In a recent report, Vietcombank Securities (VCBS) forecasts robust growth potential for the stock market in the final months of the year.

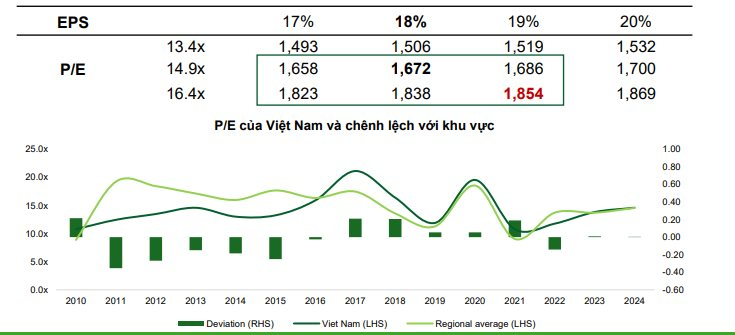

VCBS estimates the VN-Index’s P/E ratio to fluctuate between 13.4x and 16.4x, targeting a base scenario of 1,672 points and an optimistic scenario of 1,854 points by the end of 2025. This projection is underpinned by (1) anticipated market upgrades, (2) aggressive policies to stimulate growth, and (3) strategic diplomatic advancements.

Analysts attribute this optimism to low interest rates and surging credit growth in the final months, which are expected to sustain market liquidity and elevate sector P/E valuations to new highs, propelling the VN-Index toward record levels.

With ambitious economic growth targets, a market-cap-focused investment strategy for late 2025 will prioritize large-cap stocks, particularly in Vietnam’s core sectors: Banking, Securities, Real Estate, Retail, and Energy.

For real estate, VCBS highlights residential property as a promising segment, supported by improved supply dynamics and decisive legal reforms. Strong housing demand is anticipated amid low interest rates and policy easing.

The banking sector is projected to see credit growth accelerate to 18-20%, surpassing the SBV’s annual target. Net interest margins (NIM) are expected to bottom out in Q2 before recovering, while bad debt ratios decline and debt recovery efforts improve.

The securities sector is poised for broad-based improvement, driven by rising brokerage revenues, competitive transaction fees, surging margin lending, and a vibrant IPO market amid favorable equity conditions.

The consumer goods & food sector will benefit from supportive policies and sustained consumption recovery. Livestock companies are particularly attractive as hog prices remain elevated.

In the energy sector, drilling activity is robust with rising rig demand and rates. New field development and LNG imports are critical for energy security. The Ministry of Industry and Trade’s proposal to expand PVN’s decision-making authority could accelerate exploration and production timelines.

For the power sector, electricity output is expected to grow 6% YoY in H2. Renewable energy expansion continues under Power Plan VIII. Coal-fired power benefits from neutral weather patterns, with a 40% chance of La Niña returning.

Market Pulse 19/09: Strong Divergence Persists as Foreign Investors Ramp Up Net Selling of VHM

At the close of trading, the VN-Index fell by 6.56 points (-0.39%), settling at 1,658.62 points, while the HNX-Index dropped by 0.68 points (-0.25%), closing at 276.24 points. Market breadth tilted toward the downside, with 434 decliners outpacing 323 advancers. Similarly, the VN30 basket saw red dominate, as 24 stocks declined, 4 advanced, and 2 remained unchanged.

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.