Vietcombank (VCB), the joint-stock commercial bank of Vietnam, debuted on the stock market on June 30, 2009, with 1.21 billion shares. The first trading session closed at 60,000 VND per share, valuing the bank at 72.6 trillion VND.

Today, after over 16 years of trading, Vietcombank boasts 8.36 billion shares and a market capitalization of 534 trillion VND.

For years, Vietcombank has consistently ranked first in market capitalization on the Vietnamese stock exchange. Recently, however, its position has been challenged by Vingroup’s VIC.

What if you bought just 1 VCB share every day?

Hypothetically, if an investor purchased 1 VCB share daily since its IPO, they would have accumulated over 4,000 shares, investing 232 million VND and earning approximately 23.5 million VND in dividends.

Additionally, the investor would receive bonus shares from Vietcombank’s stock splits and dividend payouts. As a result, their current holdings would total 10,640 shares, valued at around 680 million VND. This strategy yields a return of approximately 226%.

Observations show that it took over five years, until mid-2024, for this ‘small-to-large’ investment strategy with Vietcombank to become profitable. At one point, the investment incurred a 43% loss.

As Vietnam’s largest bank, Vietcombank reported total operating income of over 35.1 trillion VND in the first half of 2025, a 3.2% increase. Growth was driven by foreign exchange and other business segments.

Net profit from business activities reached 23.455 trillion VND, a 2% decrease year-over-year. Pre-tax profit was nearly 21.894 trillion VND, up 5% from the previous year, due to a 48% reduction in credit risk provisions to 1.562 trillion VND.

As of Q2 2025, Vietcombank’s total assets exceeded 2.2 quadrillion VND, a 6% increase since the beginning of the year. Customer loans and deposits reached nearly 1.56 quadrillion VND and 1.59 quadrillion VND, growing 7% and 8%, respectively. As of June 30, 2025, non-performing loans totaled 15.576 trillion VND, a 12% increase, with the NPL ratio rising slightly from 0.96% to 1%.

Surprise Power Unleashes Nearly $35 Billion to Scoop Up Vietnamese Stocks on September 18th

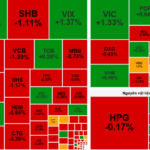

Proprietary trading firms significantly ramped up their net buying activities on the Ho Chi Minh Stock Exchange (HOSE), accumulating a total of VND 769 billion in the latest trading session. This surge underscores their growing confidence in the market and strategic positioning amidst evolving economic conditions.

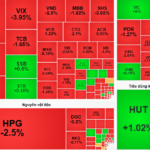

Tomorrow’s Stock Market, September 18th: Await Market Equilibrium for Investment Opportunities

Cash flow is showing signs of caution. Investors are advised to wait for the market to stabilize before seeking new investment opportunities.