I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON SEPTEMBER 15, 2025

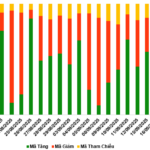

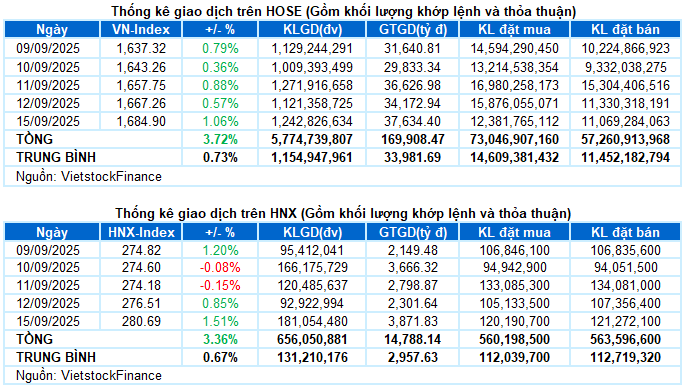

– Key indices surged during the September 15 trading session. The VN-Index gained 17.64 points (+1.06%), closing at 1,684.9 points. The HNX-Index also saw a robust increase of 4.18 points (+1.51%), reaching 280.69 points.

– Trading volume on the HOSE rose by 11.5%, exceeding 1.1 billion units. The HNX recorded over 101 million matched units, a 13.7% increase from the previous session.

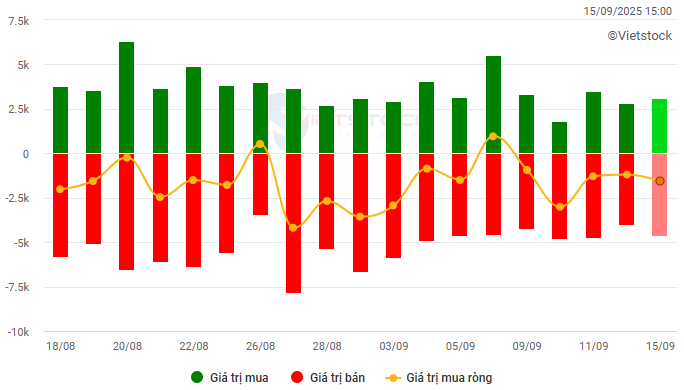

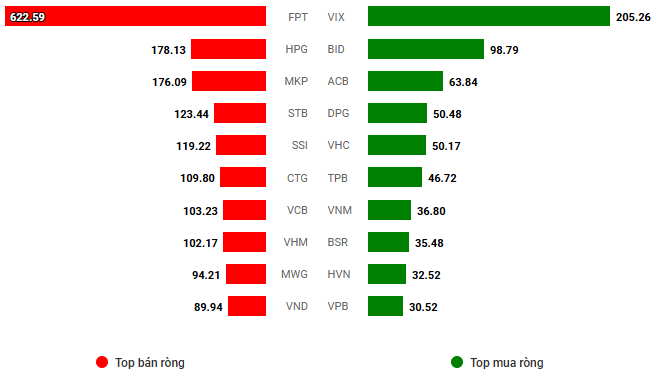

– Foreign investors continued to net sell, with a value of VND 1.3 trillion on the HOSE and over VND 53 billion on the HNX.

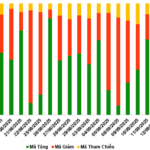

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market extended its rally in the first session of the week. The VN-Index opened in the green and approached the 1,675-point mark within the first hour. Although the upward momentum slowed due to divergence among large-cap stocks, mid- and small-cap stocks maintained strong demand, helping the index hold steady after adjustments around the 1,670-point level. Late in the session, a strong comeback from leading stocks propelled the index higher. The VN-Index closed at 1,684.9 points, up 17.64 points from the previous session.

