This year’s Better Choice Awards in the “Financial Ecosystem” category pose two pivotal questions for Vietnam’s market: How can digital finance truly reach the masses (Outstanding Comprehensive), and how can technology transform experiences to convincingly shift user habits (Impressive Breakthrough)? Viettel Money and HDBank exemplify two contrasting strategies: coverage versus architecture, and inclusivity versus seamlessness.

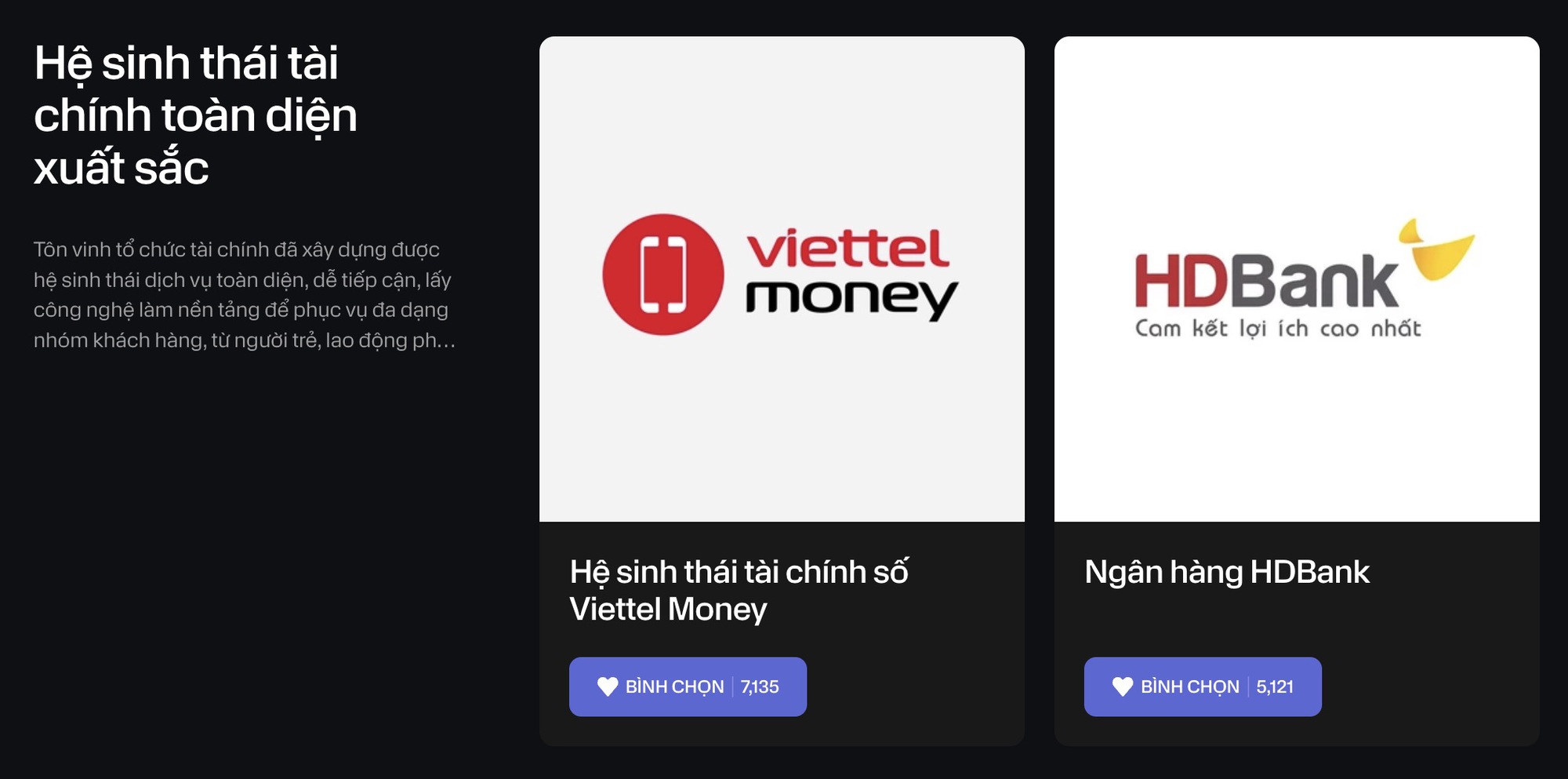

Outstanding Comprehensive Financial Ecosystem: “Inclusivity” Wins Through Reach and Essential Services

If “comprehensive” means accessibility for diverse user groups and a wide range of services, Viettel Money holds a tangible advantage. Unlike traditional digital banks, Viettel Money leverages its telecom foundation to extend digital financial services to rural and mountainous areas, where traditional banks struggle to establish a presence. More importantly, it goes beyond simple money transfers or payments, offering essential services like electricity, water, internet, tuition, healthcare, and public administration payments. Notable integrations include linking social security accounts with VNeID, direct payment on public service portals like I-Hanoi and Hue-S, and ePass solutions for transportation. These linkages position Viettel Money as a “digital payment gateway” integral to the daily lives of millions.

