According to a recent report by Vietcombank Securities (VCBS), both domestic and global macroeconomic conditions continue to support the long-term upward trend of the stock market in the final months of 2025.

With the national growth target set at 8.3% – 8.5% for 2025, the Prime Minister has directed the State Bank of Vietnam (SBV) to proactively adjust credit growth targets. Historically, credit growth accelerates in the final months of the year, significantly boosting profits for both banks and listed companies.

New policies on E-commerce and the postponement of the Property Tax plan are expected to stimulate the market, particularly for Banking and Real Estate stocks.

Additionally, measures to alleviate exchange rate pressures include the use of new monetary tools by the SBV. Anticipated Federal Reserve rate cuts in September could further reduce interbank market pressures, as treasury bills become less effective. This provides room for the SBV to maintain low-interest rates through year-end.

Moreover, the impending stock market upgrade adds a significant catalyst to market momentum. Frontier market indices typically rise in the year leading up to an upgrade, reflecting long-term economic growth potential.

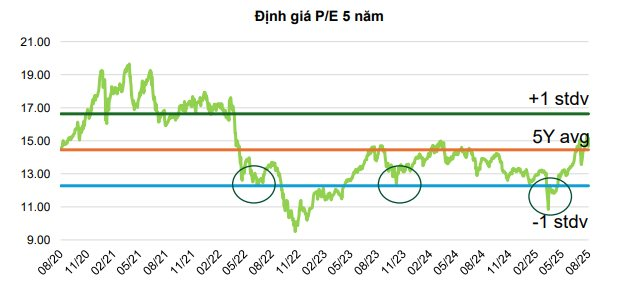

Following the VN-Index’s gains in July and August, the market is trading at a P/E ratio of 14.9x. This valuation is attractive compared to regional averages (~15.3x) and the 5-year average (~14.4x). Coupled with low-interest rates and robust credit growth in the final months, liquidity is expected to remain ample, potentially driving sector P/E ratios to new highs.

For the remainder of 2025, VCBS estimates the VN-Index P/E to range between 13.4x and 16.4x. The index is approaching all-time highs, targeting a base-case scenario of 1,672 points and an optimistic scenario of 1,854 points in the last four months of 2025, driven by (1) market upgrade expectations, (2) aggressive growth policies, and (3) continued diplomatic advancements.

However, the market’s upward trajectory will inevitably face volatility, with potential reversals due to risks such as high inflationary pressures and shifts in monetary policy.

VPBank Securities Experts: Anticipating a Stock Market Surge Following Key Announcement

With the upgrade information, experts believe that the late August and September period has already been factored into the market, tempering the upward momentum. However, as the release date approaches, the impact is expected to intensify.

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-218x150.png)

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-150x150.png)

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-100x70.png)