State Capital Investment Corporation (SCIC)

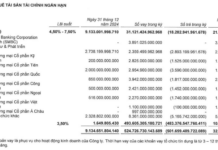

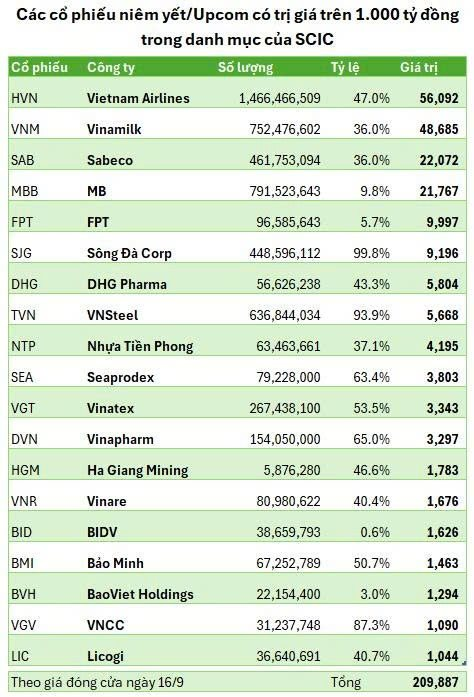

As of September 16, 2025, SCIC’s portfolio of 19 investments valued over VND 1 trillion in listed companies totaled VND 209.887 trillion.

This represents the market value of SCIC’s largest investments within its broader portfolio of 112 companies, which holds a book value of state capital at VND 56.182 trillion (as of Q2/2025).

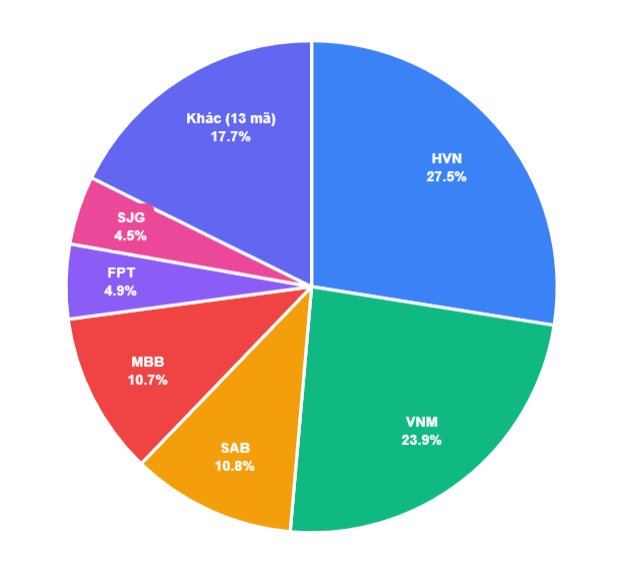

SCIC’s portfolio is heavily concentrated in four leading companies: Vietnam Airlines (HVN), Vinamilk (VNM), Sabeco (SAB), and MB Bank (MBB). These four investments alone account for VND 148.616 trillion, or 70.8% of the total key investment portfolio.

This structure highlights SCIC’s preference for holding stakes in large, industry-leading corporations that are pivotal to Vietnam’s economy.

Most recently, SCIC disbursed VND 7.770 trillion to acquire additional shares in Vietnam Airlines, in line with resolutions from the National Assembly, the Government, and the Ministry of Finance.

This move underscores SCIC’s role as a strategic shareholder, tasked with supporting and restructuring key state-owned enterprises.

Structure of SCIC’s Listed/Upcom Stock Investments Valued Over VND 1 Trillion

Since early September, HVN shares have surged by 23%, closing at a historic high of VND 38,250 on September 16. With a value of VND 56.092 trillion, this investment now constitutes 26.7% of the portfolio, equivalent to over one-quarter of its total value.

Vietnam Airlines’ recovery is further evidenced by its 2025 H1 results, reporting a net revenue of VND 58.551 trillion (up 11%) and post-tax profit of VND 6.442 trillion (up 19% YoY). On September 16, HVN shares rose by 5.37% to VND 38,250, further bolstering the investment’s value.

Beyond financial investments, SCIC fulfills its role as a state capital representative by holding controlling stakes in major corporations such as Song Da Corp (99.8%), VNSteel (93.9%), VNCC (87.3%), and Vinapharm (65.0%).

Its active involvement in restructuring and governance has yielded significant results. For instance, Vietnam Steel Corporation (TVN) has achieved healthier finances and paid consistent dividends since 2022. Similarly, Song Da Corporation (SJG), once at risk of insolvency in 2020, has stabilized under SCIC’s guidance, recording growth in both revenue and profit.

In addition to core investments, SCIC’s portfolio diversifies across critical sectors, including a VND 10 trillion investment in FPT (technology), Dhg Pharmaceutical (healthcare), and insurance holdings in Bao Minh (BMI) and BaoViet Holdings (BVH).

SCIC’s investment performance is reflected in its Q2/2025 consolidated financial report, showing investment and capital management revenue of VND 5.860 trillion (up 48% YoY) and post-tax profit of VND 6.167 trillion (up 4%).

Sustainable Development: Transforming Cost Burdens into Brand Assets

A groundbreaking innovation in bottle caps has enabled Vinamilk (HOSE: VNM) to eliminate over 5 million plastic straws, contributing to a remarkable 80% growth in the New Zealand market. This small yet impactful solution from the dairy giant demonstrates that reducing emissions isn’t solely a cost challenge—it can serve as a strategic “priority card,” expanding product presence in premium markets and elevating brand value.

SCIC Injects $338 Million into Vietnam Airlines in Continued Investment Push

This strategic investment bolsters Vietnam Airlines’ equity capital, ensuring long-term financial stability while achieving a critical milestone: the company has emerged from negative equity, gaining the resources to settle debts and execute its fleet expansion plans in the coming period.

Vietnam Airlines’ Subsidiary Wins a $27.5 Million Aircraft Maintenance Project at Long Thanh Airport

Let me know if you would like me to provide any additional revisions or transformations to this headline to better suit your needs.

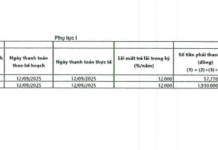

Vietnam Airlines’ subsidiary, VAECO – a leading aircraft engineering company, has been entrusted with an important project. With a substantial investment of 645 billion VND, VAECO will undertake the ‘Project for Construction and Business of Aircraft Maintenance Services No. 2’ at Long Thanh International Airport.