Domestic Investors Lead Vietnam’s Stock Market Surge

Mr. Le Thanh Hung – Investment Director, UOBAM Vietnam Fund Management JSC

|

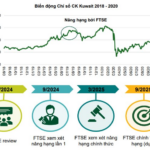

During the macroeconomic update session on the afternoon of September 17, Mr. Le Thanh Hung – Investment Director, UOBAM Vietnam Fund Management JSC, highlighted that the VN-Index soared by 25.9% in just three months since early June—an impressive rally, especially amid global economic uncertainties. This breakout growth reflects investors’ strong optimism about Vietnam’s economic and corporate prospects, as well as the anticipated upgrade of Vietnam’s market status to Emerging Market by FTSE Russell.

Key drivers of this market uptrend include: accommodative monetary policy with low interest rates fueling capital inflows; expectations of FTSE Russell’s Emerging Market upgrade in Q3, attracting significant foreign capital; robust Q2 earnings reports, particularly in banking, financial services, transportation, and retail; and surging liquidity, with trading volumes exceeding VND 40 trillion on certain sessions, driven by active retail participation.

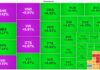

Leading growth sectors in this period were:

- Banking: Benefiting from loose monetary policy and high credit growth.

- Securities: Fueled by upgrade expectations, soaring liquidity, and TCBS’s IPO spillover.

- Real Estate: Supported by government policies resolving legal bottlenecks.

- Vingroup Stocks: Anticipated gains from involvement in key national infrastructure projects.

Domestic investors dominated this rally, accounting for 85-90% of market liquidity. In contrast, foreign investors remained net sellers, with year-to-date outflows reaching VND 74 trillion by August-end. August alone saw net foreign outflows of over VND 41 trillion.

According to Mr. Hung, foreign investors’ persistent selling stems primarily from exchange rate concerns. From January to August 2025, the Vietnamese Dong depreciated by approximately 3.5% against the USD, despite the latter’s global weakening trend. The currency’s weakness, coupled with the market’s sharp gains, prompted profit-taking and outflows from foreign players.

Mr. Hung believes foreign capital will return strongly once exchange rate worries subside, as Vietnam’s mid-to-long-term growth story remains compelling. Downward pressure on the Dong may ease by year-end as the US Federal Reserve begins rate cuts, potentially weakening the USD and stabilizing the VND.

Positive Outlook for Vietnam’s Stock Market in Late 2025

Mr. Le Thanh Hung maintains a positive outlook for Vietnam’s stock market in the second half of 2025, citing robust economic growth, supportive government policies, and the potential market upgrade.

The government is expected to accelerate public investment and maintain accommodative monetary policy, targeting 16% credit growth to achieve 8.3-8.5% GDP expansion. Legal hurdles in real estate are being addressed, boosting market confidence. UOB also anticipates Vietnam’s Emerging Market upgrade this year, attracting substantial international fund inflows. Finally, reduced US tariff concerns help sustain Vietnamese export competitiveness and FDI stability.

However, Mr. Hung identifies lingering risks, including potential global inflation resurgence from Trump’s trade policies and geopolitical tensions. Currency volatility remains a critical watchpoint, with the VND among the region’s weakest performers year-to-date.

Market Prospects Following October Upgrade

If FTSE Russell upgrades Vietnam to Emerging Market status in October 2025, the outlook will be highly positive.

The upgrade is expected to attract significant foreign capital, including approximately USD 1 billion from ETFs and active funds, boosting liquidity and corporate fundraising. It will also uplift domestic investor sentiment, sustaining local capital dominance. Additionally, the upgrade will encourage regulatory reforms in trading, settlement, ownership, and legal frameworks—laying a solid foundation for sustainable market development and paving the way for future MSCI upgrades.

Mr. Hung’s current investment strategy focuses on domestically oriented sectors and companies, less dependent on exports and directly benefiting from the government’s expansionary fiscal and monetary policies. Key sectors include:

- Banking: Benefiting from 2025’s high credit growth targets.

- Securities: Driven by market upgrade expectations and crypto exchange licensing.

- Technology & Logistics: Capitalizing on global supply chain shifts.

- Construction & Building Materials: Boosted by robust public investment.

- Retail & Consumer: Supported by rising domestic demand and tourism recovery.

- Real Estate: Aided by legal bottleneck resolutions.

– 08:58 18/09/2025

VN-Index Remains Favorable in the Medium Term, but Key Support Levels to Watch

ABS highlights that when the market confirms a close below the short-term moving average, stocks in the account breaking through the moving average… serve as a technical signal confirming a correction.

VN-Index Projected to Reach 1,854 Points by Year-End, Yet Volatility Remains Inevitable

The broader domestic and global macroeconomic landscape, coupled with the impending stock market upgrade narrative, serves as a powerful catalyst fueling the market’s upward trajectory.