VNDirect Securities (Stock Code: VND) has recently announced the materials for its 2025 Extraordinary Shareholders’ Meeting, scheduled for 2 PM on October 10th at the company’s headquarters (1 Nguyen Thuong Hien Street, Hai Ba Trung District, Hanoi). Shareholders can attend either in person or online.

The primary focus of this meeting is the capital increase plan through share issuance. According to the documents, the Board of Directors (BOD) stated that during the 2025 Annual General Meeting (AGM), shareholders agreed to proceed with various share issuance plans, including a private placement to professional securities investors as per the 2024 AGM resolution.

Amid the stock market’s robust recovery and significantly improved liquidity, the BOD sees this as an opportune moment to accelerate capital raising efforts. The funds will support business expansion, technology investments, and service diversification.

Previously, VND shareholders approved three capital increase plans: a private placement of nearly 269 million shares to professional investors, an employee stock ownership plan (ESOP) of up to 30 million shares, and a bonus share issuance of 15 million shares to employees. However, none of these plans have been implemented yet.

At the upcoming extraordinary meeting, the BOD will propose amendments to the private placement plan and introduce a new rights issue plan for existing shareholders.

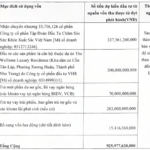

For the private placement , VNDirect plans to issue over 106.56 million shares to professional securities investors. The offering price will be negotiated between the company and investors but will not be lower than the latest book value. These shares will be subject to a one-year transfer restriction post-issuance.

Additionally, the company aims to offer up to 325.77 million shares to existing shareholders at a rights ratio of 5:1 and an offering price of VND 10,000 per share.

Shareholders may transfer their rights once during the subscription period, while any fractional shares will be canceled. Unsubscribed shares will be allocated by the BOD to other investors at a price no lower than the rights issue price. The issuance is expected to take place between 2025 and 2026.

Upon completion of both offerings, VNDirect will issue over 432 million new shares, increasing its charter capital from VND 15,223 billion to VND 19,546 billion, ranking it just behind TCBS and SSI, which have charter capitals exceeding VND 20,000 billion.

The proceeds from the share issuances will be allocated as follows: 60% to supplement margin lending activities and 40% to invest in securities, deposit certificates, and term deposit contracts.

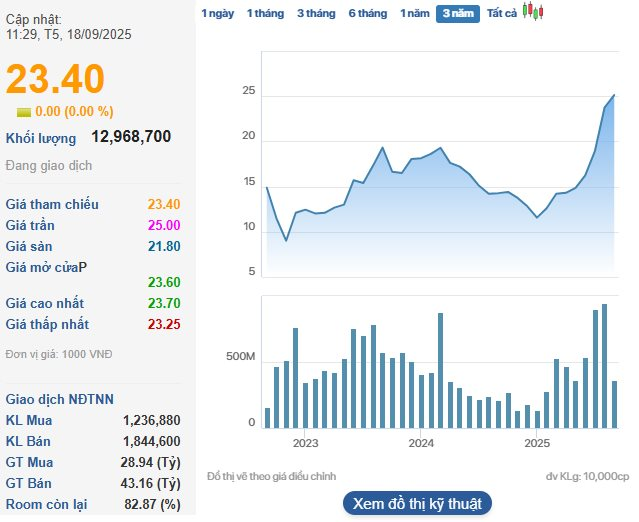

On the stock market, VND shares closed the morning session on September 18th at VND 23,400 per share.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

PV Power Plans to Issue Nearly 726 Million Shares to Boost Chartered Capital

PV Power will present an extraordinary shareholders’ meeting in 2025 to approve the issuance of nearly 726 million shares, aiming to increase its chartered capital to over 30,678.5 billion VND.

The Ultimate Capital Boost: Unveiling NRC Corporation’s Extraordinary General Meeting

The NRC Group, a dynamic organization with a fresh vision, is leaving no stone unturned to ensure its success. With a new name, a new CEO, and an extraordinary general meeting on the horizon, the Group is set to discuss a private placement plan to boost its charter capital. This forward-thinking approach demonstrates the Group’s commitment to growth and innovation, as it charts a new course for the future.