The app currently offers over 350 services, ranging from payments, savings, and digital insurance to online investments. All are designed with a philosophy of lowering barriers, embedding financial services into the most familiar contexts of daily life. This is the definition of “comprehensive” in Vietnam’s context—not just offering many services, but reaching those with limited access to traditional banking.

Viettel Money’s legal and operational framework is robust, holding the Payment Intermediary License 57/GP-NHNN (22/07/2020) and benefiting from the extended pilot period for Mobile Money (Resolution 87/NQ-CP, 15/04/2025), providing the necessary buffer to scale its inclusive reach.

HDBank’s digital ecosystem trio—Digital Core, Di HDBank, and Di HDBiz—also serves a broad range of individuals and businesses. However, it assumes users already have bank accounts and basic digital behaviors. In terms of “inclusivity & reach,” Viettel Money holds the edge by directly addressing the essential and diverse needs of the majority, especially those unfamiliar with traditional banking products.

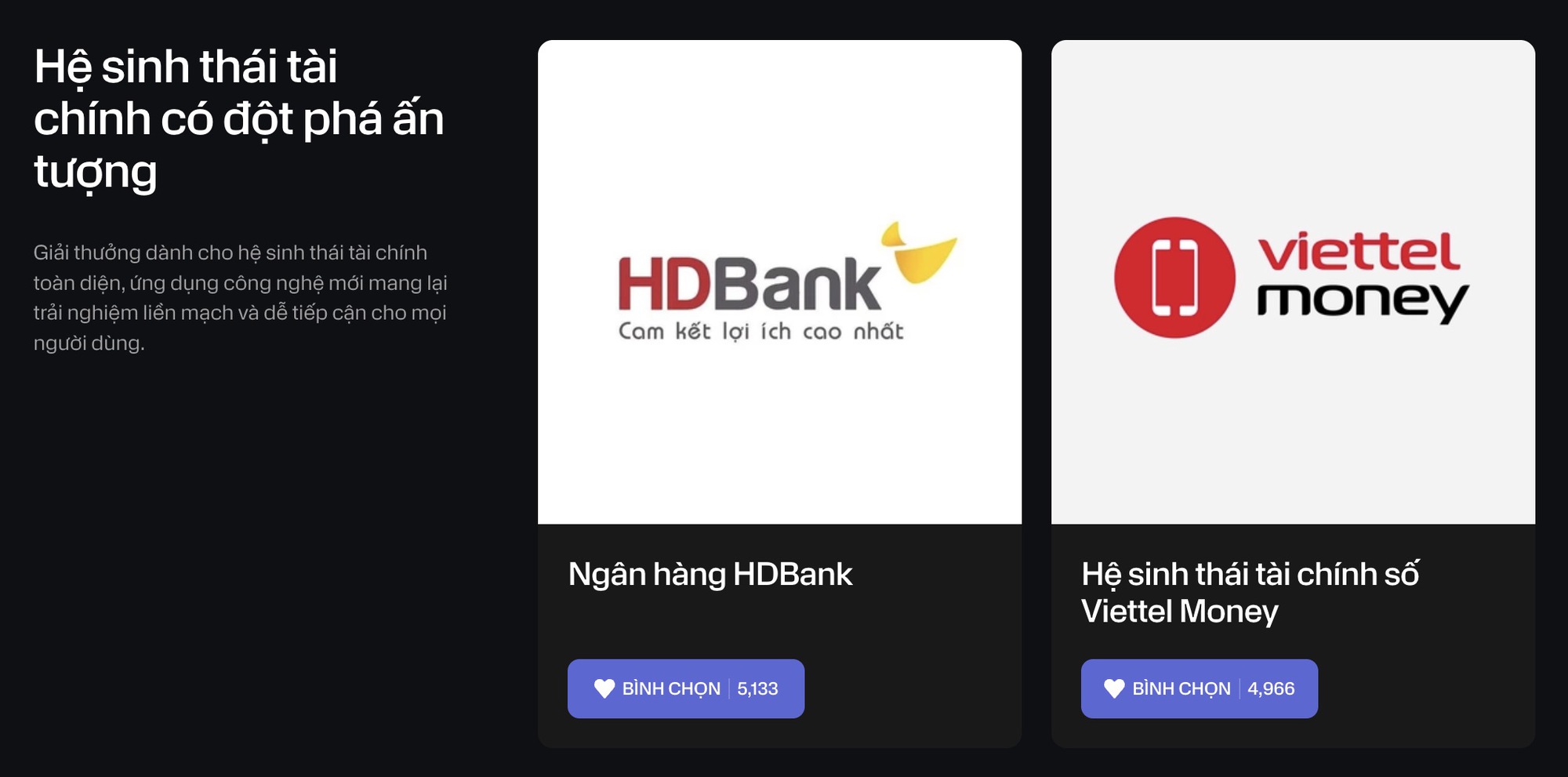

Impressive Breakthrough Financial Ecosystem: “Architecture + Experience” Wins Through Speed and Seamlessness

In the realm of “breakthrough,” HDBank presents a technologically rich landscape: interbank QR (NAPAS 24/7), direct integration of Apple Pay & Google Pay, biometrics, Soft-OTP, tokenization, and Voice-to-Action/Voice OTT interactions with chatbots. This is a “breakthrough in method,” reducing processes to just 1-2 steps, ensuring both smoothness and security, embodying the spirit of “seamless access for all.”

Parallel to this is architectural innovation: cloud-native core, microservices, and containerization (Docker/Kubernetes), enabling the system to double its capacity in a short time without compromising performance. This is a “sustainable breakthrough” as it impacts the operational layer, allowing the bank to shorten time-to-market for new products and enhance stability at scale.

Additionally, HDBank is experimenting with Banking-as-a-Platform and Agent Banking, bringing banking directly into partner apps or hybrid models at counters. This is a “quiet breakthrough,” redefining customer touchpoints and journeys rather than requiring them to actively seek out the bank.

Viettel Money’s notable innovation is integrating AI for personalized experiences and security, but its “breakthrough” approach leans more toward social inclusivity than redefining digital experiences. If the award criteria prioritize seamlessness, security, and transaction speed, HDBank stands out with its modern tech stack and ability to align with Vietnam’s smartphone-first habits.

