VPBank Securities (VPBS) plans to issue a maximum of 40,000 corporate bonds in up to 5 tranches during Q3-Q4/2025. These non-convertible, unsecured bonds will establish direct debt obligations for VPBS.

The bonds have a 12-month term with a maximum interest rate of 8% per annum, payable every 3, 6, or 12 months. Principal repayment occurs at maturity, except in cases of early redemption.

With a face value of VND 100 million per bond, VPBank’s securities arm aims to raise up to VND 4 trillion. The funds will be disbursed in Q3-Q4/2025.

VPBS intends to use the proceeds to repay principal and interest on debts maturing between October 2025 and June 2026.

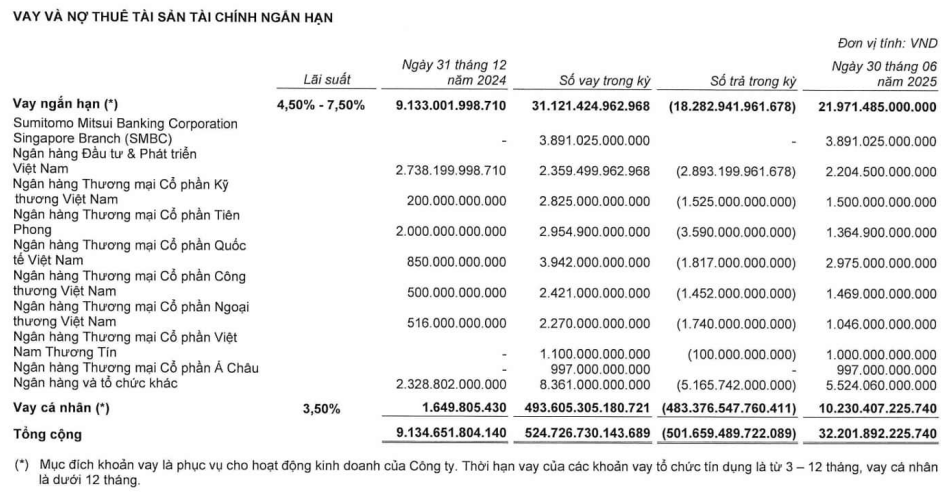

As of June 30, 2025, VPBS had no outstanding bond debt but relied heavily on short-term loans. Short-term debt surged from VND 9.135 trillion to VND 32.202 trillion, increasing its share of total capital from 34% to 63%.

Key lenders include BIDV, VietinBank, TPBank, and other individuals/entities contributing over VND 10.230 trillion in total debt.

Source: VPBS’s 2025 H1 Reviewed Financial Report

|

Increased capital boosted VPBS’s total assets to over VND 50.901 trillion, up from VND 26.714 trillion at year-start. Key drivers include: cash rising from VND 2.313 trillion to VND 14.773 trillion; FVTPL assets increasing from VND 12.538 trillion to VND 15.204 trillion (mainly fair-value bonds/unlisted shares); and loans growing from VND 9.513 trillion to VND 17.758 trillion (primarily margin lending).

IPO Launch in October

Beyond debt financing, VPBS plans an initial public offering (IPO) of up to 375 million shares (25% of outstanding shares). Post-IPO, capital is expected to rise from VND 15 trillion to VND 18.75 trillion.

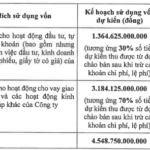

The IPO is scheduled for Q3/2025–Q2/2026. Funds will allocate: 70% for margin lending and legal operations; 30% for securities investment/proprietary trading. Proceeds will disburse in Q4/2025 and 2026.

VPBS’s online platform promotes the IPO, with subscriptions opening in October 2025.

Source: VPBS Online Trading Platform Announcement

|

Ambitious 2030 Strategy

On September 15, VPBS’s Board approved its 2026–2030 mid-term strategy, emphasizing AI, blockchain, and crypto asset platforms.

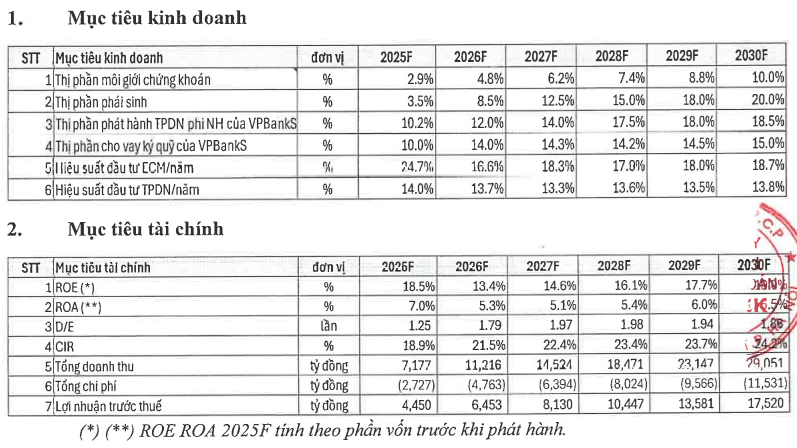

By 2030, VPBS targets: 10% brokerage market share, 20% derivatives, 18.5% non-bank bond issuance, and 15% margin lending (up from 2.9%, 3.5%, 10.2%, and 10% in 2025).

Financially, VPBS aims for VND 7.177 trillion in revenue and VND 4.450 trillion pre-tax profit in 2025, rising to VND 29.051 trillion and VND 17.520 trillion by 2030—a 4x growth.

Source: VPBS

|

– 13:53 19/09/2025

“Faith and Aspiration: Meey Group’s IPO Journey”

As the Strategy Director of Meey Group, a pioneering proptech enterprise that has cemented its market leadership, Ms. Nguyen Ly Kieu Anh firmly believes, “There’s no room for regrets. The important thing is whether you want to do it or not.”

“VPBank’s Upcoming IPO: 375 Million Shares to Double 2025 Profit Plans”

With the written shareholder vote concluded on September 3rd, the plan to initiate an initial public offering (IPO) of VPBank Securities Joint Stock Company (VPBankS) has been approved. The IPO will offer a maximum of 375 million shares to the public. In addition, shareholders have also agreed to double the profit plan for 2025 and appoint an additional member to the board of directors.