According to the board resolution, VPI will inject additional capital to increase the charter capital of Loc Binh Company from VND 558 billion to VND 1,310.7 billion. The implementation is scheduled for September 2025. Currently, VPI holds 100% ownership of this subsidiary.

In Hue, VPI is the developer of the Loc Binh physical development and recreational sports tourism complex, spanning 248 hectares with a total investment of VND 3,066 billion. The project includes 853 hotel and resort rooms, 653 villas, and 1,200 boutique hotel rooms, accommodating up to 10,000 guests per night. As of June 30, 2025, the project’s construction in progress costs nearly VND 145 billion.

Rendering of the Loc Binh physical development and recreational sports tourism complex

|

This capital injection follows the board’s late August approval for Loc Binh Company to engage in project-related transactions, acquire partner equity, and use VPI-owned assets as collateral for these transactions.

In September, VPI also plans to acquire a 27.25% stake (54.5 million shares) in Tan Phu Commercial and Real Estate Services JSC, making it an affiliate company.

Established in November 2021, Tan Phu operates in real estate with its headquarters in Binh Trung Ward, Ho Chi Minh City. Mr. Pham Viet Anh serves as CEO and legal representative. The company has a charter capital of VND 5 billion, with founding shareholders including former CEO Nguyen Hong Phong (30%), Mr. Pham Chi Son (10%), and Nguyen Van Anh (60%).

Mr. Pham Chi Son previously served as Director and legal representative of Hung Phu Real Estate Investment LLC. During his tenure, in early January 2024, Hung Phu acquired 100% of Hung Son Investment Company from VPI for VND 750 billion. Hung Son is known as the developer of the 28.4-hectare Vlasta Sam Son project in Thanh Hoa.

Ahead of these investments, on September 9, VPI’s board approved a loan of up to VND 100 billion from its subsidiary, Van Phu – Giang Vo Investment LLC.

Van Phu – Giang Vo is developing the Grandeur Palace – Giang Vo mixed-use and residential project at 138B Giang Vo, covering 9,031 m² with a total investment of VND 2,441 billion. In August 2025, VPI completed the issuance of the VPI12502 bond, raising VND 250 billion to increase capital for Van Phu – Giang Vo.

Did VPI use the Chairman’s shares to raise VND 250 billion from bonds?

– 08:59 12/09/2025

A Bright Outlook: Wood and Wood Product Exports Surpass $11 Billion

The estimated value of timber and wood product exports for August reached a remarkable $1.45 billion. This brings the total export value for the industry to an impressive $11.1 billion for the first eight months of the year, reflecting a 6.3% increase compared to the same period in 2024.

Will VinGroup’s CEO Receive a Share Transfer of VPI Shares from his Wife’s Family?

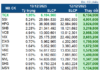

Mr. Pham Hong Chau, a member of the Board of Directors and CEO of Van Phu, has registered to purchase 400,000 shares from August 12 to September 10. During this same period, Mr. Chau’s parents-in-law have registered to sell a similar number of shares.