Credit Ratings and Sovereign Ceiling

First and foremost, it’s essential to understand what a credit rating is. It’s a metric that assesses credit risk—the ability of a country or corporation to repay its debts. For Vietnamese companies seeking to raise capital through international bond markets, a credit rating is virtually a “passport” to access global investors. The higher the rating, the lower the borrowing costs; however, achieving a high rating depends not only on internal financial health but also on the sovereign ceiling—the maximum rating a country’s entities can attain.

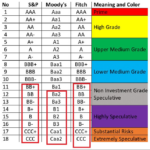

This is an immutable principle in the credit rating industry. In 2024, the three major credit rating agencies—Moody’s, Fitch Ratings, and S&P Global Ratings—maintained Vietnam’s sovereign rating at stable levels. Specifically, Fitch and S&P assigned a rating of BB+, while Moody’s retained a Ba2 rating. Consequently, no domestic entity, whether a leading private conglomerate or a major state-owned enterprise, can achieve a rating higher than BB+ with Fitch or S&P, or Ba2 with Moody’s.

Highlighted area: the maximum credit rating Vietnamese companies can achieve as per international rating agencies’ calculations

This means that both state-owned enterprises and private companies share the same sovereign ceiling. A recent example is S&P Global Ratings assigning Vietcombank a BB+ rating, Techcombank a BB rating, and Eximbank a BB‑ rating. Typically, the banking sector enjoys higher credit ratings compared to other sectors. In early 2025, Vinhomes received a Ba2 rating with a stable outlook from Moody’s and a BB- rating with a stable outlook from Fitch.

“Junk” Does Not Mean “Bad”

The term “junk” in credit ratings often leads to misunderstandings. In reality, BB+ is the highest level within the Non-Investment Grade category, just below the Investment Grade threshold (BBB-). Currently, dozens of countries worldwide are rated BB+, BB, or lower by agencies like Fitch, S&P, and Moody’s, placing them in the Non-Investment Grade group. This is not a “junk” category but rather a segment offering higher potential returns with corresponding risks.

In practice, many emerging economies and large corporations have successfully issued international bonds during their BB+ or BB- phases, attracting investors with attractive yields. Indonesia, for instance, remained at BB+ for years before achieving Investment Grade status, yet its companies continued to raise international capital effectively during that period.

Classifying bonds as Investment Grade or Non-Investment Grade merely provides investors with an initial perspective and helps determine what they consider a reasonable interest rate. Beyond the credit rating label assigned by agencies, investment decisions are heavily influenced by the intrinsic strength and potential of the issuing country or entity.

Therefore, a Vietnamese company rated BB+ or BB- is not a sign of weakness or “junk” status but rather a reflection of the characteristics of a developing economy. Understanding the true nature and principles of credit ratings will enable investors and the public to form a fairer, more objective view of Vietnamese enterprises. “Junk” is not synonymous with “bad”; it is a technical term reflecting potential returns relative to risk according to international standards, and Vietnam is steadily progressing toward achieving Investment Grade status in the near future.

Why Vietnam’s Corporate Credit Ratings Hit a Global Ceiling

Recently, concerns have arisen regarding the classification of several major Vietnamese enterprises as “junk” or “non-investment grade” by international credit rating agencies. However, a deeper understanding of how global credit rating systems operate reveals that such ratings are not inherently negative and do not equate to labeling these businesses as “junk.”

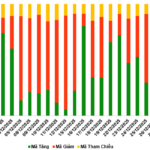

VPBank Securities Experts: Anticipating a Stock Market Surge Following Key Announcement

With the upgrade information, experts believe that the late August and September period has already been factored into the market, tempering the upward momentum. However, as the release date approaches, the impact is expected to intensify.

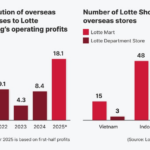

Korean Retail Giant to Launch 2-3 Luxury Shopping Malls in Vietnam

Lotte Shopping, South Korea’s leading retailer, has unveiled plans to expand its footprint in Vietnam with the addition of 2-3 new shopping malls. The company aims to double its operating profits by 2030, marking a significant growth strategy in the region.