CC1 has appointed Mr. Hoàng Trung Thanh as Deputy General Director, effective from September 18th. Born in 1971, Mr. Thanh holds a degree in construction engineering and has been with CC1 since 1996. He previously served as Deputy General Director from 2010 to March 2024, followed by a stint as Executive Director of Construction before returning to his former position.

This move comes amid a series of leadership changes within CC1‘s Deputy General Director roles since the beginning of the year. In mid-May, CC1 relieved Mr. Nguyễn Văn Ngọc of his duties to focus on his role as Vice Chairman of the Board of Directors and member of the Audit Committee.

Earlier in February, the company also removed Mr. Nguyễn Văn Tuấn from the position, assigning him a new role as Executive Director of Construction, overseeing transportation and technical infrastructure.

Additionally, at the beginning of the year, Mr. Trần Minh Doanh stepped down as Deputy General Director to pursue new responsibilities.

Current leadership of CC1

|

Metro Line 1 Advisor Takes the Helm as CC1 Chairman

In other developments, on September 11th, the CC1 Board of Directors approved the divestment of 60% of its stake in Hai Phong Coastal Road Investment Company Limited (HPRC), reducing its ownership from 75% to 15%. Following this transaction, HPRC will no longer be a subsidiary of CC1.

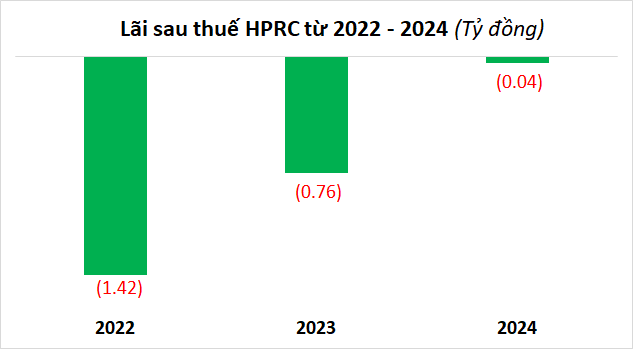

CC1‘s decision to divest from HPRC comes as the company has struggled financially in recent years, incurring losses exceeding 2 billion VND from 2022 to 2024.

Source: Compiled from CC1

|

Furthermore, CC1 has opted not to participate in the capital increase of CC1 Asset Management and Services Company Limited, which aims to raise its charter capital from 450 billion VND to 1,150 billion VND.

CC1 has agreed to allow existing members or new investors, as identified by CC1 Asset Management and Services Company Limited, to contribute the additional capital that CC1 has declined to provide, in accordance with current regulations and the company’s charter. As of late June, CC1 had 8 subsidiaries (including HPRC) and 10 associate companies, with a 48.89% stake in CC1 Asset Management and Services Company Limited.

Established in 2017 with an initial charter capital of 900 billion VND as a joint-stock company, HPRC’s founding shareholders included CC1 (40%), Bui Vu Construction and Investment JSC (25%), Vietnam Urban and Industrial Zone Development Investment Corporation – LLC (IDICO, now privatized, HNX: IDC) (25%), and Infrastructure Development Investment Corporation 9 (10%). In February 2022, the company transitioned to a limited liability company, with CC1 holding 89.109% and Bui Vu retaining 10.891%. As of December 2022, CC1 owned 75%, while Bui Vu held 25%. Mr. Hà Văn Hân serves as General Director and legal representative. HPRC is a project-based enterprise, established to invest in and construct a 29.7km coastal road section spanning Hai Phong city and 9km in Thai Binh province under a public-private partnership (PPP) model (Hai Phong – Thai Binh Coastal Road Project). The Hai Phong – Thai Binh Coastal Road Project, structured as a BOT contract, boasts a total investment of 3,759 billion VND. This comprises 720 billion VND in state funding and 3,039 billion VND in BOT capital, of which 2,139 billion VND (70% of BOT capital) is borrowed. Construction commenced in May 2017, with an initial completion target of late 2019. However, the project faced significant challenges due to a 5-6%/year discrepancy between actual and contracted lending rates in the BOT agreement. By May 2024, investors estimated that this disparity would result in a 2,000 billion VND loss, exceeding the project’s financial capacity and potentially leading to the bankruptcy of the project company. To address these issues, the Hai Phong People’s Committee has twice sought guidance from the Prime Minister regarding adjustments to lending rates and rate determination principles. As of May 2024, land clearance for the project was complete, with the investor having disbursed 2,377 billion VND out of the 3,038 billion VND contract value (78.2%) and completing 1,868 billion VND worth of construction work out of the 2,549 billion VND target (73.3%). Additionally, 2,205 billion VND out of the planned 3,100 billion VND has been mobilized. |

– 08:35 20/09/2025

“FDC – If at First You Don’t Succeed, Try, Try Again”

As of June 30, 2025, FDC Corporation has incurred a cumulative loss of nearly VND 165 billion. As a result, the Ho Chi Minh Stock Exchange (HOSE) has maintained its warning status on the company’s stock.

“Chairman of STH Aims to Purchase Over 18% of Shares, Returning as Major Shareholder”

“In a strategic move, Mrs. Nguyen Thi Vinh, Chairman of the Board of Directors at the Publishing House of Thai Nguyen Joint Stock Company (UPCoM: STH), has recently registered to purchase 3.5 million STH shares from September 3rd to October 2nd. This move comes after she sold her entire holdings of over 11% in June. The planned purchase represents over 18% of the company’s capital, indicating a significant shift in her investment portfolio strategy.”

The Ultimate Guide to Investing: Unlocking the Secrets to Financial Freedom

“Former Chairwoman of the Board of Directors of Hong Ha Food Industry Corporation (HOSE: HSL), Ms. Nguyen Thi Tuyet Nhung, has completely divested her 12.44% stake in the company, officially exiting the shareholder registry. This development comes amidst a surge in HSL’s stock price, which has climbed to historic highs, witnessing a remarkable increase of over 275% in just three months.”