In a newly released strategic report, An Binh Securities (ABS) highlights that ongoing market upgrade measures are being vigorously implemented, significantly increasing the likelihood of Vietnam’s stock market being elevated to “emerging market” status by October 2025. This milestone could attract billions in international investment funds.

Domestically, economic indicators remain positive. Vietnam’s manufacturing PMI expanded for the second consecutive month, while exports and imports sustained double-digit growth. In the first eight months, total FDI surged, with registered capital for existing projects rising 85.9% year-on-year, reflecting investor expansion in Vietnam.

However, ABS notes several concerns. Despite an eight-month trade surplus of nearly $14 billion, this figure dropped 25.7% year-on-year. Expansionary fiscal and monetary policies, coupled with geopolitical tensions, have driven up gold and currency prices, impacting purchasing power as essential goods become more expensive.

On valuation, the VN-Index’s P/E for the latest four quarters rose from 14.37x on August 8, 2025, to 14.77x on September 8, 2025, slightly above its three-year average plus one standard deviation of 14.32x.

Large-cap stocks in the VN30 trade at a P/E of 13.69x, significantly lower than mid-cap (VNMID at 18.67x) and small-cap (VNSML at 12.46x) stocks. Except for VNSML, these valuations exceed their respective three-year averages plus one standard deviation.

Two Scenarios for the VN-Index

ABS analysts present two medium-term market scenarios:

Scenario 1: The uptrend continues across monthly timeframes. A confirmed breakout occurs if prices hold Support Levels 1 and 2, targeting Resistance Levels 2 and 3.

Scenario 2: A deeper correction may follow the recent five-month rally if prices fail to hold the 1,586–1,600 weekly support. A short-term pullback to Support Level 3 is possible before resuming the uptrend.

Support levels: 1 (1,585–1,600), 2 (1,477–1,490), 3 (1,300–1,340). Resistance levels: 1 (1,727–1,740), 2 (1,740–1,794), 3 (1,813–1,820).

ABS warns that closing below short-term moving averages or stock prices breaching these levels signals a technical correction. Short-term investors should reduce positions, while medium-term investors should hold and accumulate on dips.

Notable September sectors include: Securities, Exports, Industrial Real Estate, Energy, and Retail.

For Securities, ABS forecasts strong Q3 earnings from higher trading volumes, margin lending, proprietary trading, and investment banking fees.

Export sectors (Textiles, Seafood) and Industrial Real Estate benefit from peak season demand and minimal tariff disparities versus competitors. Vietnam remains an FDI magnet.

The Energy sector gains from offshore oil/gas and wind projects, plus the 2026 E10 biofuel mandate. Real Estate and Public Investment sectors benefit from legal reforms and infrastructure projects.

Finance Minister Nguyen Van Thang: “I’m Quite Confident About the Upgrade Potential”

Finance Minister Nguyen Van Thang has expressed “cautious optimism” regarding Vietnam’s potential upgrade to Emerging Market status next month.

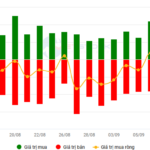

Stock Market Week Sept 8-12, 2025: Roaring Back with a Vengeance

The VN-Index extended its gains in the final session of the week, recouping all losses incurred during the week’s initial downturn with four consecutive rebound sessions. However, trading volume remained below the 20-day average, and sustained selling pressure from foreign investors remains a short-term concern.