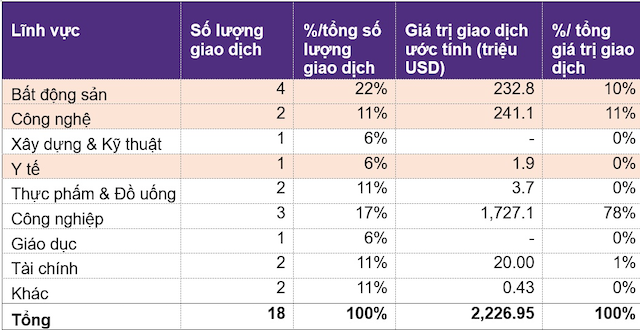

According to Grant Thornton, Vietnam’s M&A market recorded 18 deals in August, with a total estimated value of approximately 2.23 billion USD. Real estate, technology, industrial manufacturing, and financial services continued to lead in both the number and scale of transactions.

In terms of value, August’s transactions significantly surpassed July’s, despite fewer deals. This was primarily due to VinFast’s 1.5 billion USD restructuring deal, along with two strategic transactions in technology and industrial manufacturing, each exceeding 200 million USD.

By volume, real estate maintained its dominance, leading the entire market. Technology, industrial manufacturing, and financial services followed, continuing to attract strong interest from foreign investors, particularly from Japan and South Korea.

Notably, August saw no investments from investment funds. Instead, the market witnessed announcements related to successful capital raising or planned capital contributions.

Source: Capital IQ, Grant Thornton

|

Notable M&A Deals

Real Estate Sector

SSG Group acquired an 11.92% stake in Seaprodex Corporation (HOSE: SEA) from Red Capital and Gelex. The deal, valued at approximately 507 billion VND (20 million USD), was executed via agreement on August 22. Post-transaction, SCIC remains the controlling shareholder with 63-64% equity, while SSG becomes the second-largest shareholder in SEA. Known for premium real estate projects like Saigon Pearl and Thảo Điền Pearl, SSG aims to leverage Seaprodex’s prime land assets.

Gelex Infrastructure JSC, a Gelex Group subsidiary (HOSE: GEX), acquired Savico’s (HOSE: SVC) entire stake in the Cần Giờ High-End Residential Area project (29.83ha, HCMC). The project originated from a 2002 joint venture between Savico and Fideco (HOSE: FDC), with a 50:50 investment ratio. The transaction, valued at 619.4 billion VND (24.5 million USD), was completed through a public auction.

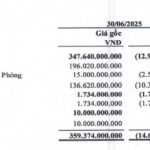

Việt Minh Hoàng Real Estate Investment and Construction JSC, affiliated with Sun Group, acquired the Constrexim Complex project (2.5ha, A1-2 lot, Cầu Giấy New Urban Area, Hanoi) from CTX Holdings. The project includes five towers ranging from 38 to 45 floors. Post-acquisition, Sun Group renamed the project Sun Feliza Suites and initiated commercialization. According to CTX Holdings’ Q2/2025 consolidated financial report, a deposit of 4.964 billion VND (195 million USD) was received, though the total deal value remains undisclosed.

Technology Sector

On August 29, Appirits Inc. announced the acquisition of Bunbu Joint Stock Company from individual shareholders for approximately 241 million USD, comprising 66.6 million USD in cash and 174.4 million USD in earn-out. Established in 2010, Bunbu specializes in web, mobile, and AI systems for Japanese clients, reporting 105.5 million USD in revenue and 41 million USD in net profit in 2024. The deal aligns with Appirits’ 2030 vision to expand technical capabilities and workforce through M&A, leveraging Vietnam’s tech resources to optimize costs and enhance global presence.

Manufacturing & Industrial Sector

HD Korea Shipbuilding & Offshore Engineering (HD KSOE), part of HD Hyundai, acquired 100% of Doosan Vina from Doosan Enerbility for approximately 210 million USD. Founded in 2006 in Dung Quất Economic Zone (Quảng Ngãi), Doosan Vina manufactures equipment for thermal power plants, LNG modules, and port cranes.

Post-acquisition, HD Hyundai plans to build a new LNG and ammonia tank manufacturing facility within Doosan Vina and develop it into a regional port crane production hub.

For Doosan Enerbility, the divestment is part of a restructuring strategy to focus on new energy sectors like small modular reactors (SMR), gas turbines, and hydrogen.

On August 14, VinFast Auto Ltd. established Novatech R&D JSC and transferred 62% of its shares to Phạm Nhật Vượng for approximately 1.5 billion USD. Post-transaction, Mr. Vượng holds 62.32% equity, while VinFast retains 37.64% but controls 99.9% of voting rights. This restructuring separates R&D from VinFast, strengthening financial resources and establishing Novatech as an independent tech hub within Vingroup.

Education Sector

Asia Business Builders, in partnership with Gakken Holdings, completed a strategic investment in QIG, a leading learning management system (LMS) provider in Vietnam. Founded in 2012, QIG has developed a digital ecosystem serving schools, training organizations, and businesses, with its LMS widely adopted in both public and private education sectors. This marks a renewed collaboration following Gakken’s investment in DTP Education three years prior.

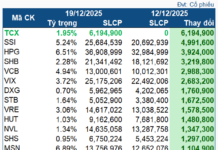

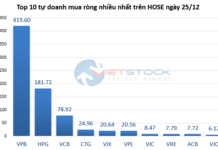

Financial Services Sector

Daiwa Securities announced plans to acquire nearly 16 million SSI shares via a private placement at 31,300 VND/share (1.25 USD/share), totaling over 497 billion VND (19.9 million USD). Currently Daiwa’s largest shareholder with 301 million shares (15.25%), its holdings will increase to over 317 million post-transaction. The deal is scheduled from August 29 to September 26, 2025. Established in 1902, Daiwa Securities Group is one of Japan’s “Big Four” brokerage firms, specializing in brokerage, investment, and asset management.

SIFEM (The Swiss Investment Fund for Emerging Markets) committed 20 million USD to ECVP II (Excelsior Capital Vietnam Partners II), Excelsior Capital’s second Vietnam-focused fund with a total size of 200 million USD. This investment supports ECVP II’s strategy to target SMEs in consumer, education, healthcare, logistics, and technology sectors.

IFC is considering a maximum 200 million USD investment in VPBank‘s 5-year sustainable bond issuance, supporting climate projects, SME financing, and promoting sustainable banking standards in Vietnam.

– 06:30 18/09/2025

Becamex IJC Offers 251 Million Shares: Strategic Infrastructure Investment Amid Stable Economic Conditions

Becamex IJC’s offering of 251 million shares successfully raised over VND 2.5 trillion, fueling strategic infrastructure investments, strengthening financial resilience, and expanding growth opportunities as the economy stabilizes.

Shocking Twist in ‘Mistaken Construction’ on Red Book Land: Landowner Reveals Startling Details

A landowner in Thien Huong Ward, Hai Phong City, claims their plot was unlawfully seized by strangers who brazenly constructed a house on it. The owner suspects the trespassers intentionally claimed a “mistaken build” to circumvent the property’s proximity to a grave, a factor that could devalue the land.