The competition between Viettel Money and HDBank in this year’s Financial Ecosystem category isn’t about superiority on a single axis but represents two strategic poles. Viettel Money pursues inclusivity through essential services, drawing a broad spectrum of Vietnamese, even those unfamiliar with banking, into digital finance. HDBank, on the other hand, elevates experience standards, making transactions so seamless and secure that users forget they’re using a bank.

In the Outstanding Comprehensive category, Viettel Money holds the advantage with its philosophy of “starting from the essential needs of the majority.” In the Impressive Breakthrough category, HDBank shines with its architecture and experience, bringing Vietnamese digital banking closer to international standards. These two perspectives show that the digital finance market is running on dual tracks: expanding access and elevating experiences. Ultimately, end-users, from rural workers to urban professionals, stand to benefit most from this competition.

The Rise of Retail and Green Banks: OCB Embraces Digital Transformation, Betting Big on Open Banking

At OCB, the strategy of prioritizing retail and green growth is translating into tangible results in operations and business performance. This approach not only drives the bank’s success but also enables it to make significant contributions to society and the national budget.

Danang Prepares to Establish an International Financial Hub

To establish Da Nang as a leading International Financial Center, the city has allocated prime real estate in a strategic location with convenient access to the airport, the urban center, and supporting services. The city has also initiated extensive on-site training and capacity-building programs to attract experts and young professionals, fostering a dynamic and skilled workforce.

A Lucky Winner Takes Home 18 Million – Sacombank Pay’s “Game” Just Got a Whole Lot More Exciting!

“After a thrilling month since its launch, Sacombank Pay’s “Walking Amidst a Vibrant Summer” campaign has witnessed an astounding engagement with nearly 400,000 customers joining the financial fun. With over 4.6 million spins, the campaign has given away almost 130,000 prizes, including a whopping cash prize of 18 million VND to four lucky winners, making it a vibrant financial playground for all participants.”