I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON SEPTEMBER 18, 2025

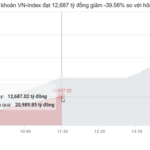

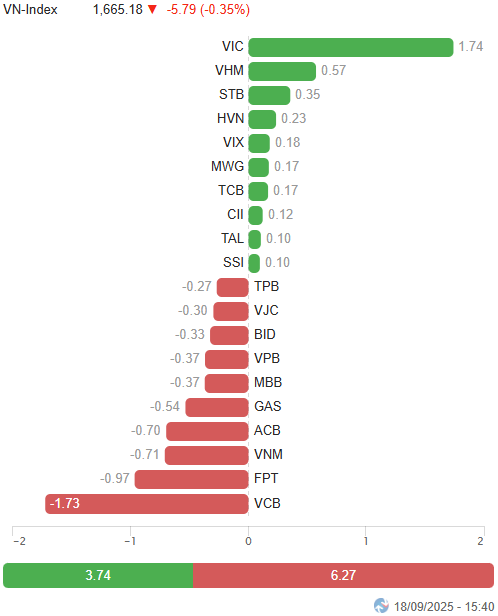

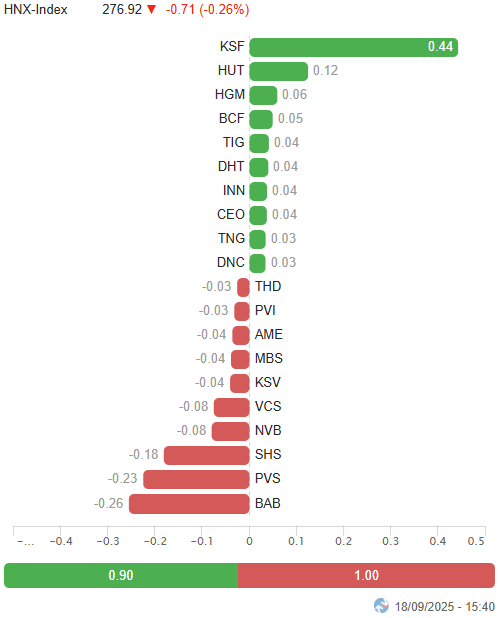

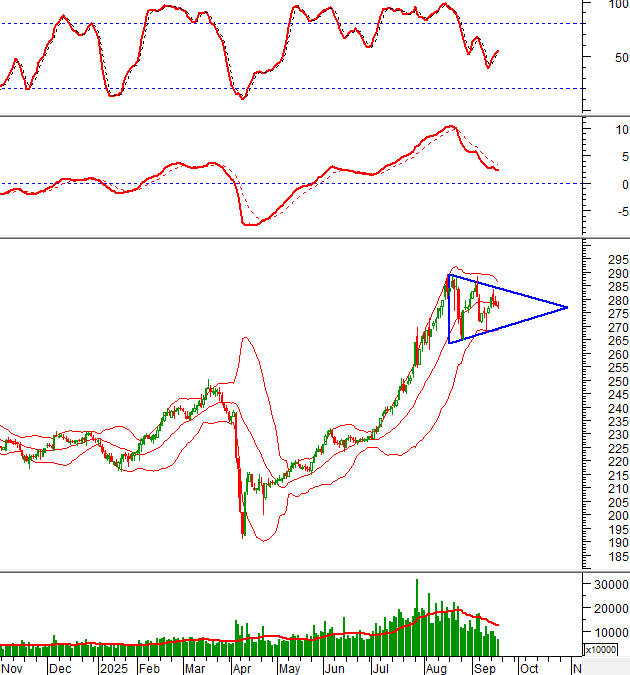

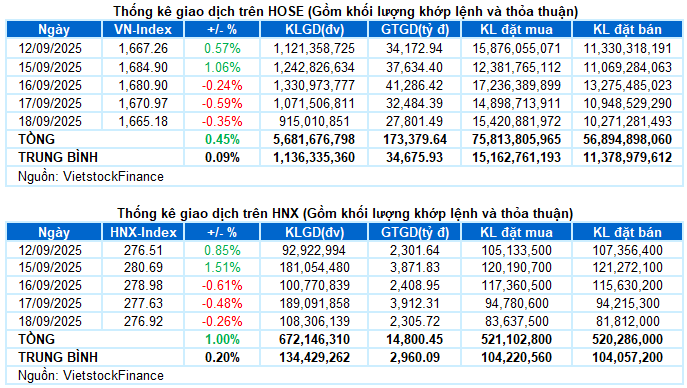

– Major indices continued to decline during the September 18 trading session. Specifically, the VN-Index dropped by 0.35%, closing at 1,665.18 points. Meanwhile, the HNX-Index also fell by 0.26%, settling at 276.92 points.

– Trading volume on the HOSE decreased by 10.7%, reaching over 863 million units. The HNX recorded 67 million units, a 15.6% decline compared to the previous session.

