Deloitte’s September 2025 report highlights Vietnam’s growing data center capabilities in the regional AI race, though it still lags significantly behind leaders like Singapore, Malaysia, and Indonesia.

The report underscores that infrastructure—particularly data centers and energy—presents the highest value-creation opportunities for investors and domestic businesses.

As of 2024, Vietnam’s operational data center capacity stands at 46 MW, with an additional 10 MW under construction and expected to complete by 2028. Another 87 MW of potential capacity stems from long-term investment commitments.

In contrast, Singapore leads the region with 988 MW operational. Malaysia, at 159 MW, is adding 280 MW, while Indonesia has 301 MW operational and 388 MW under construction. Thailand is also expanding, with 110 MW operational and 66 MW in progress.

According to Deloitte, Southeast Asia is entering a data demand boom fueled by AI, outpacing current infrastructure capacity.

Regional data center capacity is projected to surge over fourfold, from 1.68 GW in 2024 to 7.59 GW long-term. This growth is driven by next-gen AI applications like image and video processing, which require immense computational power and minimal latency.

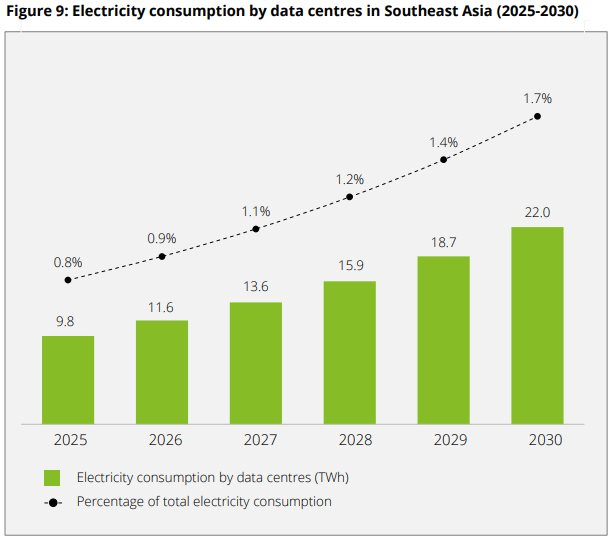

Consequently, regional data center electricity consumption is expected to rise from 9.8 TWh in 2025 to 22 TWh by 2030. AI-focused GPUs consume significantly more energy than traditional CPUs, necessitating sustainable and efficient power solutions. By 2035, AI is projected to handle 40–50% of IT workloads, up from 8% in 2023.

However, Deloitte forecasts AI to contribute $1 trillion to Southeast Asia’s GDP by 2030, creating a “once-in-a-generation opportunity.”

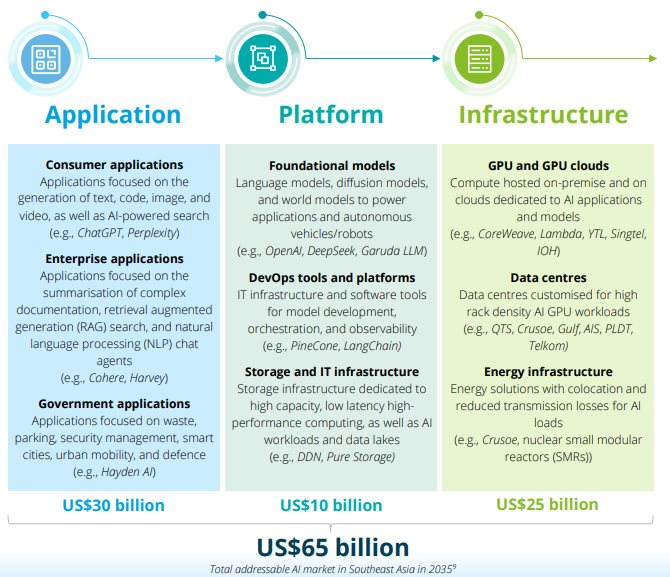

By 2035, the region’s AI market could reach $65 billion, segmented into:

– Applications (consumer, enterprise, government): $30 billion.

– Platforms (large language models, development tools): $10 billion.

– Infrastructure—the linchpin at $25 billion—encompassing GPUs, GPU clouds, AI-specialized data centers, and energy systems. Deloitte likens this segment to the “toll roads” of the AI era, foundational for all future operations.

What Should Governments, Businesses, and Investors Do?

Deloitte offers targeted recommendations to capitalize on opportunities and mitigate risks.

For governments, the priority is fostering a transparent, stable investment environment by clarifying policies, standardizing data security norms, offering incentives, and crafting competitive, sustainable energy strategies.

Telecom and energy companies must define their value chain positions, design tailored market strategies, and diversify energy sources.

In Vietnam, local tech firms like Viettel IDC, FPT, CMC, VNPT, and VNG are actively expanding their data center footprints in response to AI trends.

Investors face high upfront costs—up to $1 billion for a 100 MW AI-ready data center—but the returns are substantial. Deloitte estimates 1 MW of AI power can generate $1.5–2 million annually, while 1 MW of GPU capacity can yield up to $15 million. Investors should explore partnerships, phased investments, and diversification into emerging energy solutions.