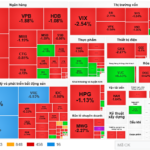

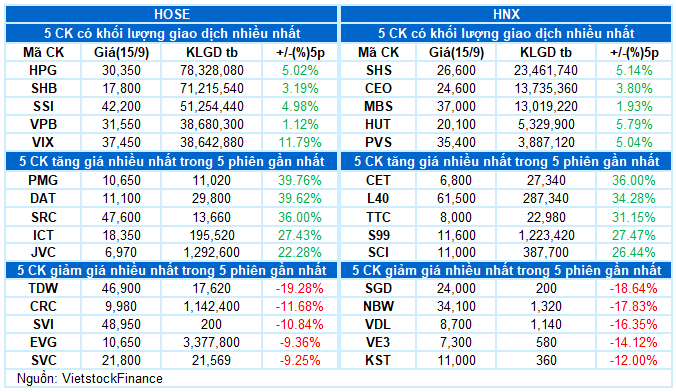

– In terms of influence, BID, CTG, and HVN were the most positive contributors, adding nearly 5 points to the VN-Index. Conversely, VHM had the most significant negative impact, reducing the index by nearly 1 point.

– The VN30-Index staged an impressive late-session rally, gaining over 11 points to close at 1,876.75 points. The basket recorded 22 gainers, 6 losers, and 2 unchanged stocks. Notably, BID, MSN, BCM, CTG, and DGC led the gains with increases of over 2%. On the downside, the six declining stocks—VHM, HDB, VRE, VJC, VPB, and VNM—all fell by less than 1%.

Green dominated all sectors. The industrial sector stood out with a 2.44% gain, driven by strong performances from transportation and construction stocks. HVN and CTD hit their upper limits, while other notable gainers included GMD (+6.65%), VSC (+4.29%), HAH (+3.17%), ACV (+2.93%), VTP (+3.48%), VOS (+3.25%), VCG (+6.12%), HHV (+3.63%), DPG (+6.1%), FCN (+4.58%), and HBC (+3.85%).

The materials and consumer staples sectors also posted gains of over 1%, with strong demand lifting KSB to its upper limit from the start, HPG (+1.17%), DGC (+2.05%), MSR (+6.05%), DDV (+5.86%), NTP (+3.08%), TVN (+5.81%), MSN (+2.91%), PAN (+5.84%), MML (+3.12%), ANV (+2.28%), ASM (+5.58%), and VHC and IDI hitting their upper limits.

The financial sector staged an impressive late-session rally, driven by the strong return of “king stocks” such as BID, CTG, TCB, LPB, STB, TPB, SHB, SSB, and EIB. Meanwhile, securities stocks maintained their momentum from the start, with VIX hitting its upper limit, VND (+2.93%), SHS (+2.31%), MBS (+3.93%), VCI (+1.92%), HCM (+1.09%), and FTS (+1.61%).

The VN-Index extended its winning streak to five consecutive sessions after successfully testing the short-term trendline (equivalent to the 1,630-1,645 point range). The short-term outlook for the index has turned more positive as the Stochastic Oscillator has given a buy signal. The upward momentum will be further supported if trading volume soon exceeds the 20-day average in the coming sessions.

II. PRICE TREND AND VOLATILITY ANALYSIS

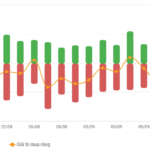

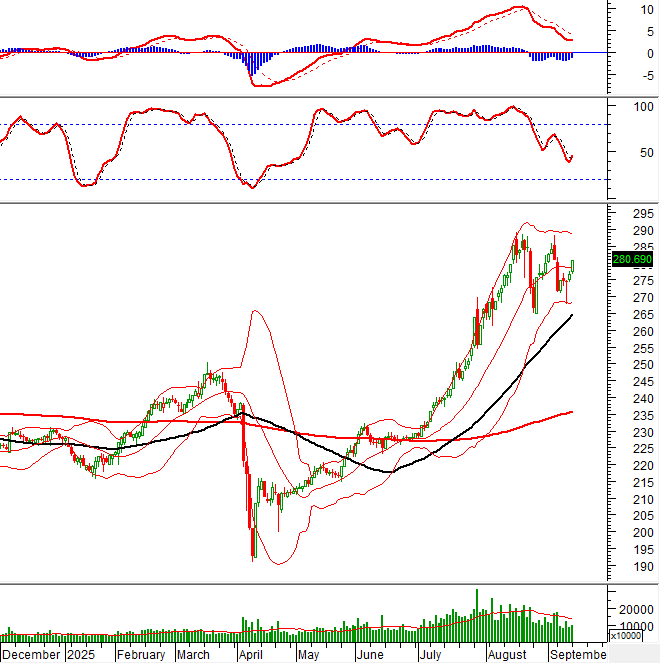

VN-Index – Stochastic Oscillator Gives Buy Signal

The VN-Index extended its winning streak to five consecutive sessions after successfully testing the short-term trendline (equivalent to the 1,630-1,645 point range).

