At the close of the session on September 12, the USD Index (DXY), which measures the greenback’s strength against a basket of six major currencies, dipped by 0.12 points to 97.62.

Fresh data reveals that the Consumer Price Index (CPI) for August in the U.S. rose by 0.4% on a seasonally adjusted basis, doubling the previous month’s increase and surpassing the expected 0.3% rise. Year-over-year, the CPI climbed by 2.9%, aligning with analysts’ forecasts.

Meanwhile, the U.S. Department of Labor reported a surprising uptick in weekly jobless claims, reaching 263,000 after seasonal adjustments, significantly higher than the anticipated 235,000 and marking a 27,000 increase from the previous week.

Inflation remains above the Fed’s 2% target, while the labor market shows signs of rapid weakening. This dynamic has led investors to almost unanimously predict that the Fed will cut its benchmark interest rate by at least 25 basis points in the upcoming meeting.

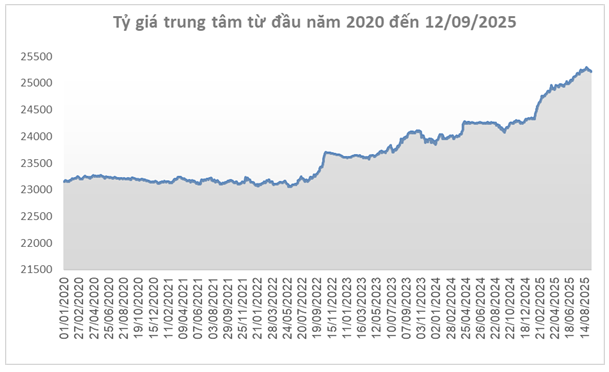

Source: SBV

|

Domestically, the State Bank of Vietnam set the central exchange rate on September 12 at 25,216 VND/USD, a sharp decline of 32 VND from the previous week. With a ±5% band, commercial banks are allowed to trade within the range of 23,955 – 26,477 VND/USD.

The reference exchange rate at the Foreign Exchange Reserve Management Department stood at 24,006 – 26,426 VND/USD (buying – selling), decreasing by 30 VND/USD on the buying side and 34 VND/USD on the selling side compared to the previous week.

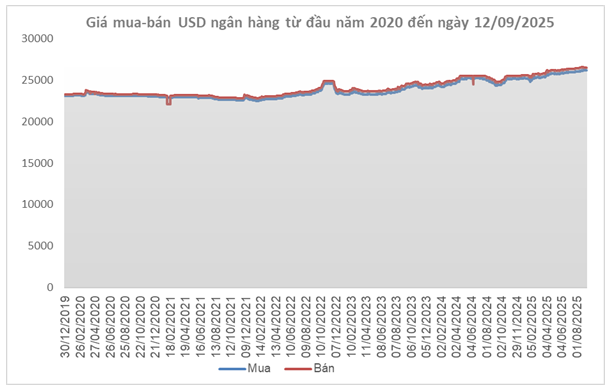

Source: VCB

|

At Vietcombank, the USD rate closed at 26,166 – 26,476 VND/USD (buying – selling), edging up by 6 VND/USD on the buying side but dropping by 34 VND/USD on the selling side from the previous week.

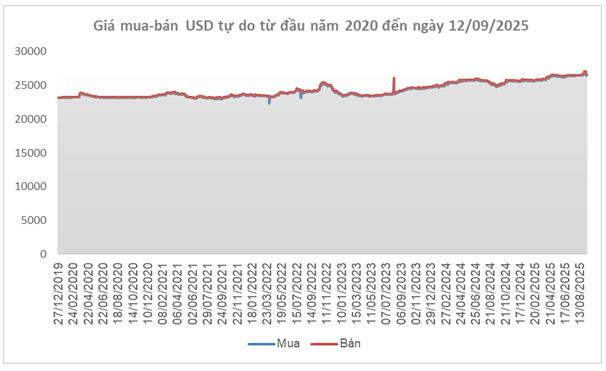

Source: VietstockFinance

|

In the free market, the USD rate hovered around 26,460 – 26,560 VND/USD (buying – selling), plunging by 455 VND/USD on both sides compared to the previous week.

– 16:57 14/09/2025

The Weakening US Dollar: Opportunities and Challenges for Emerging Economies?

Standard Chartered forecasts a weaker USD over the next 6–12 months, predicting the DXY index to drop to around 96 as the Federal Reserve initiates rate cuts. This scenario presents opportunities for exchange rate stability, easing import inflation pressures, and attracting capital inflows into Asia. However, it also poses challenges for export competitiveness and capital flow risks should market expectations reverse.