According to the Ho Chi Minh City Stock Exchange (HoSE), the exchange has decided to place the CMD shares of Vimedimex Pharmaceutical Joint Stock Company under warning status starting from September 23, 2025.

The reason is that the listed company delayed submitting its semi-annual financial report for 2025 by more than 15 days beyond the stipulated deadline, falling under the category of securities subject to warning as per point g, clause 1, Article 36 of the Listing and Trading Rules for Listed Securities, issued under Decision No. 22/QĐ-HĐTV dated April 18, 2025, by the Board of Members of the Vietnam Stock Exchange.

Illustrative image

Earlier, in early September 2025, HoSE sent a notice to Vimedimex regarding information disclosure.

According to the notice, Vimedimex has not yet disclosed its audited semi-annual financial report for 2025 (both standalone and consolidated) in Vietnamese and English as required.

HoSE reminded and urged the company to strictly fulfill its reporting and disclosure obligations in accordance with current securities and stock market regulations to protect investors’ interests.

In other developments, Ms. Tran My Linh, a Board Member and CEO of Vimedimex, was elected as the Chairwoman of the Board of Directors of Hoa Binh Securities JSC (Stock Code: HBS, HNX) for the 2023-2028 term, effective from August 25.

Born in 1982, Ms. Tran My Linh holds a Bachelor’s degree in Economics and a Master’s degree. Previously, she served as Deputy CEO of HBS from September 2022.

Additionally, Ms. My Linh is a representative at several companies, including: Nhue Giang Construction Investment JSC, Bac Tu Liem Housing Development JSC, and Thien Khanh Real Estate LLC.

Earlier, Mr. Le Dinh Duong resigned from his position as Chairman of the Board of Directors of Hoa Binh Securities for the 2023-2028 term due to personal work reasons. However, he remains with HBS as Vice Chairman of the Board from August 25, 2025. According to Hoa Binh Securities’ 2024 Governance Report, as of December 31, 2024, Mr. Le Dinh Duong holds over 6.5 million HBS shares, equivalent to 19.71% of the company’s capital.

Meanwhile, Mr. Le Xuan Tung (born in 1995), Chairman of Vimedimex’s Board of Directors, also serves as a Board Member of HBS. Both Mr. Le Xuan Tung and Mr. Le Dinh Duong are known as the sons of former HBS Chairwoman Nguyen Thi Loan.

Ms. Loan previously served as Chairwoman of Vimedimex’s Board of Directors before her arrest in November 2021 in connection with the auction of 16,000 square meters of land in Dong Anh.

On September 4, 2024, the Hanoi People’s Court sentenced Ms. Loan to 36 months in prison for “Violating regulations on auction activities” and imposed a supplementary fine of VND 40 million.

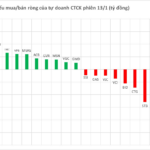

Foreign Sell-Off Extent: Unraveling the Nearly 1.2 Trillion VND Dump in the Week’s Finale

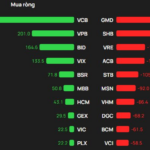

The afternoon trading session witnessed a strong net buying of GEX across the market, totaling 178 billion VND.