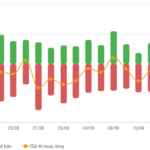

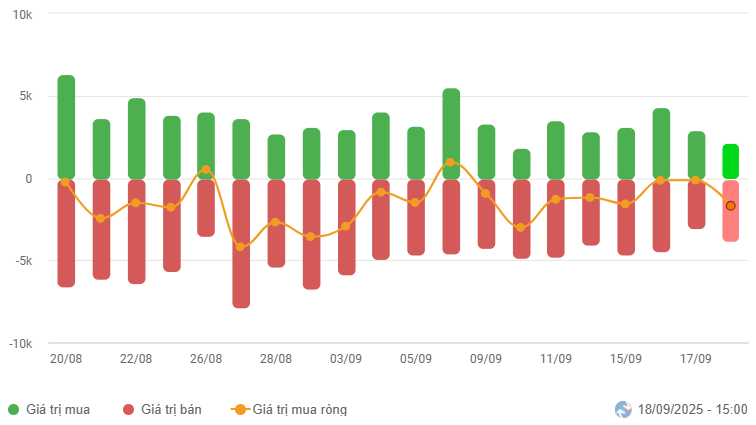

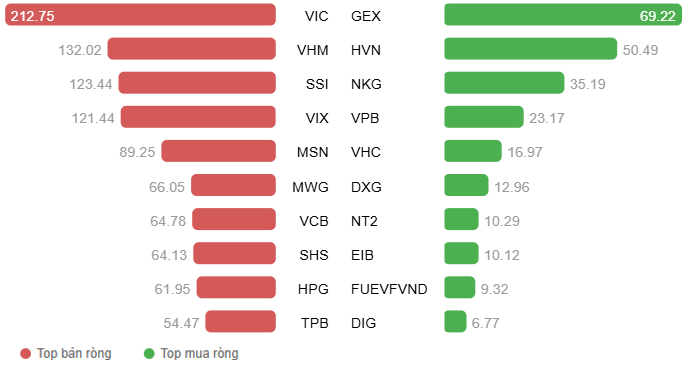

– Foreign investors intensified net selling, with a value of 1.5 trillion VND on the HOSE and over 98 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– Vietnam’s stock market remains cautious following the U.S. Federal Reserve’s (Fed) rate cut decision. The session saw continued tugs-of-war around the reference point on low liquidity throughout the morning. In the afternoon, the efforts of major stocks to maintain momentum became increasingly fragile as selling pressure spread widely. Strong fluctuations near the derivatives expiration deadline caused the VN-Index to lose over 16 points at one point, but the index managed to narrow its decline to nearly 6 points, closing at 1,665.18 points.

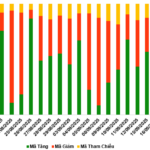

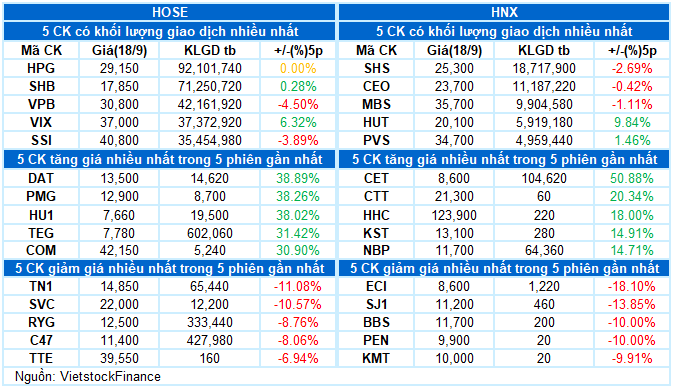

– In terms of impact, VCB was the stock exerting the most pressure on the market today, causing the VN-Index to drop by 1.7 points. Additionally, FPT, VNM, and ACB collectively pulled the index down by 2.4 points. Conversely, VIC was the most positive contributor, holding back 1.7 points for the index.

Top Stocks Influencing the Index. Unit: Points

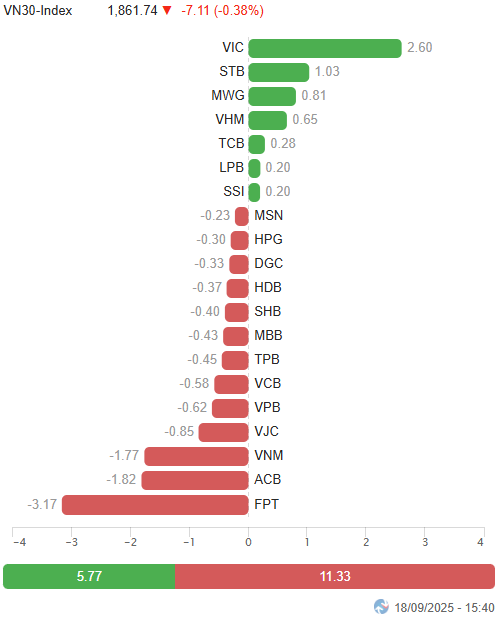

– The VN30-Index closed down 0.38%, at 1,861.74 points. The basket’s breadth heavily favored sellers, with 22 decliners, 7 gainers, and 1 unchanged stock. Leading the decline was FPT, down 2.4%. Followed by VNM, TPB, and ACB, all adjusting by 2.3%. Meanwhile, STB and VIC were the bright spots, maintaining gains of over 1% until the end of the session.

