s Perspective on Monetary Policy”

“Vice Governor Doan Thai Son cautioned that robust credit growth could lead to two significant ramifications. Firstly, banks would be compelled to ramp up their capital mobilization efforts, which might entail hiking up deposit rates and subsequently pushing up lending rates. Secondly, robust credit growth effectively translates to an increased money supply, exerting inflationary pressures over the long haul.”