The Vietnamese government is set to issue a resolution addressing land-use conversion fees for households and individuals transitioning agricultural land to residential use. Drafted by the Ministry of Finance and reviewed by the Ministry of Justice, this resolution aims to resolve practical challenges arising from the 2024 Land Law.

Land-use conversion fees for households and individuals will be determined by provincial People’s Councils within a framework set by the government, differentiating between land areas within and outside local residential land limits.

The residential land limit for fee calculation is assessed at the time of the land-use conversion decision. Each household or individual is entitled to only one residential land limit determination, even in cases of household separation.

Upcoming resolution aims to ease land conversion fees, reducing financial strain on residents transitioning to residential land. |

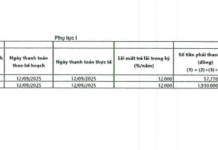

Notably, the resolution includes transitional provisions for land-use conversion fees applicable to cases approved between August 1, 2024, and the resolution’s effective date.

For households or individuals approved to convert land originating from gardens, ponds, or agricultural land within residential areas to residential use, or those with separated land plots due to pre-July 1, 2004 cadastral measurements, the following applies:

If land-use conversion fees have not been paid as per tax authority notices, fees will be recalculated under the new resolution, and tax notices will be adjusted accordingly. Late payment fees, if applicable, must also be settled.

If fees have already been paid, no recalculation will be made under the new resolution.

This resolution is proposed as a temporary measure to address urgent issues arising from practical implementation, with an anticipated issuance in September 2025 and an effective period until February 28, 2027.

By Nguyễn Lê

– 06:15 11/09/2025

Is There a 50% Land Use Fee Reduction? Residents Still Await an Answer After Four Months.

As an ethnic Nung person residing in an area that is not classified as economically or socially disadvantaged, there remains uncertainty about eligibility for a 50% reduction in land use fees upon conversion, even after submitting the necessary documents over four months ago.

What Are the Requirements for Obtaining a Red Book for Land Without Documents?

The 2024 Land Law introduces a host of new provisions, including relaxed requirements for land use certificate eligibility for undocumented land. This significant development addresses long-standing issues related to land ownership and paves the way for a more efficient and equitable land management system.