As of the latest update on September 19th, major brands reported a significant drop in ring gold prices, while SJC gold prices remained unchanged. Specifically, ring gold prices at Bao Tin Minh Chau fell by 200,000 VND per tael compared to this morning, reaching 126.8–129.8 million VND per tael, marking a total daily decrease of 400,000 VND per tael.

Earlier in the morning, DOJI Group reduced ring gold prices by 300,000 VND per tael, while SJC and PNJ companies applied a slight reduction of 200,000 VND per tael.

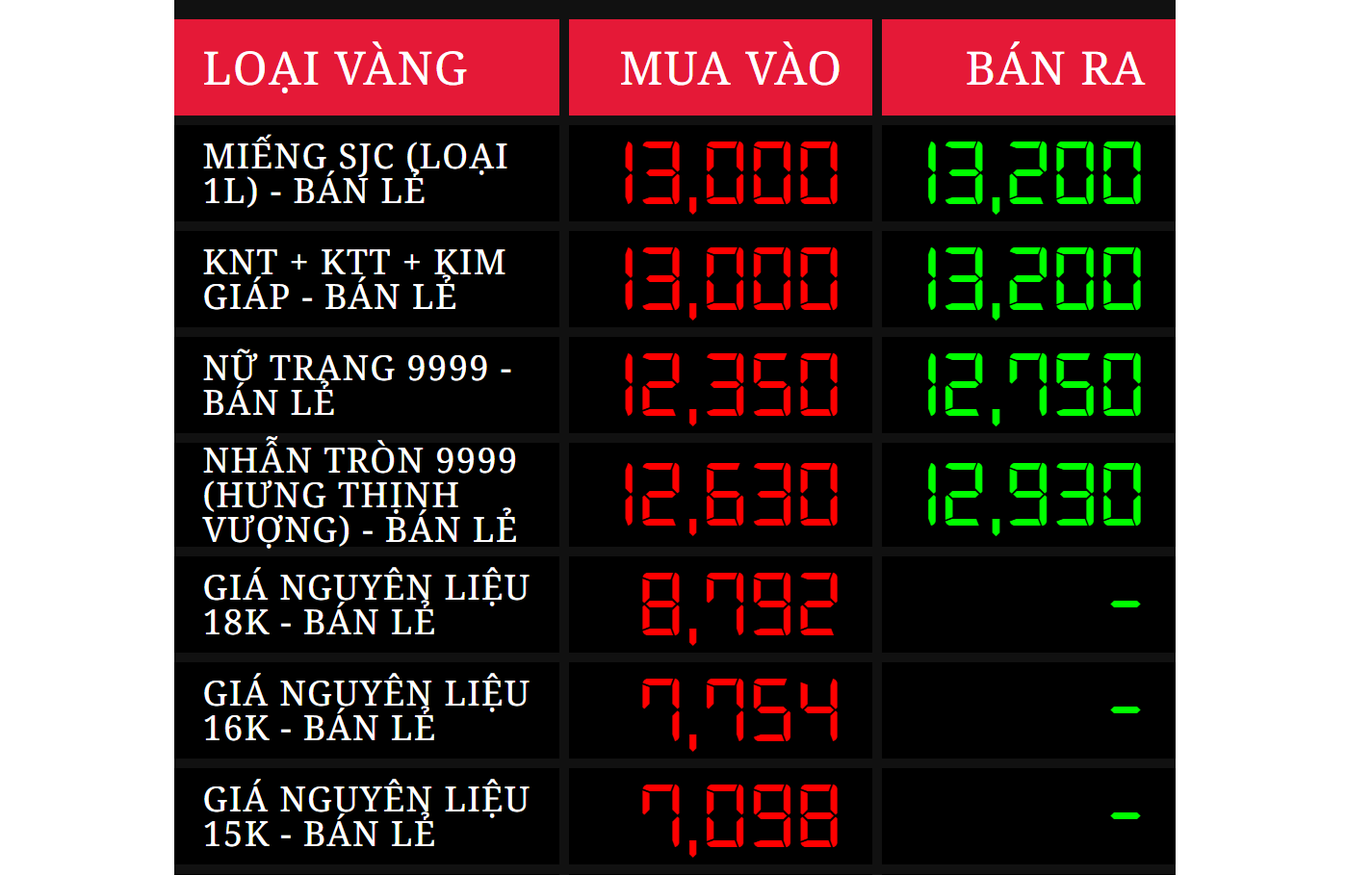

Gold prices listed at DOJI

——————-

At DOJI Group, plain ring gold is listed at 126.3–129.3 million VND per tael, a 300,000 VND per tael decrease from yesterday.

SJC Company lists ring gold at 126.0–128.7 million VND per tael, while PNJ sets the price at 126.3–129.3 million VND per tael.

Bao Tin Minh Chau also reduced prices by 200,000 VND per tael early in the morning, now ranging from 127.0–130.0 million VND per tael.

Previously, on September 18th, ring gold prices across the market dropped by 400,000–800,000 VND per tael.

In the international market, gold prices continued to adjust downward to $3,638 per ounce. Compared to yesterday’s record high, gold has decreased by approximately $70 per ounce.

The gold market is witnessing significant profit-taking as economists describe the Federal Reserve’s latest move as a cautious easing cycle. However, a research firm asserts that gold remains in a long-term upward trend.

Metals Focus analysts note that the Fed’s latest “dot plot” indicates only one rate cut next year. In contrast, the CME FedWatch tool predicts rates will be 100 basis points lower by the end of 2025.

“Since the FOMC statement largely aligned with market expectations, the emergence of technical profit-taking in the short term for gold is unsurprising,” Metals Focus stated.

However, analysts emphasize that gold’s upward momentum is not solely driven by short-term interest rate policies.

“The macroeconomic and geopolitical landscape continues to support investment and gold prices. Therefore, the ‘buy-the-dip’ trend is likely to persist, pushing the metal to new record highs until 2026. Even if the outlook for 2026–2027 becomes slightly more hawkish, the market still anticipates further rate cuts,” they added.

Metals Focus CEO Philip Newman told Kitco News in an interview before Wednesday’s decision that a significant risk not yet priced into gold is political pressure on the Fed’s independence.

Economists warn that the USD could be impacted if the market perceives the Fed as an extension of the White House.

“The Federal Reserve’s independence is a major wildcard, and that scenario is currently unpriced in the market,” Newman said. “If the Fed’s independence is compromised, it could weaken the USD. While suggesting the USD’s status as the world’s reserve currency is threatened may be extreme, it will undoubtedly raise questions.”

Despite slower central bank gold purchases during the summer, Newman expects reserves to continue growing as banks diversify away from the USD. He added that if the Fed succumbs to political pressure, inflation risks could escalate—a positive scenario for gold.

Surprise Power Unleashes Nearly $35 Billion to Scoop Up Vietnamese Stocks on September 18th

Proprietary trading firms significantly ramped up their net buying activities on the Ho Chi Minh Stock Exchange (HOSE), accumulating a total of VND 769 billion in the latest trading session. This surge underscores their growing confidence in the market and strategic positioning amidst evolving economic conditions.

Bitcoin and a Wave of Cryptocurrencies Surge Ahead of a Major Event

As Bitcoin and numerous altcoins experience a surge in value, global investors are turning their attention to the Federal Reserve’s monetary policy meeting, a pivotal event that could shape the future of the cryptocurrency market.