Red dominated most sectors. Information technology was today’s laggard, with leading stocks like FPT (-2.37%) and CMG (-2.81%) seeing deep corrections.

Communication services and energy sectors also recorded over 1% declines as adjustments spread widely. Notable stocks included VGI (-2.05%), VNZ (-3.01%), YEG (-1.43%), FOC (-1.21%); BSR (-0.92%), PLX (-1.39%), PVS (-1.98%), PVD (-2.13%), OIL (-1.69%), and PVC (-1.64%).

Conversely, the real estate sector was a rare bright spot, up 0.6%, primarily driven by large-cap stocks like VIC (+1.33%), VHM (+0.58%), SJS (+1.54%), and DIG (+2.11%). However, other stocks in the sector performed poorly, such as BCM (-0.72%), NVL (-2.58%), TCH (-1.41%), and VPI (-3.14%).

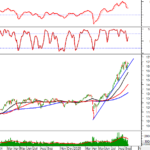

The VN-Index managed to narrow its decline and closed just above the Middle line of the Bollinger Bands. Thus, the short-term trendline (equivalent to the 1,645-1,660 point range) continues to support the index effectively. However, trading volume shows no signs of improvement, making it difficult to expect a breakout or surge in the short term.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Holding Steady Above the Short-Term Trendline

The VN-Index narrowed its decline and closed just above the Middle line of the Bollinger Bands. Thus, the short-term trendline (equivalent to the 1,645-1,660 point range) continues to support the index effectively.

However, trading volume remains below the 20-day average, making it difficult to expect a breakout or surge in the short term.

HNX-Index – Third Consecutive Session of Decline

The HNX-Index declined for the third consecutive session, with trading volume continuing to fall below the 20-day average.

The index is still tugging around the Middle line of the Bollinger Bands as a Triangle pattern forms. This situation is expected to persist in the coming period.

Capital Flow Analysis

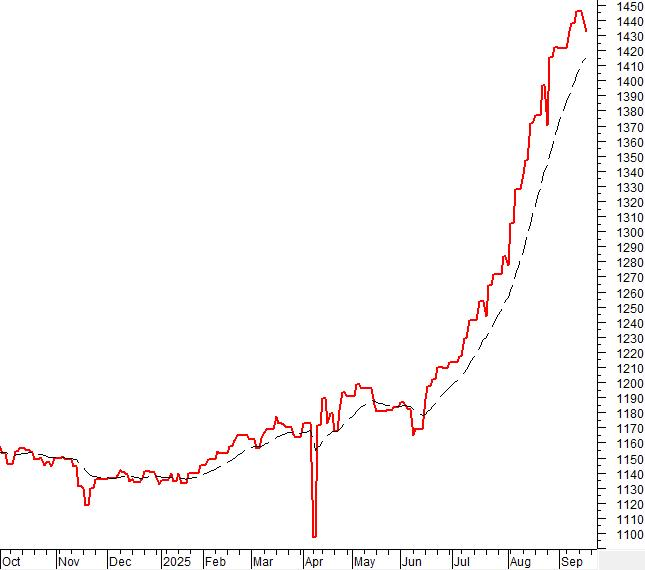

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors were net sellers in the September 18, 2025 session. If foreign investors maintain this action in upcoming sessions, the outlook will become even more pessimistic.

III. MARKET STATISTICS ON AUGUST 27, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:52 September 18, 2025

Vietstock Daily 18/09/2025: Cautious Sentiment Prevails?

The VN-Index persists in its corrective phase, with trading volumes remaining below the 20-day average for seven consecutive sessions, reflecting investors’ cautious sentiment. However, short-term risks appear manageable as the Stochastic Oscillator has generated a buy signal, and the short-term trendline (equivalent to the 1,635-1,650 point range) continues to provide robust support.

Market Pulse 17/09: Continued Volatility as VN-Index Drops Nearly 10 Points

At the close of trading, the VN-Index fell by 9.93 points (-0.59%), settling at 1,670.97 points, while the HNX-Index dropped by 1.35 points (-0.48%), closing at 277.63 points. Market breadth favored the sellers, with 483 decliners outpacing 283 advancers. Similarly, the VN30 basket saw red dominate, with 19 losers, 10 gainers, and 1 unchanged stock.

Bank Stocks and the Calm Before the Rating Upgrade Storm

Banking stocks, the backbone of the VN-Index, are entering a consolidation phase following a heated rally. Over 60% of banking codes have officially corrected from their peaks, yet several key players continue to buoy the market. This resilience is particularly notable as investors anxiously await the Fed’s interest rate decision and FTSE Russell’s market upgrade assessment in October. The contrasting dynamics within banking stocks thus serve as a critical litmus test for overall market sentiment.