Private Banks Accelerate Capital Increase

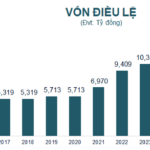

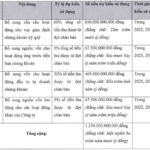

An Binh Commercial Joint Stock Bank (ABBank) has announced a resolution from its shareholders’ meeting, approving a capital increase from VND 10,350 billion to VND 13,973 billion, a 35% rise. ABBank plans to execute this through two methods: issuing shares to existing shareholders and an ESOP program.

The Board of Directors of Ho Chi Minh City Development Commercial Joint Stock Bank (HDBank) has also approved a resolution to increase its charter capital by up to VND 3,493 billion through bond conversions, representing a 10% increase.

Sai Gon – Ha Noi Commercial Joint Stock Bank (SHB) has announced an increase in voting shares from 4.1 billion to nearly 4.6 billion after completing a share issuance for the 2024 dividend payment, officially raising its charter capital to nearly VND 46,000 billion, a 13% increase.

Private banks race to increase charter capital.

In August, Orient Commercial Joint Stock Bank completed an 8% bonus share distribution to existing shareholders, raising its charter capital to VND 26,630 billion.

Earlier, Military Commercial Joint Stock Bank (MB) announced an increase in voting shares from 6.1 billion to nearly 8.1 billion after issuing shares for dividend payments, officially raising its charter capital to VND 80,550 billion, a 32% increase.

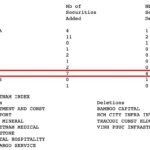

As of now, most private banks listed on the stock exchange have completed their 2025 capital increase plans approved by shareholders. However, the three state-owned commercial banks—Vietcombank, VietinBank, and BIDV—remain relatively inactive with just over three months left in the 2025 fiscal year.

As the backbone of the financial system, leading the market and implementing policy tasks, capital increases are crucial for state-owned banks to strengthen their capabilities and support economic growth.

The Government issued Resolution No. 273 on September 9, 2025, urging the State Bank of Vietnam to expedite capital increases for state-owned commercial banks.

As pillars of the system, supporting state policies and economic development, state-owned banks urgently need capital increases to lead Vietnam’s banking sector.

Due to their operational nature, capital increases for state-dominated banks require multiple approvals from the State Bank, Ministry of Finance, Government, and National Assembly. This lengthy process must be repeated annually.

Circular 14/2025 from the State Bank introduces the concept of systemically important banks. These banks, including Vietcombank, BIDV, and VietinBank, must maintain additional capital buffers to ensure systemic safety.

Banks Strengthen Capital Buffers

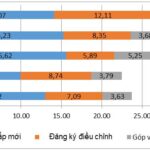

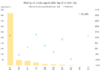

FiinGroup forecasts that 2025 could be a peak year for bank capital increases, with a projected total of VND 33,000 billion, surpassing previous years. The primary goal is to strengthen capital buffers, meet safety requirements (CAR, LDR, short-term capital ratios for medium-long term loans), as credit growth outpaces deposits, with the industry LDR exceeding 108%.

Dr. Nguyen Tri Hieu, a banking expert, notes that banks must urgently increase charter capital due to rising risk provisions, the need for medium-long term capital, technology investments, and CAR improvements.

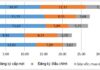

Despite regular capital injections, Vietnamese banks’ CAR remains lower than regional averages.

To meet CAR standards, banks must increase charter capital through dividend share issuances and ESOP programs.

The State Bank recently issued Circular 14, effective from September 15, setting stricter capital adequacy requirements for commercial banks and foreign bank branches. Circular 14 aligns with Basel III standards, requiring banks to maintain a minimum CAR of 10.5% from 2030, up from the current 8%.

With this CAR roadmap, capital increases are no longer optional but mandatory for banks.

ABBank Plans to Boost Chartered Capital to Nearly VND 14 Trillion

On September 16th, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) announced a resolution passed by its Annual General Meeting of Shareholders to increase its chartered capital from VND 10,350 billion to nearly VND 13,973 billion, representing a 35% increase.

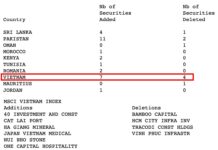

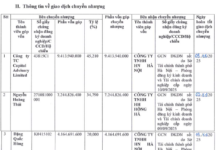

Spring Securities Shareholders Eye Pre-IPO Exit as 135 Million Shares Gear Up for Public Offering

In the lead-up to Xuan Thien Securities’ shareholder list closure for the issuance of 135 million shares, several major shareholders, including key company executives, have filed to divest their holdings.