Services

In a landscape of robust cash flow, transaction costs—often perceived as minor—emerge as a critical factor, particularly for individual investors with high trading frequency. Even a marginal brokerage fee difference of 0.01% can significantly impact cumulative profits. This dynamic compels securities firms to strike a delicate balance between maintaining service quality and offering competitive fee structures.

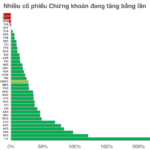

During the first half of 2025, despite leading securities companies unveiling attractive transaction fee promotions, fee disparities remained pronounced among top market share holders: VPS at 0.17%; SSI at 0.16%; HCM at 0.15%; VND, MBS, and VCI at 0.12%; and VCBS at 0.11%.

VCBS stands out with fees lower than major competitors like SSI, VPS, and HCM, even outperforming peers such as VND, MBS, and VCI, all at 0.12%. (*)

|

However, transaction fees represent just one facet of the equation. In a fiercely competitive market, securities firms must transcend fee reductions by investing in technology and enhancing service quality. Savvy investors now prioritize a comprehensive benefits package, encompassing system stability, product diversity, and brand reputation.

VCBS leverages its unique advantage through the backing of Vietcombank, one of Vietnam’s foremost banks. This partnership not only ensures safety but also fosters seamless service integration, enabling clients to benefit from competitive fees and a robust trading platform.

As the stock market evolves, cost-efficiency remains pivotal. Yet, only firms that harmonize reasonable fees with superior service quality will sustain their market position and meet the increasingly diverse demands of investors in Vietnam’s securities landscape./.

(*) Source: Financial reports of securities companies

– 15:00 17/09/2025

How to Value Stocks of Securities Companies Ahead of TCBS’s IPO?

The brokerage stocks group is generally not a bargain basement, but there’s plenty of potential left and valuation is just one of the factors to consider when picking stocks.

The Future of Electricity Pricing: A Market-Driven Approach

According to the Ministry of Industry and Trade and industry experts, the newly amended Power Law, passed by the National Assembly, will bring about significant changes in legal regulations. This will untie the knots hindering the development of the electricity industry, particularly in terms of capital mechanisms and investment incentives to attract resources for electricity development and operation.