The short-term outlook for the index has turned more positive as the Stochastic Oscillator has given a buy signal. The upward momentum will be further supported if trading volume soon exceeds the 20-day average in the coming sessions.

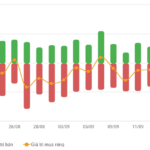

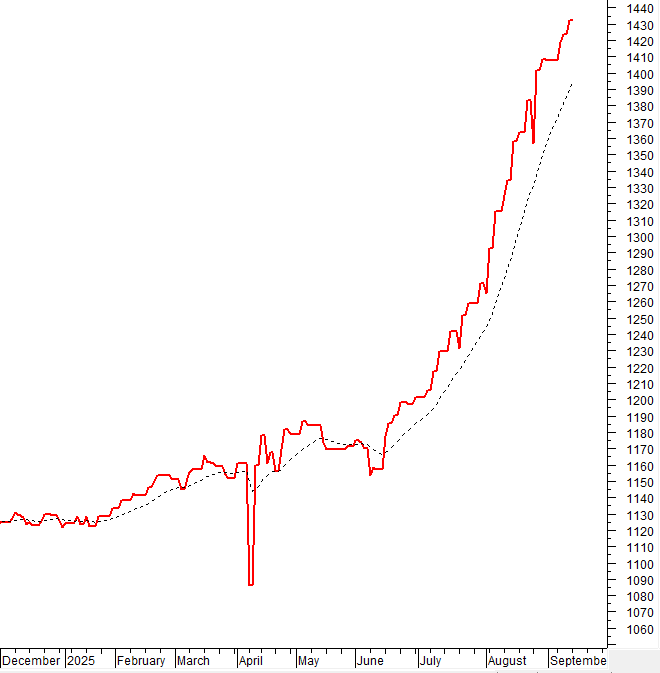

HNX-Index – Breaks Above Middle Bollinger Band

The HNX-Index gained points and broke above the Middle Bollinger Band. If the index maintains this level in the coming sessions, accompanied by trading volume exceeding the 20-day average, the upward momentum will be reinforced.

Additionally, the Stochastic Oscillator has given a buy signal, indicating a more optimistic short-term outlook.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign Capital Flow: Foreign investors net sold in the September 15, 2025 session. If foreign investors continue this action in the coming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS ON SEPTEMBER 15, 2025

Economic & Market Strategy Analysis Department, Vietstock Consulting Division

– 17:10 September 15, 2025

Vietstock Daily 17/09/2025: Market Shakes at the 1,700-Point Threshold

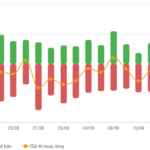

The VN-Index retreated after facing profit-taking pressure at its August 2025 peak and early September 2025 highs (around 1,690–1,711 points). Volatility near this resistance zone is likely to persist in the short term. Should selling pressure dominate, the short-term trendline support (approximately 1,635–1,650 points) will be critical for the index.

Vietstock Daily 19/09/2025: Market Volatility Persists – Can Stability Be Regained?

The VN-Index swiftly narrowed its decline and closed just above the Middle Bollinger Band. This indicates that the short-term trendline (ranging between 1,645 and 1,660 points) continues to effectively support the index. However, with trading volume showing no signs of improvement, expectations for a short-term breakout or surge remain low.

Vietstock Daily 18/09/2025: Cautious Sentiment Prevails?

The VN-Index persists in its corrective phase, with trading volumes remaining below the 20-day average for seven consecutive sessions, reflecting investors’ cautious sentiment. However, short-term risks appear manageable as the Stochastic Oscillator has generated a buy signal, and the short-term trendline (equivalent to the 1,635-1,650 point range) continues to provide robust support.