A key highlight of the new circular is the regulation on reporting electronic money transfer transactions. Financial institutions, payment service providers, and related entities are required to report transactions that meet specific thresholds.

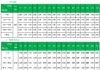

For domestic electronic money transfers, financial institutions must report transactions valued at 500 million VND or more. International transactions require reporting when the value reaches 1,000 USD or its equivalent in other currencies.

The circular takes effect on November 1, 2025. To allow organizations time to prepare, the State Bank of Vietnam (SBV) has established a transition period until December 31, 2025, during which entities may continue using existing internal procedures and risk management protocols.

Reports must include comprehensive details: initiating and receiving organizations, sender and recipient information, account numbers, transaction amounts, currencies, purposes, and dates. Data must be submitted electronically, ensuring accuracy and timeliness as mandated by regulatory authorities.

Beyond reporting obligations, financial institutions must proactively review, suspend, or reject transactions if discrepancies or suspected money laundering activities are detected.

The circular also outlines value thresholds and documentation requirements for customs declarations when carrying foreign currency, Vietnamese currency, negotiable instruments, precious metals, or gemstones exceeding specified limits. Specifically, precious metals (excluding gold) and gemstones valued at 400 million VND or more must be declared. Similarly, negotiable instruments valued at 400 million VND or higher are subject to declaration.

Declaration requirements for foreign currency, Vietnamese currency, and gold at border customs follow existing SBV regulations.

– 11:00 20/09/2025

15th Annual IR Awards Ceremony to be Held on October 2, 2025

The IR Awards program, dedicated to fostering “Transparency and Fairness in the Stock Market,” is set to unveil the most outstanding Investor Relations (IR) performers in Vietnam’s securities market. These exceptional companies will take center stage at the 15th IR Awards Ceremony, scheduled for October 2, 2025, where their achievements will be celebrated in a prestigious event.

Banks Must Maintain a Minimum Capital Adequacy Ratio of 8% Effective September 15th

The State Bank of Vietnam has mandated that banks maintain a minimum capital adequacy ratio of 8%, with an additional capital buffer, effectively raising the consolidated standard to 10.5% over a four-year period.